IHS Markit: Permian oil producers hedging 65% of their output at $50/bbl

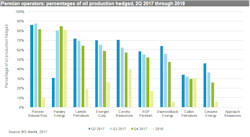

Crude oil-weighted operators in the Permian basin have hedged 65% of their remaining 2017 oil production at $50/bbl and 50% of their remaining gas production at $3/Mcf, according to analysis from IHS Markit Ltd.

The information and analysis firm evaluated oil and gas hedging for a group of 18 oil-weighted US exploration and production firms, including a subgroup of 10 Permian basin-focused operators. Among the non-Permian E&P oil-weighted peer group, just 19% of oil production and 29% of gas production has been hedged in 2017.

“The different levels of hedging between the two oil-weighted subgroups of Permian vs. non-Permian E&P operators is reflected in the wide disparity of their production growth targets, and the difference is striking,” explained Paul O’Donnell, principal equity analyst at IHS Markit and author of the hedging analysis.

“The median Permian E&P is expected to increase its production by 25% in 2017 as compared to those oil-weighted operators outside the Permian who have hedged just 19% of 2017 oil production and are anticipating a median decline of 1% in oil-liquids production,” he said. “Consequently, we expect the Permian E&Ps will be less likely to downwardly revise 2017 spending plans and production targets in the upcoming second-quarter 2017 earnings announcements compared with their non-Permian counterparts.”

Companies hedge their production to provide a level of protection against oil and gas price fluctuations, and during the period of volatile prices throughout most of 2015 and 2016, North American operators benefitted from having large hedge books, O’Donnell said.

“In 2017, hedging is still important for these E&Ps, especially the more debt-laden companies, which are less likely to withstand sustained low prices or significant price fluctuations,” O’Donnell said. “The oil-weighted peer group increased its 2017 oil hedging from 22% to 34% since the time of our previous hedging study, based off of third-quarter 2016 data.”

If prices were to drop to $35/bbl, Permian operators with the best downside protection include Concho Resources Inc., Parsley Energy Inc., and Laredo Petroleum Inc., IHS Markit indicated.

For 2018, the Permian operators have already hedged 25% of oil production at $51/bbl and 9% of gas at $3/Mcf, while the non-Permian operators are largely unhedged for oil but have 9% of their gas production hedged. “At present, it would be a challenge for the Permian E&Ps to replicate their 2017 hedge positions in 2018 given the weakness in oil prices and the relatively flat futures curve,” O’Donnell said.