Eni SPA has released the 18th edition of its World Oil Review, which is the first volume of the report, World Oil, Gas & Renewables Review.

The WOR is devoted to oil reserves, supply, demand, trade, and prices with a special focus on crude oil quality and the refining industry. The second volume, the World Gas & Renewables Review, which focuses on gas and renewables sources like solar, wind, and biofuels, will be published in the fall.

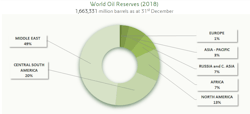

In 2018, world oil reserves rose slightly by 0.4% to 1,663 billion bbl, mainly because of growth in the US. North America’s reserves increased 4.5% in 2018 to 220.4 billion bbl.

Reserves also increased in Brazil and Norway. The Organization of Petroleum Exporting Countries’ reserves dipped 0.2% to 1,213.6 billion bbl, in particular for the downsizing of Iraq, even if OPEC confirms its predominance with a 73% share of the total world.

Among the whole top reserves holders, Venezuela is in first position, with the estimate of 302.8 billion bbl unchanged, followed by Saudi Arabia and Canada. US reserves increased 22.6% in 2018 to 51.5 billion bbl.

Oil production in 2018 recorded an overall increase of 2.5 million b/d, 88% because of the US, which hit a new record, consolidating the first position in the rank of world producers. The US also broke into the international crude trade, doubling export volumes and entering the Top 10 ranking.

Canada’s production increased 8.1% from a year ago, exceeding the threshold of 5 million b/d. Russia’s production, which accelerated in the second part of the year, also reached a record of 11.5 million b/d.

Zero growth instead for OPEC which, despite the increases in the gulf countries, especially Saudi Arabia, suffered losses due to sanctions against Iran (-0.2 million b/d) and the collapse of Venezuela (-0.6 million b/d).

The new record of tight oil production continued to increase the share of sweet, light crudes, which rose above 20% worldwide. The US light crude covers 60% of global growth. The collapse of Venezuela, Mexico, and Iran's retreat prevailed over increases in Saudi Arabia and Iraq, reducing the weight of medium sour crude oil for the first time below 40%, with impacts on price differentials and refining.

Regional oil dependence

In the regional crude oil balance 2018 for the first time, the deficit of the Americas is cleared, which in the last decade exceeded even 5 million b/d. The surge in US production and Canada’s growth far outweighed domestic demand, generating a sharp decline in North American oil dependence.

The crude surplus in the Middle East is slightly up, due to the yearend increases of big producers including Saudi Arabia, Iraq, and the UAE.

The Asia Pacific’s oil dependence continues to grow, ranking first in terms of crude deficit.

In a context of increasing oil prices, global oil demand grew by 1.4% in 2018, slightly lower than a growth of 1.6% in 2017. The growth is slightly under the 5-year average of 1.7% recorded in 2013-17.

For the fourth year in a row, the Organization for Economic Cooperation and Development gave positive support to global growth, but non-OECD maintained the dominant share, accounting for 69% of the overall growth.

Asia keep leading global refining capacity growth with 77% of the 1 million b/d increase vs 2017. In Africa a minor cut reduced capacity by around 300,000 b/d.

The OPEC and non-OPEC alliance and the sustained growth in consumption led to a 30% rise in ICE Brent price ($72/bbl) compared with 2017 ($55/bbl). In the first part of the year the high OPEC+ discipline and the announcement of the US sanctions against Iran supported a rising price curve. The year ended in sharp decline, due to increases of Saudi Arabia and Russia production in excess of geopolitical losses and due to growing fears of a slowdown in economic growth.