WoodMac: China’s 2020 second quarter oil demand shows signs of recovery

China’s oil demand will recover to 13 million b/d in this year’s second quarter, a 16.3% jump compared to the first quarter, according to Wood Mackenzie analysis.

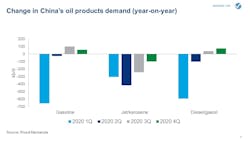

However, comparing year-on-year (y-o-y), second-quarter 2020 demand is about 2.5% below second-quarter 2019. The pace of recovery differs among oil products. China’s demand for gasoline and diesel are expected to increase y-o-y from third-quarter 2020 onwards.

Since April, the Chinese government has gradually lifted the coronavirus containment measures. Specifically, China is now easing restrictions on social, commercial and travel activities,” said Wood Mackenzie research associate Yuwei Pei.

“More people are returning to the office after a period of telecommuting. In addition, private car use is now seen as the safest mode of mobility, shifting passengers from public transport to private cars.”

As a result, gasoline demand is recovering quickly and is likely to return to last year’s levels by June 2020. Wood Mackenzie estimates gasoline demand to reach 3.4 million b/d in second quarter, just a 0.8% decline y-o-y. By third quarter this year, China’s gasoline demand would have surpassed the same period last year by 3% to 3.5 million b/d.

Diesel or gasoil demand is recovering this quarter as well, supported by industrial and road freight activities. China’s demand is expected to reach 3.4 million b/d in second quarter 2020, a 3% decline y-o-y. Courier delivery services are emerging as a major growth driver of road freight, reflecting a surge in e-commerce. This is reflected in demand turning green by 1.2% to 3.4 million b/d in 2020 third quarter compared to the same period last year.

On the other hand, China’s jet fuel demand will continue to fall for the rest of the year. Wood Mackenzie expects an even larger y-o-y decline of 51% to 0.4 million b/d for demand in second quarter compared to this year’s first quarter. Air traffic remains weak due to restrictions on international flights and precautions taken by passengers to avoid crowded places. China’s aviation industry is also struggling financially due to the coronavirus pandemic.

Overall, China’s oil demand is expected to rise a modest 2.3% to 13.6 million b/d for 2020 second half, compared to 2019 second half.

Despite some pockets of recovery in China’s oil demand for the rest of the year, Wood Mackenzie consultant Yujiao Lei warns of external risks that could set the country back.

She said: “China’s oil demand recovery trajectory will depend on how the pandemic pans out globally. Even if China avoids a second wave of infections, as long as the pandemic remains globally, the country will maintain strict border controls, thus restraining aviation. Besides, the ongoing global economic downturn will likely have an adverse impact on China’s exports and investments, putting downward pressure on industrial and commercial transport activity.”