Morgan Stanley forecasts a protracted oil market recovery

Since the end of April, prompt WTI has more than doubled from $19/bbl to just over $40/bbl and the 2021 strip has risen around 25%. However, E&P stocks have now declined 4% over the same period as the combination of a slowing demand recovery, reversal of supply curtailments, and uncertainty around a COVID second wave have dampened investor sentiment on the pace of the oil market recovery, according to an analysis from Morgan Stanley.

Furthermore, the recent unprecedented decision by a federal judge to shut an operating oil pipeline (Dakota Access) has brought regulatory risk back to the forefront, Morgan Stanley noted.

“Now, after intrinsically pricing in high $40s WTI in early June, our coverage now reflects a median oil price of closer to $43/bbl, just above the 2021 strip of $42. While the convergence between the equities and commodity does point to a more balanced risk-reward, we continue to expect a protracted and bumpy recovery. This, coupled with growing regulatory uncertainty as we approach election season, reinforces our preference for more defensive positioning within the sector.”

In a Midyear outlook report, Morgan Stanley oil strategist Martijn Rats expects supply to remain constrained while demand improves. However, demand is unlikely to return fully to pre-COVID-19 levels until the end of 2021, and inventories are still elevated. OPEC has extended record cuts of 9.7 million b/d through July, though with meaningful latent capacity, will also want to restore output. To prevent shale from growing at levels that are too high (and growing market share), he believes WTI cannot trade much above the low $40s.

In the gas market, Morgan Stanley believes a relatively tight winter 2020-21 balance due to declining supply should still drive a modest recovery in prices into year-end, though with the US on pace to reach record end-October storage levels, the level of upside is likely limited. Globally, the combination of falling supply from cargo cancellations and recovering demand should begin to put LNG prices on a recovery path.

Takeaways

- Improving, but still uncertain oil price backdrop.

OPEC+'s record supply cuts have been a major factor in rebalancing the oil markets. While Morgan Stanley oil strategist Martijn Rats believes OPEC+ will continue to manage supply, the cartel is now operating with unusually high levels of spare capacity. When cuts are eventually unwound, production could sharply rise. Longer term, risk remains that OPEC targets market share instead of supporting prices.

While Morgan Stanley Refining analyst Benny Wong expects demand to continue to recover, potentially supported by a strong US summer driving season, a second wave of COVID-19 infections remains a key risk. Furthermore, refining margins may remain subdued from bloated product inventories and soft exports, limiting near-term upside to crude throughput.

- Supply stabilization for US E&Ps

In response to the downturn, US producers slashed budgets to levels 47% below 2019 and announced about 1.5 million b/d of domestic supply curtailments in May. The industry is in the first of three phases required to restore US production to pre-Covid-19 levels: (1) reversal of curtailments (requiring $25-30 WTI), (2) stabilization of production ($40 WTI needed to hold 2020 fourth quarter levels flat), and (3) resumption of growth ($40-50 WTI).

With WTI now back around $40/bbl, pipeline flows suggest 1 million b/d of curtailments have been reversed over the past few weeks. If current prices hold, Morgan Stanley believes effectively all curtailed volumes will return by the end of the third quarter.

“While some companies have provided updates on this process, we expect most will disclose plans with second quarter earnings updates. Those who can bring curtailments back most effectively should see a near-term cash flow uplift, including ConocoPhillips, Parsley Energy, & Cimarex Energy Co.”

- Indicative 2021 guidance: growth vs Free Cash Flow (FCF)

"As we look into next year, we expect the market will continue to reward an emphasis on capital discipline, FCF and maximization of return on and of cash. While we see limited investor appetite for short-cycle growth into a market that doesn’t need more barrels of oil, stabilizing production is also important, as the current lack of FCF and sharp production declines for many E&Ps leads to rising leverage and per unit costs - an unsustainable strategy.”

“We expect indicative 2021 outlooks through second quarter earnings to continue to point to attractive $30-40/bbl breakevens for most of our coverage, we also look for signs of degradation in capital efficiency over time, as the benefits of high grading, temporary cost savings, and drilled-but-uncompleted (DUC) well backlogs diminish.”

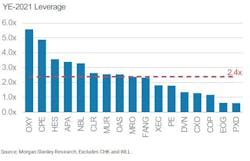

- Financing backdrop challenged for high-yield producer

“For high-yield producers that entered the downturn with already stressed balance sheets, leverage metrics have become uncomfortably high. Access to capital, especially for those with upcoming maturities, is either closed or comes with a high cost. Companies may look to alternatives such as asset sales, though valuations do not support debt accretive transactions. This backdrop has implications for budgeting decisions and could put downward pressure on activity for those with greater liquidity needs.”

- Regulatory risk & election season outcomes

“We think a second term for President Trump would likely do little to aid oil & gas producers through further rollback of regulations. However, polls now favor Joe Biden, and surveys suggest an increase in down ballot voting for the same party relative to prior years. Under a unified Democratic government, many feasible options exist to constrain oil and gas development and accelerate the transition to clean energy. Infrastructure projects should remain challenging regardless of the election season outcome. This week's DC Circuit court decision to remove an operating pipeline from service is unprecedented and reflects regulatory risks that increasingly extend beyond new build energy infrastructure.”