Dallas Fed: Oil and gas activities deteriorated further in second quarter

Oil and gas sector activity deteriorated further in second-quarter 2020, according to oil and gas executives responding to the Dallas Fed Energy Survey.

The business activity index—the survey’s broadest measure of conditions facing Eleventh District energy firms—fell to -66.1 in the second quarter from -50.9 in the first quarter. It was the lowest reading in the survey’s 4-year history and indicative of significant contraction in activity.

The business activity index for oilfield services firms plunged to -73.5 from -46.3, while the business activity index for exploration and production (E&P) firms fell to -62.6 from -53.3.

Production indexes suggest oil and gas production sank relative to the previous quarter. According to E&P executives, the oil production index declined sharply, falling to -62.6 from 36. The natural gas production index also fell significantly, to -47.8 from -21.2. The oil production index is at its lowest point in the survey’s 4-year history.

The index for capital expenditures for E&P firms declined to -66.1 in the second quarter from -49.0 in the first quarter, indicating a further reduction in capital spending. Additionally, the index for capital expenditures for oilfield services firms declined to -73.5 from -50.0.

Most indexes point to worsening conditions among oilfield services firms. The equipment utilization index fell to a survey low of -69.2 in the second quarter from -47.2 in the first quarter.

The operating margins index dropped to -68.6 from -50.0. While firms found relief as input costs collapsed—that index fell to -50.0 from -11.3—the index of prices received for services also slid further into negative territory, to -64.7 from -37.7.

The aggregate employment index posted a fifth consecutive negative reading, declining to -46.1 from -24.0, which suggests an acceleration in job cuts. Additionally, the aggregate employee hours worked index dropped to -47.0 from -32.1. The index for aggregate wages and benefits fell further into negative territory, to -41.7 from -8.2.

The company outlook index reading improved but remained deeply negative at -51.0 in the second quarter, indicating outlooks deteriorated. While uncertainty remained elevated, slightly fewer firms noted rising uncertainty this quarter than last, and the aggregate index fell 28 points to 35.7.

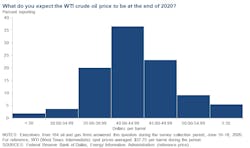

On average, respondents expect a West Texas Intermediate (WTI) oil price of $42.11/bbl by year-end 2020, with responses in the range of $22-65/bbl. Survey participants expect Henry Hub natural gas prices to be $2.15/MMbtu by year-end. For reference, WTI spot prices averaged $37.75/bbl during the survey collection period, and Henry Hub spot prices averaged $1.61/MMbtu.

Special questions

1. Did your firm shut in or curtail any production in the second quarter?

Eighty-two percent of E&P executives said their firm shut in or curtailed production in the second quarter. The remaining 18% did not shut in or curtail production.

2. If you shut in or curtailed any production, what was the primary reason driving that decision?

Of the firms that shut in or curtailed production, the majority of executives—94%—cited low wellhead prices as the primary reason driving that decision. Four percent of executives cited pipeline or refinery operators refusing to accept crude oil, and 1% noted that storage was unavailable.

3. Does your firm still have any oil production shut in or curtailed as of now?

Of the firms that shut in or curtailed production in the second quarter, the majority—71%—still have some oil production shut in or curtailed. The remaining 29% have no oil production shut in or curtailed.

4. By the end of which month do you expect to restart the majority of your shut-in and/or curtailed production?

This question was posed to E&P executives whose firms still have production shut in and/or curtailed. Thirty-six percent said they expect to restart the majority of their shut-in and/or curtailed production in June 2020. Twenty percent expect to do so by July, 18% by August, and 14% by September. The remaining 13% expect to put off restarting to November 2020 or later. (Percentages don’t sum to 100 due to rounding.)

5. Do you expect extra costs when putting the wells back online?

This question was only posed to E&P executives whose firms still have production shut in and/or curtailed. More than half of executives—61%—expect minor costs when placing shut-in and/or curtailed wells back online. Twenty-seven percent anticipate no costs, while 11% expect significant costs. (Percentages don’t sum to 100 due to rounding.)

6. At what price do you expect the majority of producers in US to restart horizontal shut-in wells?

Thirty percent of executives said that they expect the majority of producers in US to restart horizontal shut-in wells if oil prices were $36-40/bbl. Twenty-seven percent of executives anticipate that the majority of producers in US would restart horizontal shut-in wells if oil prices were $41-45/bbl. Nineteen percent believe firms would restart horizontal shut-in wells if prices were below $36/bbl, while 24% believe firms would restart wells when prices are at or above $46/bbl.

7. When do you expect US drilling and completions activity to return to pre-COVID-19 levels?

Forty-one percent of executives expect drilling and completion activity to return to pre-COVID-19 levels sometime in 2021. Thirty-nine percent expect a return in 2022 or later, while 16% don’t foresee a return to prior levels. Three percent expect a return to pre-COVID-19 levels later in 2020.

8. When do you expect global oil consumption to return to pre-COVID-19 levels?

Slightly more than half of executives—54%—expect global oil consumption to return to pre-COVID-19 levels sometime in 2021. The third quarter was the most-picked quarter in 2021 (18%). Thirty-six percent expect a return in 2022 or later, and 5% don’t foresee a return to prior levels. The remaining 5% expect a return to pre-COVID-19 levels later 2020.

On a cumulative basis, 59 percent of executives expect global oil consumption to return to pre-COVID-19 levels by the end of 2021, and 95% of respondents expect it to return sometime by 2022 or later.

9. Do you expect your firm to remain solvent for the next year?

Almost all executives—95%—expect their firm to remain solvent for the next year. The remaining 5% said they anticipate being insolvent within the next year.