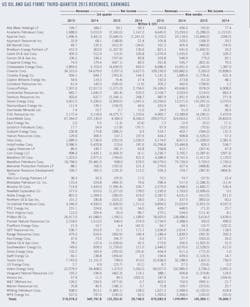

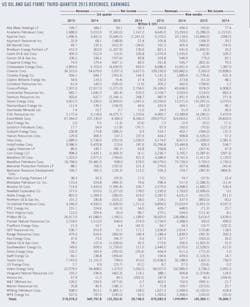

Third-quarter results bleak on weak oil prices, impairments

Conglin Xu

Senior Editor-Economics

Laura Bell

Statistics Editor

Most North American exploration and production companies reported losses in this year's third quarter because of tight operating margins and major asset impairments.

Refiners' earnings, meanwhile, jumped over the same period aided by lower oil prices and strong US gasoline demand. Integrated firms' rising profits from downstream operations provided a hedge against losses from exploration and production activities.

Prices, refining margins

Oil prices continued to plunge in the third quarter. The average price for West Texas Intermediate crude, the domestic benchmark, fell 24% to finish the quarter at $45.06/bbl, while the Brent price, the global benchmark, fell 22% to $47.29/bbl.

During the quarter, total US crude oil production of 9.37 million b/d was up 6% from a year ago but down 0.4% from this year's second quarter, according the US Energy Information Administration.

Front-month natural gas contracts on the New York Mercantile Exchange averaged $2.73/MMbtu in this year's third quarter vs. $3.95/MMbtu a year earlier.

According to Muse, Stancil & Co., US refining cash margins in this year's most recent quarter averaged $25.67/bbl for the West Coast, $12.62/bbl for the Gulf Coast, $6.88/bbl for the East Coast, and $24.12 for the Midwest. In the same quarter of last year, cash margins for these areas were $16.65/bbl, $8.94/bbl, $5.68/bbl, and $19.23/bbl, respectively.

US producers

ExxonMobil Corp. reported earnings of $4.38 billion for the third quarter, down 47% from third-quarter 2014. Revenues for the 3 months were $67.34 billion, down 37% year-over-year. Capital and exploration expenditures totaled $7.7 billion, down 22%.

On an oil-equivalent basis, the company's production increased 2.3% from a year ago. Upstream earnings were $1.4 billion in this year's third quarter, down $5.1 billion from third-quarter 2014 because of lower liquids and gas realizations. US upstream earnings declined $1.7 billion year-over-year to a loss of $442 million in the most recent quarter.

ExxonMobil's downstream earnings were $2 billion in this year's third quarter, up $1 billion from third-quarter 2014, getting a boost from stronger margins.

Chevron Corp. posted earnings of $2 billion for this year's third quarter, which was down 63% from third-quarter 2014. The company's US upstream operations incurred a loss of $603 million in the third quarter compared with earnings of $929 million a year earlier. US downstream operations earned $1.2 billion in the third quarter, up from earnings of $809 million during the same quarter a year earlier.

During the third quarter, many E&P companies took large writedowns on their oil and gas properties.

Devon Energy Corp. reported a third-quarter loss of $3.9 billion on asset impairment of $5.85 billion, the largest impairment of the quarter. Devon has been recording asset impairments all this year, totaling $15.48 billion.

Chesapeake Energy Corp. reported a net loss of $4.6 billion for the third quarter, reflecting a $5.42-billion writedown on some of its oil and gas assets. During the first 9 months of the year, the company's impairments of oil and gas properties totaled $15.4 billion.

EOG Resources Inc. reported a third-quarter loss of $4.1 billion, mainly due to a $4.1-billion writedown of assets. Apache Corp. reported a loss of $5.56 billion on a $3.7-billion writedown. Occidental Petroleum Corp. posted a loss of $2.6 billion for the quarter after it recorded $2.6 billion in aftertax charges. Murphy Oil Corp.'s net loss of $1.6 billion for the quarter included a noncash impairment of oil and gas properties of $2.3 billion. Whiting Petroleum Corp. recognized $1.7 billion in noncash pretax impairment charges.

Pioneer Natural Resources Co. reported third-quarter net income of $646 million compared with $374 million in last year's third quarter. The firm's third-quarter earnings included a gain of $499 million related to the sale of PNR's Eagle Ford Shale midstream business.

Refiners

Valero Energy Corp. reported net income of $1.37 billion in this year's third quarter compared with $1.1 billion in third-quarter 2014. The company's refining segment generated third-quarter operating income of $2.3 billion compared with $1.7 billion in third-quarter 2014 due to stronger throughput margins.

HollyFrontier Corp. posted third-quarter net income of $210 million, up from $187 million in the same period of 2014. Included in the current quarter results was a noncash inventory valuation charge that decreased aftertax earnings by $146.3 million.

Tesoro Corp. reported third-quarter net income of $799 million compared with net income of $413 million for third-quarter 2014. The increase was driven by a favorable market environment and strong performance across all business segments.

Phillips 66 Co. reported that higher refining capacity utilization and product margins helped boost its third-quarter net income to $1.6 billion from $1.2 billion a year earlier. Refining adjusted earnings were $1.05 billion in the third quarter compared with $604 million in the second quarter.

Canadian firms

All financial figures in this section are presented in Canadian dollars unless noted otherwise.

EnCana Corp. reported a net loss of $1.65 billion in third-quarter 2015 compared with net earnings of $3.79 billion a year earlier. In the third quarter and first 9 months of 2015, the company recognized aftertax noncash ceiling test impairments of $1.066 billion and $3.616 billion, respectively, in the US cost center. Revenues fell 43% to $1.75 billion on lower commodity prices and lower gas volumes.

Suncor Energy Inc. reported a net loss of $376 million in this year's third quarter compared with net earnings of $919 million in the same quarter in 2014. Net loss for the most recent quarter included an unrealized aftertax foreign exchange loss of $786 million on the revaluation of US dollar denominated debt.

The company's third-quarter operating earnings were $410 million compared with $1.3 billion for the same quarter in the prior year. The decrease was driven by significantly lower upstream price realizations, partially offset by increased E&P and oil sands production, a favorable downstream pricing environment, stronger refinery utilization, lower operating costs, and lower royalties compared with third-quarter 2014.

Husky Energy Inc. recorded a net loss of $4.1 billion in the third quarter, including an aftertax impairment of $3.8 billion and a writedown of $167 million related to legacy oil and natural gas assets in Western Canada.

Cenovus Energy Inc.'s net earnings were $1.8 billion in the third quarter-a more than fivefold increase from the same period a year earlier. The increase was primarily due to an aftertax gain of $1.9 billion resulting from the disposition of Cenovus's royalty and fee land business as well as a $385-million deferred tax recovery associated with Cenovus's US refining assets.

The company's cash flow was $444 million in the third quarter, 55% lower than in the same period in 2014 mainly because of lower crude oil and gas prices.