WoodMac cuts Norway capital investment forecast by $50 billion

Research and consulting firm Wood Mackenzie Ltd. has slashed $50 billion from its oil and gas capital investment forecast for Norway during 2016-20, reflecting the deferral or scrapping of more than 10 projects.

“Companies are seeking lower-cost solutions, be that from cheaper market rates or different development options,” commented Malcolm Dickson, WoodMac principal analyst for upstream oil and gas.

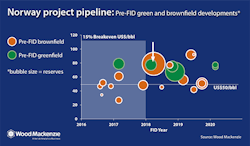

The firm notes that some 3 billion bbl in pre-final investment decision (FID) projects await sanction, and timing is crucial in determining the costs required for development. “The best time to FID from that point of view is before 2018, after which we expect demand to pick up in line with oil-price recovery,” Dickson said. “This will push costs up in the global supply chain, and there could be a demand crunch at that point.

“Mid-2017 is the bottom if you believe in oil-price recovery as we do,” Dickson said. “That means that cost inflation will begin to creep into fields from 2018 onwards. FID in the next year or so would make sense to capture lower costs. However, cost optimization can trump everything.”

Dickson said that “too many of those projects” break even at more than $50/bbl, noting that “simplification, standardization, and optimization—not cyclical benefits—are the keys to new investment.”

Dickson observes many companies are now “moving to lower cost drilling techniques, scaling down vessel spec, and moving from large platforms to subsea.” Examples of optimization include more efficient drilling in exploration, with wells drilled 50% faster than in 2013, along with new technological approaches such as Asgard’s subsea compression, which adds around 300 million boe to the project (OGJ, May 2, 2016, p. 56).

WoodMac cites as an example Asgard operator Statoil ASA as among the companies benefitting from use of standardized and simplified well designs to cut time and costs. The Norwegian oil and gas firm also on Aug. 29 reported plans for reduced spending and increased production capacity on Johan Sverdrup field (OGJ Online, Aug. 29, 2016). Statoil executives calculated Johan Sverdrup will be profitable at below $25/bbl, down from the company’s February forecast of below $30/bbl.

WoodMac’s research shows that subsea equipment, drilling, and seismic will see the most cost deflation in 2016. Based on the firm’s recent survey, independent oil companies are more optimistic about further deflation in 2017, while the supply chain foresees an earlier demand uptick curtailing deflation.