Rystad: Oil price spike likely short-lived after Saudi drone attack

The drone attack on the world’s largest oil processing facility, Abqaiq in the heart of Saudi Arabia’s oil industry, forced Saudi Aramco to shut in 5.7 million b/d of crude production, which equates to roughly 7% of the current global crude and condensate production.

However, the bullish reaction in oil prices after the biggest attack on oil infrastructure since the Gulf War will likely be short-lived, according to Bjornar Tonhaugen, head of oil market research at Rystad Energy.

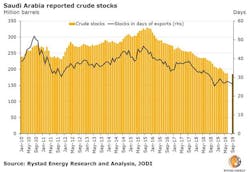

Saudi Arabia has vast quantities of crude in storage, estimated to equal about 26 days of current crude exports, a large portion of which is at the main export terminal Ras Tanura. The country also has strategic storage facilities in Rotterdam, Okinawa, and Sidi Kerir in Egypt.

“The world is not even close to being able to replace more than 5 million b/d of Saudi Arabian exports. The market’s reaction to Saudi Arabia’s importance, in the new era of US shale, will now be put to the test,” Tonhaugen remarked.

The longer the processing facility remains disrupted, the larger the potential impact on actual crude flows will be.

“In a scenario where the damages result in a longer duration of the 5.7 million b/d production shut-in, say for 10 days or more, the situation for Saudi Arabian crude flows to the market will be critical, in our view, as there are limits globally to the volume of export replacement barrels,” Tonhaugen said.

“Strategic Petroleum Reserves in the [Organization for Economic Cooperation and Development] countries would then be called upon. The US stands as one of the few countries that would be able to increase exports in the short term. We believe US crude exports could potentially be increased by about 1 million b/d, from 3 million to 4 million b/d, if prices allow for higher utilization of the current crude exports capacity. Other countries with available capacity to increase exports by a few hundred thousand barrels per day each include UAE, Russia, Kuwait, and Iraq.”

Saudi Arabia has about 185 million bbl of crude stocks in storage currently and has drawn down its domestic crude stockpiles by more than 40% (or 140 million bbl) since 2015. A large part of the storage is located near crude loading terminals, with storage capacity at Ras Tanura estimated at 60-70 million bbl, representing 10-11 days of normal crude exports from the terminal.

The global flow of crude oil will not be disrupted immediately, Rystad Energy believes, due to storage capacity at the main export terminals. However, the longer the processing facility remains disrupted, the larger the potential impact on actual crude flows will be.