OGJ Newsletter

GENERAL INTEREST — Quick Takes

Oil company chiefs back climate-change pact

The chief executives of 10 large oil and gas companies have agreed to collaborate on cutting emissions of greenhouse gases, calling for an international agreement on climate change at the "COP21" summit next December in Paris.

In a "joint collaborative declaration," members of the Oil & Gas Climate Initiative said they have lowered GHG emissions from operations by a collective 20% over the past 10 years and continue to invest in natural gas, carbon capture and storage (CCS), renewable energy, and research.

"However, neither our contributions nor those of any one industrial sector alone will be enough to address the challenge of climate change. It can only be met by each part of society making an appropriate contribution," they said.

At the Paris meeting, held under auspices of the United National Environmental Program, world leaders will seek agreement on steps to lower emissions thought to be enough to keep globally averaged temperature from rising more than 2° C. above preindustrial levels. The declaration noted a dual challenge to governments of allowing energy supply to grow as needed and of lowering GHG emissions.

Signatories represent BG, BP, Eni, Pemex, Reliance Industries, Repsol, Shell, Aramco, Statoil, and Total.

They committed to collaborate, "with the aim of going beyond the sum of our individual efforts," in these areas: efficiency of energy use in operations and in end use of their products; natural gas, including raising the gas share of global energy use; "long-term solutions," such as investing in research, supporting public-private partnerships to advance CCS, and boosting the energy-market share of renewable energy; energy access; and partnerships and "multistakeholder initiatives" to "accelerate climate change solutions."

OPEC accepts Indonesia's request to rejoin group

The Organization of Petroleum Exporting Countries has accepted Indonesia's request to reactivate the country's membership. Indonesia formally asked for reinstatement at the cartel's June ministerial meeting in Vienna (OGJ Online, June 5, 2015).

The Southeast Asian country withdrew from OPEC in 2009 citing growing internal demand for energy, declining crude oil and condensate production in mature fields, and limited investment to increase production capacity.

Indonesia had become a net importer of petroleum and other liquids by 2004 after domestic demand exceeded production.

Indonesian government officials said rejoining OPEC will strengthen its cooperation with oil-producing countries, provide greater access to crude oil supplies, and allow the country to be a link between energy producers and consumers.

Indonesia currently buys crude oil and petroleum products through third parties or traders and seeks direct access to long-term crude supply contracts through negotiations between OPEC-member national oil companies.

Indonesia produced about 790,000 b/d of crude and condensates in 2014, the third-lowest level among OPEC countries. Once it rejoins, Indonesia will regain its status as the only Asian member of OPEC and the only member that is a net importer of petroleum and other liquids.

COS urges shareholders to reject Suncor offer

Canadian Oil Sands Ltd. (COS) recommended that shareholders reject the offer made earlier this month by Suncor Energy Inc. to acquire all outstanding shares of COS (OGJ Online, Oct. 6, 2015). COS's board has completed a full review of the $4.3-billion (Can.) offer and determined it to be inadequate, opportunistic, and exploitative.

The offer "substantially undervalues" the COS 36.74% ownership in the Syncrude oil sands joint venture, COS said.

In a letter to shareholders, COS said the Suncor bid "fails to recognize that COS is strongly positioned to withstand low oil prices and emerge with even greater value when oil prices recover." COS said the Suncor bid is "highly opportunistic" as it is "designed to take advantage of unprecedented political, economic and regulatory uncertainty in the industry and the dramatic deterioration in the price of COS common shares."

COS's board is looking at a "full range of strategic alternatives," it said.

Repsol to divest €6.2 billion in assets, cut spending

Repsol SA plans to divest €6.2 billion in nonstrategic assets and cut spending by 38% "without altering its company profile" as part of its 2016-20 strategic plan.

The company says it has identified "new synergies" following its $8.3-billion acquisition of Talisman Energy Inc. completed earlier this year, enabling it to raise its savings target resulting from the integration to $350 million from the initially expected $220 million (OGJ Online, Dec. 16, 2014).

The synergies supplement the efficiency program included in the strategic plan, the company says. The program will be applied to the entire company and will lead to cost savings, including synergies, of €2.1 billion/year from 2018.

Following the Talisman deal, Repsol's exploration and production unit will focus on three strategic regions: North America, Latin America, and Southeast Asia.

The plan includes lower exploration expenses, a 40% reduction in investment levels, and production between 700,000-750,000 boe/d guaranteed by current reserves, allowing the exploration and production business to reduce the free cash flow breakeven price, Repsol says.

The company intends a broader integration of refining and marketing activities, with divestments in nonstrategic assets for the downstream unit. This allows the company to set the downstream unit's target for free cash flow generation for the next 5 years at an average of €1.7 billion/year.

Repsol also noted that its 2015 net profit will drop to €1.25-1.5 billion from €1.61 billion in 2014 caused by low crude oil prices and refining margins.

Jefferies: RBL redeterminations 'surprisingly gentle'

Analysts with Jefferies Equity Research Americas report banks protected their oil and gas producer customers by giving them more time to improve financial health, but next year's spring reserve-based lending (RBL) redeterminations likely could be tougher unless commodity prices improve.

Banks were widely expected to trim producers' borrowing bases by as much as 15% this month in the semiannual RBL review. Those RBLs were made when oil and gas prices were higher.

"But of the 25 companies we track (which have disclosed fall loan redeterminations) aggregate borrowing base capacity fell only 2% as banks seem to have set aside more capital to protect for loan losses to maintain liquidity for customers," Jefferies said in an Oct. 19 industry note.

Proved reserve value is recalculated for each producer by bank-approved outside engineers twice a year in a redetermination process. Second-quarter financial results indicated losses and reserve writedowns for many. Third-quarter results have yet to be reported.

"Recent fall redeterminations…have been surprisingly gentle, leading to stable producer liquidity," Jefferies analyst Jonathan Wolff said.

Wolff said it appears proved, developed, and producing reserves have risen in 2015 for producers amid development budgets largely financed by early-year equity rises.

In addition, recent amended RBL agreements include new or modified restrictive covenants, he said.

"But with annualized prices rolling into weakness, producers will need to be vigilant to maintain stable liquidity," Wolff added, suggesting that banks also might have shown flexibility because government regulators were on edge, fearing any repeat of the 2008 financial crisis.

Jefferies expects spring 2016 redeterminations could push liquidity lower on anticipated production declines.

"With most oily producers having sharply reduced completion activity in recent weeks, oil production is set to fall, and proved developed producing additions are unlikely to match organic declines," Wolff said. "Likewise, we believe borrowing-base capacity is likely to fall next spring," assuming no major change in bank price decks, he said.

Exploration & Development — Quick Takes

Total-led venture presses on with Elk-Antelope appraisal

A joint venture led by Total SA at the proposed Elk-Antelope gas development in the eastern highlands of Papua New Guinea has decided to bring in a second rig to speed the fields' appraisal program.

The second rig was to have appraised InterOil Corp.'s Raptor gas discovery, but now has been diverted and signed up for Antelope-6.

InterOil, which is part of the Total group, said the Elk-Antelope appraisal in retention license PRL15 took priority over its discretionary drilling program, including the Raptor appraisal.

Antelope-6, due to spud before yearend, will test what is thought to be the eastern flank of Antelope field. Site preparation is advanced.

Another well, Antelope South-1, also is planned as a step-out to Antelope South about 1.9 km southeast. This will evaluate a large equivalent structure that partially underlies-but is separate from-Antelope field.

Operator Total is currently drilling Antelope-4 ST-1 sidetrack where the top of the reservoir has been encountered 36 m higher than in the original Antelope-4.

Elk-Antelope is estimated to hold 7-9 tcf of gas, which is sufficient enough to supply two LNG trains. There also is a significant liquids component.

The field will underpin the proposed Total-operated Papua New Guinea LNG project.

The Total JV includes InterOil and Oil Search Ltd.

MEO Australia drops Heron field permit

After many years of trying to prove up a commercial project, MEO Australia Ltd. has relinquished its interest in the Heron gas discovery in permit NT/P68 in the Timor Sea.

The company also has relinquished two large offshore Western Australian blocks: WA-360-P and WA-361-P. MEO says an internal review found the permits no longer fitted the company's strategy.

It said after several wells on Heron with farminee Eni SPA, it now appeared to be too small to be a potential gas supply source for the company's proposed Tassie Shoal offshore fixed-platform LNG and methanol projects.

MEO and Eni split up the permit early this year with Eni retaining the Blackwood discovery and MEO keeping Heron.

Off Western Australia, MEO will hand over its 62.5% share of the two Carnarvon basin permits, located between Wheatstone field and the Rankin trend fields, to JV partner and fellow Melbourne company Cue Energy Resources Ltd.

The permits contain the undrilled Maxwell and Hercules prospects that are said to have potential to hold 1 tcf of gas or more. However attempts to find a farm-in partner have been unsuccessful and MEO has decided to opt out, saying the permits are too high risk compared to its other assets.

MEO will now focus on the recently awarded Block 9 in Cuba; PEP 51153 in New Zealand; the Tassie Shoal projects, where environmental approvals are valid until 2052; its Bonaparte basin permits WA-488-P and WA-454-P; and Vulcan Sub-basin permits AC/P50, AC/P51, and AC/P53.

Latif field exploration well flows 2,500 boe/d

OMV AG made a natural gas discovery with its Latif South-1 exploration well drilled in Pakistan's Sindh Province, about 25 km south of Latif gas field. Wireline logging and testing operations confirmed the discovery flowed 2,500 boe/d of gas from Lower Goru Intra C sands. The company said further appraisal is needed to confirm the discovery's size.

The Latif exploration license is owned jointly by OMV (Pakistan) Exploration GMBH 33.4%, Pakistan Petroleum Ltd. 33.3%, and Eni Pakistan Ltd. 33.3%. The discovery's proximity to Latif field provides an opportunity to use nearby transmitting and processing facilities constructed in 2013, OMV said (OGJ Online, Dec. 6, 2013).

Drilling & Production — Quick Takes

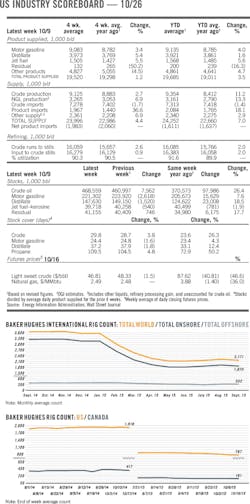

NEB: Canada has biggest percentage drop in rigs

Canada's National Energy Board says Canada's 47% drop in rig activity thus far in 2015 makes it "the hardest hit region in the world" on a percentage basis.

"This is likely because many Canadian oil and gas resources tend to be the highest cost production and their development was amongst the first to be halted as oil prices fell," NEB said, noting that Canada's rig count declined from 380 to 200.

Rig activity in the US decreased 44% into September, said NEB, citing Baker Hughes Inc. as its source. Outside North America, rig counts have fallen 11%. Worldwide, the decline is 32%. NEB said world oil and gas rig activity was "relatively steady" in 2012-14, averaging close to 3,500 rigs in each year. The annual average thus far in 2015 is 2,439.

FAR contracts rig for Senegal work

FAR Ltd., Perth, and its joint-venture partners have finalized contracts for the use of Ocean Rig's Athena drillship for the forthcoming program offshore Senegal.

The rig is under long-term contract to ConocoPhillips (one of the JV partners) and is currently offshore Angola. The vessel will begin mobilization to Senegal later this week.

FAR says the new drilling program will include three wells-two appraisal wells on the SNE-1 oil discovery and one shelf exploration well to evaluate that region's prospectivity.

The work will involve coring and testing at SNE and the whole three-well program is slated for completion by mid-2016.

The SNE-2 and SNE-3 appraisals are planned to prove up the threshold economic field size that FAR estimates is about 200 million bbl for a foundation project.

The exploration well, BEL-1, will be drilled further north and will be the first exploration of the shelf area following the discoveries at FAN-1 and SNE-1.

The aim is to build the resource base within tie-back range of a potential future hub development over SNE field. BEL stands for Bellatrix prospect which, as currently mapped, has a strong seismic amplitude anomaly similar to the one over SNE field and has potential to contain 168 million bbl of oil.

FAR estimates that there are a total of 1.5 billion bbl of prospective resources in several prospects within subsea tie-back distance to the proposed SNE production hub. Bellatrix will be the first of these to be evaluated.

Athena is a new seventh generation dual derrick dynamically positioning drillship first delivered from the shipyard in March 2014. ConocoPhillips has it on a 3-year contract with an option to extend for a further 2 years.

QP lets jacket contract for Bul Hanine redevelopment

Qatar Petroleum (QP) has let a contract to McDermott International Inc. to engineer, procure, construct, and install four wellhead jackets for the redevelopment of Bul Hanine oil field offshore Qatar.

The company says the first two jackets will be installed by December 2016 and the final two by July 2017.

QP announced its $11-billion plan to redevelop Bul Hanine in 2014 (OGJ Online, May 14, 2014). The project includes new central production facilities offshore and a gas liquids processing facility at Mesaieed. One hundred-fifty wells will be drilled from existing and modified wellhead jackets and from 14 wellhead jackets, including those contracted with McDremott.

On production since 1972, Bul Hanine field lies 120 km off the Qatar's east coast.

PROCESSING — Quick Takes

Celanese JV commissions Texas methanol plant

Fairway Methanol LLC, a 50-50 joint venture of Celanese Corp., Dallas, and Mitsui & Co. Ltd., Tokyo, has commissioned a grassroots methanol plant at Celanese's integrated chemical production complex in Clear Lake, Tex.

With a methanol production capacity of 1.3 million tonnes/year, the new unit is now operating at full rates, Celanese said.

The grassroots plant, which took 19 months to build and became fully operational within 21 months from start of construction, was completed at a capital investment of less than $910 million, according to Celanese.

The plant, which will produce methanol from abundant supplies of low-cost US natural gas feedstock, initially was due for startup in mid-2015 at a cost of $800 million, Celanese said in a May 15, 2013, release announcing its partnership with Mitsui.

The company first announced its intention to build and operate the methanol production site at the Clear Lake complex in 2012, at which time it was still seeking partners for the project, according to a June 14, 2012, release from the company.

Earlier this year, Celanese entered a separate agreement with Mitsui to explore a separate joint venture for construction of an additional methanol production plant at Celanese's integrated specialty chemical complex in Bishop, Tex., Celanese said in an Apr. 4 release.

The Bishop methanol plant, which would leverage the design benefits of the newly commissioned Clear Lake plant, also would have a production capacity of 1.3 million tpy.

While Celanese already has filed for air permits with the Texas Commission on Environmental Quality for the proposed Bishop unit, a final decision to advance the project will depend on several factors, including prevailing market conditions for methanol and construction costs, Celanese said.

Indian Oil commissions unit at Paradip refinery

Indian Oil Corp. Ltd. has commissioned another unit at its long-delayed 15 million-tonne/year, full-conversion refinery at Paradip, on India's northeastern coast (OGJ Online, Nov. 16, 2011). The refinery's diesel hydrotreater began operations on Oct. 13, IOC said.

The unit is designed to process 5.2 million tpy of blended gas oil to produce ultralow-sulfur diesel that with a maximum sulfur content of 10 ppm, the company said.

The diesel hydrotreater uses Shell Global Solutions' (SGS) deep hydrodesulfurization technology (OGJ Online, Apr. 29, 2015).

IOC previously initiated crude processing at Paradip's atmospheric and vacuum distillation unit in late April, with the unit now producing LPG, naphtha, kerosine, gas oil, reduced crude oil, and other products.

While secondary units were gearing up for startup at the time, IOC Director Sanjiv Singh said full commissioning of the integrated refining complex likely would take 6-8 months.

The $5-billion grassroots refinery, which began some startup activities in early 2014, initially was scheduled to become fully operational in November 2013, with additional commissioning of units subsequently rescheduled for December 2014 (OGJ Online, Aug. 14, 2014).

By late November 2014, however, local media reported official commissioning at Paradip would not occur until late March or early April (OGJ, Dec. 1, 2014, p. 34).

Production from the refinery will be transported domestically via pipeline (20-25%), rail (20-25%), trucking (15-20%), with coastal movement of products (40-50%), including exports, to be shipped through a southern jetty at the complex owned by Paradip Port Trust, the company said.

Configured to process a broad basket of crudes, including less expensive heavy and high-sulfur crude grades, to produce Euro 4 and Euro 5-standard fuels, the refinery has an overall Nelson complexity factor of 12.2.

TRANSPORTATION — Quick Takes

First cargo shipped from Gladstone LNG

The Santos Ltd.-led $18 billion Gladstone LNG (GLNG) project on Curtis Island in Queensland has shipped its first cargo of LNG.

The vessel Sri Bakti, owned by project partner Petronas of Malaysia, set sail for Incheon in South Korea with the inaugural cargo for another project partner, Korea Gas.

Project construction began in 2011 and saw more than $15 billion invested Australia-wide according to outgoing Santos Chief Executive Officer David Knox. About $8 billion of that was in Queensland.

It involved coal seam gas developments in the Surat and Bowen basins in southeast Queensland and a 420-km gas pipeline to feed the two LNG trains on Curtis Island on the coast.

Work on Train 2 of the project is continuing and is expected to be completed by the end of the year. First LNG from Train 2 is scheduled for the second quarter of 2016.

When fully operational, GLNG will produce a total of 7.8 million tonnes/year of LNG.

GLNG is Australia's fifth operating LNG project. Another five are progressing towards completion in the country.

KMI, BP form terminal business JV

Kinder Morgan Inc. (KMI) has finalized agreements with BP Products North America Inc. to acquire 15 refined products terminals and associated infrastructure in the US in a deal valued at $350 million.

KMI and BP will form a joint venture limited liability company terminal business to own 14 of the acquired assets, which Kinder Morgan will operate and market on the venture's behalf. One terminal will be owned solely by KMI.

The terminals, with 9.5 million bbl of storage, are pipeline-connected to key refining and processing centers across the US and offer extensive truck, vessel, and barge access and terminal service capabilities, KMI says. In connection with the deal, BP will enter into commercial agreements securing long-term storage and throughput capacity from the JV, which plans to market additional capacity to third-party customers.

The deal is expected to close in first-quarter 2016.

KMI will own 75% interest in the venture, with BP owning the balance. The terminals are in the Midwest, Northeast, Southeast, and on the West Coast.