IEA lowers oil demand growth forecasts for 2019, 2020

In its latest Monthly Oil Market Report, the International Energy Agency reduces its oil demand forecasts for 2019 and 2020, both by 100,000 b/d, to a respective 1 million b/d and 1.2 million b/d.

For 2019, the reduction mainly reflects a technical adjustment due to new data showing higher US demand in 2018 which has depressed this year’s growth number. For 2020, the reduction reflects a lower global gross domestic product outlook.

According to IEA, demand for this year is seeing two very different halves. In the year’s first half, demand expanded by 425,000 b/d year-over-year, which is the weakest demand growth since the latest recession. For the second half of this year, however, IEA is projecting demand growth of 1.57 million b/d with recent data lending support to the outlook: non-OECD (Organization for Economic Cooperation and Development) demand growth in July and August was 1 million b/d and 1.5 million b/d, respectively, with Chinese demand growing solidly by more than 500,000 b/d year-over-year. The OECD countries remain in a relatively weak state, although year-over-year growth returns through this year’s second half, helped by a comparison vs. a low base in the latter part of 2018. Demand also is supported by prices (Brent) that are more than 30% below year-ago levels.

For 2020, IEA’s oil demand outlook is cut back to a still solid 1.2 million b/d due to a weaker GDP growth forecast.

The economic outlook used in this month’s report has been revised downward following the publication of the OECD Interim Economic Outlook on Sept. 19. The organization reduced its projections of world economic growth for 2019 to 2.9% from 3.2% and for 2020 to 3% from 3.4%. The main factors behind the downgrade are uncertainty due to trade disputes and the impact of the UK’s exit from the European Union.

EIA said, “Investment growth has decreased in the G20 economies from 5% at the start of 2018 to 1% in the first half of 2019 and demand for certain durable consumer goods, e.g. cars, has collapsed. Tensions are also reducing trade volumes, and the World Trade Organization now expects trade volumes to increase by only 1.2% in 2019. The slowdown in trade volumes has already affected bunker deliveries. It has also had a strong impact on truck transportation and thus diesel consumption.”

Supply

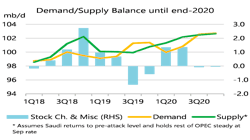

Global oil supply plunged 1.5 million b/d in September to 99.3 million b/d after attacks on Saudi oil facilities, the steepest month-on-month decline in more than a decade.

Crude output of the Organization of Petroleum Exporting Countries tumbled to a 10-year low of 28.83 million b/d in September, down 890,000 b/d month-over-month. In addition to Saudi’s production shut-in, Venezuela’s supply sunk by another 150,000 b/d. Iraq and Nigeria took steps towards improving compliance with the OPEC+ agreement. The compliance from the 11 members taking part in the OPEC+ deal jumped to 242% during September from 145% the previous month.

Saudi officials say production capacity has recovered to 11 million b/d and they expect a return to the pre-attack level of 12 million b/d by the end of November. A full restoration could, however, prove ambitious given the amount of time required to source and install equipment, according to IEA.

Non-OPEC supply eased 400,000 b/d month-over-month in September, partly reversing August’s stronger than expected 930,000 b/d monthly gain. A seasonal decline in biofuels supply and lower production in Canada, Norway, Russia, and Kazakhstan made up most of the September decline. Higher US oil output provided a partial offset.

At just over 65 million b/d, total non-OPEC oil supply was nevertheless 1.6 million b/d higher than a year ago. Annual growth came primarily from the US—despite a slowdown in activity since the start of the year—and from Brazil where output has surged in recent months on the start-up of new production units. Additional gains came from biofuels and LNG projects in Australia.

For all of 2019, non-OPEC supply growth is largely unchanged at 1.8 million b/d as a slightly weaker outlook for the US is offset by improved expectations for Australia and China.

While the pace of the US expansion eases further in 2020, total non-OPEC supply growth accelerates to 2.2 million b/d, with marked gains also coming from Brazil and Norway, where the start-up of the giant Johan Sverdrup field in early October will underpin a 370,000 b/d increase next year.

OECD stocks, refining

OECD industry stocks built 20.8 million bbl month-over-month in August to 2,974 million bbl—the fifth straight monthly increase. They reached the highest level since September 2017 and were 43.1 million bbl above the 5-year average. The gain was in line with the usual increase of 19.2 million bbl for the month. On a forward demand basis, stocks were 0.6 days lower than the 5-year average of 62.2 days.

Specifically, crude oil inventories fell by 14.4 million bbl to 1,098 million bbl while stocks of oil products rose by 32.5 million bbl to 1,514 million bbl.

Preliminary data for September showed stocks falling in all three OECD regions and by 21.7 million bbl overall. US crude oil stocks increased counter-seasonally by 1.9 million bbl due to strong production and reduced refinery runs. Total oil product inventories drew by 3.6 million bbl.

Floating storage of crude oil rose by 1.8 million bbl in September to 70.1 million bbl. The number of Iranian vessels used for storage was unchanged from the previous month.

In this year’s third quarter, global refining throughput continued the recent pattern of decline, falling by 500,000 b/d year-over-year and reducing IEA’s annual growth forecast to just 150,000 b/d—the lowest in 10 years.

However, global refinery throughput is expected to return to growth in this year’s fourth quarter and stay elevated throughout 2020 as refined products demand growth accelerates to 800,000 b/d—the highest rate since 2017. In 2020, throughput is expected to increase by 1.2 million b/d.