In its February Oil Market Report, the International Energy Agency warned that the short-term risk to the downside has increased, as the surplus of oil supply over demand in the early part of 2016 is even greater than forecast in last month’s OMR.

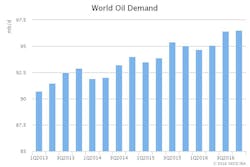

Having peaked at a 5-year high of 1.6 million b/d in 2015, global oil demand growth is forecast to ease back considerably in 2016, to 1.2 million b/d, pulled down by notable slowdowns in Europe, China, and the US. Early elements of the projected slowdown surfaced in fourth-quarter 2015. Notably, global demand growth has decelerated from 2.15 million b/d in the third quarter 2015 to just 800,000 b/d in the fourth quarter of the year.

“Estimates by the International Monetary Fund that global GDP growth in 2016 will be 3.4% followed by 3.6% in 2017 is heavily caveated with risks to growth in Brazil, Russia, and of course slower growth in China. Economic headwinds suggest that any change will likely be downwards,” IEA said.

“Although it is widely believed that interest rate hikes in 2016 in the US and the UK are increasingly unlikely, the dollar is still likely to remain strong as it benefits from its safe haven status with other economies faring relatively worse.”

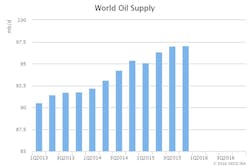

Global oil supply dropped 200,000 b/d to 96.5 million b/d in January, as higher output from members of the Organization of Petroleum Exporting Countries only partly offset lower non-OPEC production. Non-OPEC supplies slipped 500,000 b/d from a month earlier to stand close to levels of a year ago.

OPEC crude oil output rose 280,000 b/d in January to 32.63 million b/d as a sanctions-free Iran, Saudi Arabia, and Iraq all turned up the taps. Supplies from the group during January stood nearly 1.7 million b/d higher year-on-year.

IEA assumes that, for 2016 as a whole, non-OPEC output will decline 600,000 b/d to 57.1 million b/d. But “there is a lingering feeling that the big fall-off in production from US shale producers is taking an awful long time to happen. Perhaps resilience still has some way to go,” said IEA.

OECD commercial stocks built counterseasonally by 7.6 million bbl in December to stand at 3.012 billion bbl at month end, 350 million bbl above average. Refined products covered 32.3 days of forward demand, 0.1 days above end-November. Preliminary information indicates that inventories have continued building into January.

Global refinery runs fell 1.3 million b/d in January to 79.8 million b/d, as the onset of seasonal maintenance in the US and weakening refinery margins curbed runs. Global throughputs nevertheless stood more than 1.7 million b/d above a year earlier, with gains particularly strong in the US and the Middle East.