IEA: 2020 second half could see oil demand exceed supply

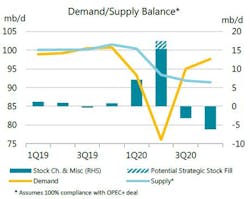

If oil production falls sharply, some oil goes into strategic stocks, and demand begins to recover, the second half of 2020 will see demand exceed supply, the International Energy Agency said in its April Oil Market Report.

On Apr. 12, oil producers in the OPEC+ group agreed to cut output by an initial 9.7 million b/d versus their agreed baseline, effective May 1. Meantime, G20 countries offered their support of efforts by OPEC+ countries to stabilize the oil market and, in some cases, discussed output cuts that would take place immediately or over time.

The OPEC+ and G20 initiatives will impact the oil market in three ways, according to IEA.

First, to reach the baseline, May’s OPEC+ production cut will be 10.7 million b/d and not 9.7 million b/d, as April production was high. This will provide some immediate relief from the supply surplus in the coming weeks, lowering the peak of the build-up of stocks.

Second, four countries (China, India, Korea, and the US) have either offered their strategic storage capacity to industry to temporarily park unwanted barrels or are considering increasing their strategic stocks to take advantage of lower prices. This will create extra headroom for the impending stock build-up, helping the market get past the hump.

Third, other producers, with the US and Canada likely to be the largest contributors, could see output fall by around 3.5 million b/d in the coming months due to the impact of lower prices, according to IEA estimates. The loss of this supply combined with the OPEC+ cuts will shift the market into a deficit in the second half of 2020, ensuring an end to the build-up of stocks and a return to more normal market conditions.

“At the time of publication, we were still waiting for more details on some planned production cuts and proposals to use strategic storage. If the transfers into strategic stocks, which might be as much as 200 million bbl, were to take place in the next 3 months or so, they could represent about 2 million b/d of supply withdrawn from the market,” IEA said.

“There is no feasible agreement that could cut supply by enough to offset such near-term demand losses. However, the past week’s achievements are a solid start and have the potential to start to reverse the build-up in stocks as we move into the second half of the year.”

According to IEA’s forecasts, global oil supply is set to plunge by a record 12 million b/d in May. Additional reductions are set to come from other countries with the US and Canada seeing the largest declines. Total non-OPEC output declines could reach 5.2 million b/d in fourth-quarter 2020. For the year, non-OPEC output may be 2.3 million b/d lower than last year.

On the demand side, IEA forecasts a drop in demand in April of as much as 29 million b/d year-on-year, followed by another significant year-on-year fall of 26 million b/d in May. In June, the gradual recovery likely begins to gain traction, although demand will still be 15 million b/d lower than a year ago. For the whole 2020 second quarter, demand is expected to be 2.3 million b/d below year-ago levels. The recovery in second-half 2020 will be gradual—in December demand will still be down 2.7 million b/d y-o-y.

Refining throughput in 2020 is forecast to fall 7.6 million b/d y-o-y to 74.3 million b/d on sharply reduced demand for fuels. Global refinery intake is expected to plummet by 16 million b/d y-o-y in second-quarter 2020, with widespread run cuts and shutdowns in all regions. Although refinery runs are falling, product stocks are still expected to build by 6 million b/d. In second-half 2020, refining activity will slowly recover as the global market moves into deficit.

Early data show China’s implied stock build in first-quarter 2020 at 2.1 million b/d, and US stocks increased by 500,000 b/d. OECD data show that industry stocks in February fell by 35.4 million bbl to 2.87 billion bbl as a draw for products more than offset a build in crude. Total OECD oil stocks stood 42.4 million bbl below the 5-year average and, due to the weak outlook, now provide 79.2 days of forward demand coverage. In March, floating storage of crude oil increased by 22.9 million bbl (700,000 b/d) to 103.1 million bbl.