In its latest short-term energy outlook, the US Energy Information Administration forecasts global liquid fuels inventories in 2020 will build by an average of 300,000 b/d as supply growth outside the Organization of the Petroleum Exporting Countries (OPEC) outpaces growth in global liquid fuels demand.

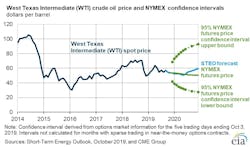

EIA forecasts Brent crude oil prices will average $59/bbl in the fourth quarter of 2019, falling to $57/bbl in the second quarter of 2020 before increasing to more than $62/bbl in the second half of 2020 as oil market balances firm.

Overall, EIA forecasts Brent crude oil prices will average $60/bbl in 2020, $2/bbl less than in the September STEO.

EIA is making this forecast against a backdrop of competing risks. On one hand, this forecast recognizes a higher level of oil supply disruption risk than previously assumed. However, risks that economic growth will be lower than forecast, which could cause oil demand to be weaker than expected, have also increased in the past weeks, notably in contractionary manufacturing indicators from US and Germany.

OPEC production

EIA estimates that crude oil production (OPEC) averaged 28.2 million b/d in September, down 1.6 million b/d from August, the lowest level of OPEC production since November 2003—as a result of the disruptions in Saudi Arabia—and down 4 million b/d from September 2018.

The decrease in OPEC crude oil production during the past year was primarily the result of falling production in Iran and Venezuela as well as the recent disruption in Saudi Arabia. EIA forecasts that annual average OPEC crude oil production will average 29.8 million b/d in 2019, down by 2.1 million from 2018, and 29.6 million b/d in 2020.

The attack on Saudi Aramco’s Abqaiq crude oil processing facility on September 14 initially disrupted about 5% of global liquid fuels supply and caused a significant increase in crude oil prices on the first trading day following the disruption. However, the company has restored most operational capacity at the facility and has met customer demand by selling oil from inventories and reducing domestic refinery intake. By early October, crude oil prices had declined to pre-attack levels.

“The long-term effects from the disruption remain highly uncertain,” EIA said. “The attack revealed vulnerabilities to a significant amount of crude oil production in a country that holds most of the spare production capacity within OPEC. At the same time, the market appears to have adapted fairly smoothly to the disruption and oil companies will likely enhance security in the future.”

As a result of the crude oil supply disruption, EIA estimates Saudi Arabia’s crude oil production declined to 8.5 million b/d on average in September, down from 9.9 million b/d in August. EIA estimates the outage reduced September OPEC spare capacity by 1 million b/d. EIA forecasts OPEC spare production capacity will approach pre-attack levels by January 2020.

US oil production

EIA reported that US crude oil production averaged 11.8 million b/d in July, the most recent data available, down 300,000 b/d from June. Declining production was a result of Hurricane Barry, which disrupted crude oil production in the Gulf of Mexico.

US crude oil production remained relatively flat during the first seven months of 2019 because of disruptions to Gulf of Mexico platforms and slowing growth in tight oil production. The slowing rate of growth in tight oil production reflects relatively flat crude oil price levels and slowing growth in well-level productivity in the Lower 48 states.

However, EIA expects growth to pick up in the fourth quarter as production returns in the Gulf of Mexico and pipelines in the Permian basin come online to link production areas in West Texas and New Mexico to refining and export centers on the Gulf Coast.

However, EIA forecasts growth to level off in 2020 because of falling crude oil prices in the first half of the year and continuing declines in well-level productivity.

EIA forecasts US crude oil production will average 12.3 million b/d in 2019, up 1.3 million from the 2018 level, and will rise by 900,000 b/d in 2020 to an annual average of 13.2 million b/d.

Natural gas

The Henry Hub natural gas spot price averaged $2.56/MMbtu in September, up 34₵/MMbtu from August, which was the first monthly price increase since March.

EIA forecasts Henry Hub prices to average $2.43/MMbtu in this year's fourth quarter, a decrease of more than $1/MMbtu from the fourth quarter of 2018, subsequently increasing to an average of $2.52/MMbtu in 2020.

US natural gas prices have fallen in 2019 because of strong supply growth that has enabled natural gas inventories to build more than average during the April through October injection season.

EIA forecasts that average annual US dry natural gas production will average 91.6 bcf/d in 2019, up 10% from the 2018 average. EIA expects that natural gas production will grow much less in 2020 because the delayed effect of low prices in the second half of 2019 will reduce natural gas-directed drilling in 2020. EIA forecasts natural gas production in 2020 will average 93.5 bcf/d.

Natural gas storage injections have outpaced the previous 5-year (2014–18) average so far during the 2019 injection season as a result of rising natural gas production.

At the beginning of April, the natural gas inventory injection season started with working inventories 28% below the 5-year average for the same period. By the week ending Sept. 27, working gas inventories reached 3,317 bcf. EIA forecasts that natural gas storage levels will total 3,792 bcf by the end of October, which is 2% above the 5-year average and 17% above October 2018 levels.