Global E&P operators may only be able to cut supply chain costs from efficiency and productivity improvements by up to 12% in this year’s downturn as much of the potential has been exhausted since the 2014 oil-price drop and few inefficiencies have arisen since then, Rystad Energy analysis shows.

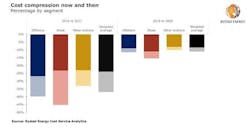

Overall, from the total expected cost compression in 2020, about 9% relates to service prices and 3% to efficiency improvements. Rystad Energy expects very similar improvements within shale (-16%), offshore (-12%), and other onshore (-10%), leaving the cost competitiveness between these segments little changed.

“Operators cannot rely on the supply chain to help them make uneconomic production and projects economic again in the very depressed oil market. This time around, the global oversupply and the demand destruction from Covid-19 will have to be resolved to get project economics back on track,” says Rystad Energy’s Head of Energy Service Research Audun Martinsen.

By contrast, the last oil-industry downturn in 2015 and 2016 triggered massive programs to trim unit costs and improve efficiency, resulting in a total cost compression of around 37%. Within shale the cost compression was as much as 45% and for offshore 40%. In addition, there have also been cost savings due to changes to design, downsizing, and currency gains.

Cost levels have been stable after the last round of improvements. More use of digital solutions has brought further gains in efficiency and productivity, but most of that has been balanced out by a modest price inflation across drilling contractors and well services as well as within labor rates.

In fact, for pressure pumping there was a 40% increase in fracing prices from the trough in 2016 to the peak in 2018, but with a weaker fourth quarter in 2018 and a continued weakening in 2019, frac prices are still the same as in the first quarter of 2017.

“Although [fracing] margins are still at 10% and overall margins for the top 50 companies have rebounded to 15%, we don’t expect to see much price deflation in 2020. In the offshore drilling segment there is some room for prices to come down as certain asset classes have seen rig rates improve 30%, but also here the supply-demand balance is significantly different than before the last downturn, making it harder to expect lower rates.”

The previous downturn in 2015-2016 forced E&P companies to initiate major cost savings programs, and as they scaled back activity levels within offshore, shale, and other onshore activities they were able to achieve much more competitive bidding and forced service companies to lower prices.

Shale service prices bottomed out in 2016 with a 23% drop, led by softer pricing within pressure pumping, proppant, land rigs, and other well services. Offshore costs fell even more, with a 27% drop in service prices in 2017 as a heavily inflated segment such as floating drillings rigs was forced back down to $110,000/day. The combined effect on the supply chain was a drop of 24% in service prices from 2014 to 2016.

Service companies were quick to react to lower pricing by kicking off their own cost-cutting programs to send the reduced prices further down through the value chain. Thanks to efficiency and productivity measures, as well as existing long-term contracts with relatively good margins, the top 50 suppliers were still able to generate positive EBITDA margins of 14% in 2017, down from 21% in 2014. With a heavy debt burden they had to generate these levels of margins to cover their interest payments, depreciation, and amortization.

However, some sectors saw their margins develop quite differently. Pressure pumpers saw margins in 2016 shrink to -5% on average from 20% in 2014, while US land drillers saw margins contract to 25% in 2017 from 40% in 2014 and subsea players saw margins halve to 10% from 20%.

The previous downturn’s total impact on costs is greater than what the reduction in service prices and margins suggest. From 2014 and up to today there has been a great improvement in efficiency and productivity within the supply chain. Offshore drilling has reduced the time it takes to drill a well from 104 days in 2014 to 70 days today. Within shale, drilling efficiency has climbed to 22 wells per rig per year from 17.5 in 2017.