E&Y: Private equity to ramp up global oil, gas capital deployment

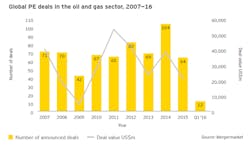

The global oil and gas industry is set to receive an infusion of capital from private equity (PE) firms, Ernst & Young LLP indicates in a global survey of 100 PE firms active in the business.

Some $971.4 billion of PE from June is still to be deployed, according to the survey, “Capitalizing on Opportunities: Private Equity Investment in Oil & Gas,” with 25% of PE firms planning acquisitions before yearend and 43% by first-half 2017.

“Greater consensus over the oil-price future and more favorable asset valuations are improving the conditions for PE,” explained Andy Brogan, E&Y global oil and gas transactions leader.

The survey shows that creative capital structures are on the rise due to the debt burden of many PE-backed oil and gas firms. Of the 71% of respondents exploring new capital structures, 62% cite joint ventures and drilling companies, and 59% cite contingent pricing as the most popular options.

When it comes to where capital is being deployed, E&Y notes increased attention to rising energy demand in emerging economies. All respondents expect to see more PE involvement in Asia-Pacific, rising from 79% in the last survey conducted in 2013. Investors are being drawn to the region for its low costs, ease of doing business, and general macroeconomic growth.

Similarly, 99% of respondents believe PE interest in North America will grow. Medium-sized companies looking to service debt, merge, or sell assets are providing opportunities for funds looking to bolster their existing portfolios.

“The US shale market saw an influx of PE resources before prices dropped,” said Deborah Byers, E&Y US energy leader. “And as liquidity, asset-based lending, and reserve-based lending continue to decrease, companies will increasingly look to alternative financing like PE.”

PE firms are set to become more involved in the midstream and upstream segments over the next 2 years, with 44% of respondents considering the two sectors as their best opportunity for return on investment.

“Many of the recent upstream bankruptcy filings are balance sheet fixes,” noted Byers. “Once these companies emerge from restructuring, they will reevaluate their assets which may lead to increased sales in the market.”

Amid depressed oil prices, PE firms are positioning to provide short-term and long-term financial solutions across the industry, with 63% saying they will provide value to corporates through growth capital.