MARKET WATCH: New York, London oil prices tumble on oversupply concerns

Crude oil prices tumbled more than $1 on the New York market to settle at just above $37/bbl on Mar. 14 following news reports that Iranian Oil Minister Bijan Zanganeh said his nation would not participate in an oil production freeze until Iran’s production reaches 4 million b/d.

“I have already announced my view regarding the oil freeze, and I’m saying now as long as we have not reached 4 million b/d in production, they should leave us alone,” Zanganeh said during the weekend.

The comment renewed questions among analysts and traders about any possible production freeze pact actually happening.

During February, representatives of Saudi Arabia, Russia, Venezuela, and Qatar agreed to freeze production at January levels if other producers, including Iran, also freeze production.

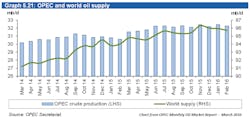

Meanwhile in its Monthly Oil Market Report, the Organization of Petroleum Exporting Countries said the cartel’s production declined by about 175,000 b/d during February to 32.28 million bbl. OPEC said Iran produced 3.1 million b/d during February, up 187,000 b/d from January.

Barclays Capital researcher Miswin Mahesh said in a research note that he continues to believe at least two quarters of prices below $40/bbl are required to balance the oil market.

“If current price gains gather more momentum and hold, this would delay the balancing process for oil and bring downside risks,” for oil prices, Mahesh said.

He noted oil supply statistics are helping “sow the seeds of a recovery,” but he also said world oil demand growth so far this year appears to be “softer” than during the same period last year.

Energy prices

The April crude oil contract on the New York Mercantile Exchange declined $1.32 to $37.18/bbl on Mar. 14. The May contract was down $1.25 to $38.84/bbl.

The NYMEX natural gas contract for April edged down less than a penny to a rounded $1.82/MMbtu. The Henry Hub gas price for Mar. 14 was $1.68/MMbtu, dropping 4¢.

Heating oil for April delivery fell by 2¢ to a rounded $1.20/gal. The price for reformulated gasoline stock for oxygenates blending for April declined by about 2¢ to a rounded $1.42/gal on Mar. 14.

The Brent crude contract for May on London’s ICE fell 86¢ to $39.53/bbl. The June contract was down 93¢ to $40.16/bbl. The ICE gas oil contract for April was $355.75/tonne, down $11.25.

The average price for OPEC’s basket of 12 benchmark crudes was $34.74/bbl, dropping 88¢.

Contact Paula Dittrick at [email protected].

About the Author

Paula Dittrick

Senior Staff Writer

Paula Dittrick has covered oil and gas from Houston for more than 20 years. Starting in May 2007, she developed a health, safety, and environment beat for Oil & Gas Journal. Dittrick is familiar with the industry’s financial aspects. She also monitors issues associated with carbon sequestration and renewable energy.

Dittrick joined OGJ in February 2001. Previously, she worked for Dow Jones and United Press International. She began writing about oil and gas as UPI’s West Texas bureau chief during the 1980s. She earned a Bachelor’s of Science degree in journalism from the University of Nebraska in 1974.