OGJ Newsletter

GENERAL INTEREST — Quick Takes

Former Chesapeake Energy CEO dies in car crash

Aubrey K. McClendon, chairman and chief executive officer of American Energy Partners LP (AEP) and former chief executive officer of Chesapeake Energy Corp., died in a car crash in Oklahoma City on Mar. 2, KFOR in Oklahoma City reported.

McClendon on Mar. 1 was indicted by a federal grand jury for conspiring to rig the price of oil and natural gas leases in Oklahoma. American Energy Partners subsequently released the following statement from McClendon:

"The charge that has been filed against me today is wrong and unprecedented. I have been singled out as the only person in the oil and gas industry in over 110 years since the Sherman Act became law to have been accused of this crime in relation to joint bidding on leasehold," McClendon said.

"Anyone who knows me, my business record, and the industry in which I have worked for 35 years, knows that I could not be guilty of violating any antitrust laws. All my life I have worked to create jobs in Oklahoma, grow its economy, and to provide abundant and affordable energy to all Americans. I am proud of my track record in this industry, and I will fight to prove my innocence and to clear my name," he stated.

McClendon launched American Energy Partners in 2013 "to capitalize on opportunities available in unconventional resource plays onshore in the US (OGJ Online, June 9, 2014)."

The move almost immediately followed his departure from Chesapeake, which he cofounded in 1989, amid allegations of inappropriate behavior including running an energy-focused hedge fund from Chesapeake's offices and personally borrowing $1.3 billion from the company's business partners (OGJ Online, Jan. 31, 2013).

Pemex defers projects, cuts 2016 budget by $5.5 billion

Petroleos Mexicanos (Pemex) has reduced its 2016 capital budget by 22% compared with that of 2015 to $20.8 billion. The firm says the sharp decline in crude oil prices "poses serious liquidity problems" necessitating the downward revision.

Deferred projects are expected to comprise $3.6 billion of the reduction, which includes deepwater projects. Operational efficiencies are expected to make up another $1.6 billion.

The firm reported a 2015 net loss of $32 billion, roughly double that of a year ago.

Petronas makes up to 1,000 jobs redundant

Malaysia's state-run Petronas plans to reduce capital and operating expenditures by $12 billion over the next 3 years, starting with $3.6-4.8 billion in 2016. The move comes with a companywide reorganization that will result in about 1,000 redundancies.

Effective Apr. 1, executive leadership will in part consist of Datuk Wan Zulkiflee Wan Ariffin, president and group chief executive officer; Datuk Mohd Anuar Taib, executive vice-president and chief executive officer, upstream; and Md Arif Mahmood, executive vice-president and chief executive officer, downstream.

"Exhaustive efforts are ongoing to redeploy affected employees," the firm said, adding that it "will further embark on a separation exercise for these employees as needed, which is expected to be completed over the next 6 months."

Datuk Wan Zulkiflee noted the budget cuts will impact some of Petronas's capital projects. "At this point, we have taken the decision to rephase the Petronas Floating LNG 2 [(PFLNG2)] project (OGJ Online, Feb. 14, 2014), to be commissioned at a later date than originally planned," he said.

The 1.5-million tonnes/year PFLNG2, originally slated to begin production in 2018, is to be moored at Rotan gas field on deepwater Block H offshore Sabah.

Encana further cuts 2016 budget by 40%, jobs by 20%

Encana Corp., Calgary, will further cut its planned capital budget for 2016 to $900 million-$1 billion, down 40% from its initial budget for the year and 55% from its 2015 capital investment (OGJ Online, Dec. 14, 2015).

The additional drop includes a 20% workforce reduction, bringing the firm's total workforce reduction since 2013 to more than 50%.

The firm says the reduction will have minimal impact on 2016 production, which is expected to range 340,000-360,000 boe/d. The company estimates total liquids volumes will average 120,000-130,000 b/d with natural gas production ranging 1,300-1,400 MMcfd.

Encana also reported a 2015 net loss of $5.2 billion, largely attributable to after-tax noncash ceiling test impairments totaling $4.1 billion and a nonoperating foreign exchange loss of about $700 million.

Exploration & Development — Quick Takes

Revised plan pushes Leviathan development

Partners in deepwater Leviathan natural gas field offshore Israel have filed a revised development plan that increases production capacity to 21 billion cu m (bcm)/year from 16 bcm/year in the original plan. Development would be based on subsea completions linked by pipeline to a fixed platform.

Delek Group, whose subsidiaries Avner Oil Exploration LP and Delek Drilling LP, hold interests in the giant field, said the revision accommodates the gas framework agreement Leviathan partners reached with the government in December and advances development (OGJ Online, Dec. 17, 2015).

Prime Minister Benjamin Netanyahu earlier this month made a rare personal appearance before the High Court to defend the framework agreement, which continues to face political opposition (OGJ Online, Feb. 15, 2016).

Delek said the revised development plan anticipates a final investment decision in the fourth quarter this year and a production start in the fourth quarter of 2019.

Noble Energy Inc. operates Leviathan field, which is in 1,645 m of water 130 km off Haifa. In addition to Leviathan development, the framework agreement covers expansion of production from nearby Tamar field, which produced an average 800 MMcfd last year, Noble said.

Delek said the revised Leviathan plan calls for eight production wells initially, two of which have been drilled. Development might occur in stages of four wells each.

A subsea pipeline would link wells with a fixed platform containing treatment equipment. Delek didn't specify the platform's location. From the platform, a pipeline with capacity of 12 bcm/year would carry treated gas to a connection point with the Israel National Gas Lines Ltd. system.

A separate pipeline from the platform with capacity of as much as 12 bcm/year would carry gas for export.

In a phased development, treatment capacity on the platform would be 12 bcm/year in the first stage and 9 bcm/year in the second.

Delek said the estimated cost of Leviathan development has been lowered to $5-6 billion from $6-7 billion in the original plan.

Leviathan interests are Noble Energy Mediterranean Ltd. 39.66%, Delek Drilling and Avner Oil Exploration 22.67% each, and Ratio Oil Exploration (1992) LP 15%.

Eni progresses on Egypt appraisal drilling

Eni SPA has completed drilling its first appraisal well of the Zohr discovery on the Shorouk block offshore Egypt (OGJ Online, Sep. 7, 2015). The Zohr 2X well was drilled to 13,684 ft, encountering 1,614 ft of continuous hydrocarbon column in a carbonate sequence with 305 m of net pay. The well is 1.5 km southeast of Zohr 1X and down-dip of the initial discovery in 4,800 ft of water.

The formation evaluation program has confirmed the same gas-water contact and connection with the initial Zohr discovery well, forming a "continuous mega tank of natural gas," the company said.

The Zohr prospect if fully comprised within Egypt's exclusive economic zone on the Shorouk block. Eni is arranging a production test for the latest well, and the company is laying plans for three additional appraisal wells to fully delineate the giant field. Potential for Zohr discovery is estimated at 30 tcf of lean gas in place, or 5.5 billion boe.

Additionally, Eni drilled the Nidoco North 1X well in Abu Madi West license to evaluate the Nooros East prospect in Egypt's Nile Delta. The well was drilled onshore as a deviated well to the Nooros East field offshore. The well encountered 43 m of net gas and condensate bearing sandstone layers of Messinian age.

The company began producing from the Nooros area in September 2015 and expects to ramp up the latest near-field discovery by the end of March (OGJ Online, Oct. 29, 2015).

Eni holds a 100% share in the Zohr prospect, through its subsidiary IEOC Production BV. The company holds a 75% stake in the Abu Madi West concession with partner BP PLC holding 25%.

Mozambique approves Coral discovery development

Rovuma basin offshore Mozambique will soon see the first development granted for the region. Eni SPA has reported that the government of Mozambique's Council of Ministers granted its plan to drill and complete six subsea wells and construct and install a floating LNG facility with a capacity of 3.4 million tonnes/year (OGJ Online, Oct. 16, 2014). The approval relates to the first phase of development of 5 tcf of gas in the Area 4 permit.

The Coral discovery was made in 2012 and delineated in 2013 (OGJ Online, Feb. 26, 2013). It lies in 2,000 m of water about 80 km offshore in Palma Bay in the northern province of Cabo Delgado. To date, exploration drilling has proved a field of Eocenic age, which is estimated to contain 15 tcf of gas in place, wholly located in Area 4.

Eni and its partners are also pursuing development of the Mamba discovery, which was granted a unitization agreement with Area 1 in December 2015 (OGJ Online, Dec. 3, 2015).

Eni is operator of Area 4 with a 50% indirect interest, owned through Eni East Africa (EEA), which holds a 70% stake. Galp Energia, Korea Gas Corp., and Mazambique's state Empresa Nacional de Hidrocarbonetos (ENH) have 10% each. China National Petroleum Corp. owns 20% indirect interest in Area 4 through EEA.

Rex expands exploration at Moraine East, Warrior North

Rex Energy Corp., State College, Pa., has entered a joint-venture agreement to develop 58 wells in its Moraine East and Warrior North prospects in Pennsylvania and Ohio, respectively.

An affiliate of Benefit Street Partners LLC (BSP) has committed to fund 15% of the first 16 wells in Moraine East, 12 of which have already been drilled and completed (OGJ Online, Mar. 31, 2015); and 65% of six wells in Warrior North, of which three have been drilled and completed.

The $175-million JV also earns BSP a 15-20% assignment in Moraine East and Warrior North for all acreage within each unit in which it participates.

The exploration and development agreement covers 42,000 acres in Moraine East and about 6,300 acres in Warrior North. Initial commitment for 22 wells is $37 million, with a cash reimbursement of $20 million for 15 wells drilled and completed in 2015 once those are placed into sales. The company has an option to participate in 36 additional wells for an incremental capital commitment of $138 million.

Drilling & Production — Quick Takes

Production drilling started on Johan Sverdrup

Production drilling has commenced on the first of a total of 35 wells to be drilled during Phase 1 of the Johan Sverdrup field development offshore Norway in the North Sea, operator Statoil ASA reported.

The well is being drilled using Odfjell Drilling's Deepsea Atlantic semisubmersible drilling rig. The rig is drilling the first production well through a predrilling template that was installed on the field in summer 2015. A total of eight wells will be drilled through the predrilling template before the rig is relocating to drill injection wells on three locations in the field.

In 2018, the permanent Johan Sverdrup drilling platform will be installed as the second of four platforms. The drilling platform is currently being constructed at Aibel's yard in Haugesund, north of Stavanger, and in Thailand.

When the drilling platform is installed and operational, the eight predrilled wells will be hooked up from the predrilling template. At this point, Deepsea Atlantic will drill the injection wells providing reservoir pressure support to maintain high field production.

A 1.5-billion kroner contract for integrated drilling services was let to Baker Hughes Inc. in July 2015. The contract for rig and drilling services on Johan Sverdrup, totaling more than 4.35 billion kroner, was let to Odfjell Drilling in June 2015. Contracts worth more than 50 billion kroner have been let by the Johan Sverdrup project.

Johan Sverdrup has estimated resources of 1.7-3 billion boe. Peak production will be equivalent to 25% of all Norwegian petroleum production, Statoil said. First-phase production is expected to reach 315,000-380,000 b/d of oil with peak production pegged at 550,000-650,000 b/d.

Partners in the project inclue Statoil 40.0267%, Lundin Norway 22.6%, Petoro 17.36%, Det norske oljeselskap 11.5733%, and Maersk Oil 8.44%.

Vega Pleyade field starts up off Argentina

Production has started from Vega Pleyade natural gas and condensate field offshore Tierra del Fuego, Argentina, reports operator Total SA (OGJ Online, Oct. 24, 2013).

The field can produce 10 million cu m/day.

Total developed it with a wellhead platform in 50 m of water tied back via a 77-km pipeline to onshore Rio Cullen and Canadon Alfa onshore treatment facilities, also operated by Total.

Total said Vega Pleyade is the world's southernmost gas development.

The field is in the Cuenca Marina Austral 1 Concession, interests in which are Total and Wintershall Energia 37.5% each and Pan American Energy 25%.

Other fields in the concession are Ara and Canadon Alfa, both onshore, and Hidra, Kaus, Argo, Carina, and Aries, offshore.

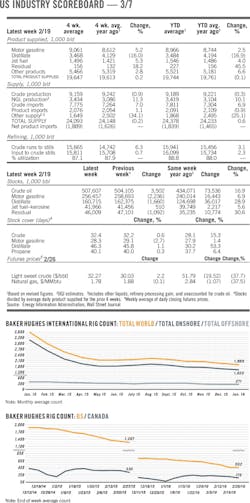

EIA: US crude output averaged 9.43 million b/d in 2015

US crude oil production in 2015 averaged 9.43 million b/d, up from 8.71 million b/d in 2014, according to data from the US Energy Information Administration. The increase in output shrunk to 722,000 b/d in 2015 from 1.25 million b/d in 2014.

The latest "Monthly Crude Oil, Lease Condensate, and Natural Gas Production Report," released in tandem with the Petroleum Supply Monthly (PSM), shows output in December averaged 9.26 million b/d, down from 9.31 million b/d in November and 9.43 million b/d in December 2014.

Texas crude production fell to 3.34 million b/d in December from 3.41 million b/d in November and 3.51 million b/d in December 2014. During the year, Texas averaged 3.46 million b/d, compared with 3.17 million b/d in 2014.

North Dakota crude production dropped to 1.14 million b/d in December from 1.17 million b/d in November and 1.23 million b/d in December 2014. For 2015, North Dakota averaged 1.17 million b/d, up from 1.09 million b/d in 2014.

Federal offshore Gulf of Mexico, meanwhile, posted an increase in December to 1.63 million b/d from 1.52 million b/d in November and 1.45 million b/d in December 2014. During 2015, the US gulf averaged production of 1.54 million b/d, up from 1.4 million b/d in 2014.

PROCESSING — Quick Takes

Texas ethane cracker on track for 2017 startup

Occidental Chemical Corp. (OxyChem) and Mexichem SAB de CV (Mexichem) remain on schedule to commission their 50-50 joint venture Ingleside Ethylene LLC's 1.2 billion-lb/year (550,000-tonne/year) ethane cracker at Ingleside, Tex., in early 2017. The cracker is due to enter operation and reach full rates of production during first-quarter 2017, as originally planned (OGJ Online, Nov. 1, 2013), Mexichem said.

Currently under construction at OxyChem's existing plant in Ingleside, the $1.5-billion cracker will process ethane feedstocks from US shale gas supplies to supply OxyChem with an ongoing source of ethylene for manufacturing vinyl chloride monomer, which Mexichem will use to produce polyvinyl chloride resin and PVC piping systems (OGJ Online, Dec. 17, 2014).

Braskem's Triunfo petrochemical unit due upgrade

Braskem SA, a subsidiary of Odebrecht SA, will invest 45 million Brazilian real ($11.3 million) to upgrade electrical systems at its basic petrochemical unit 2 (Unib 2) in the Triunfo petrochemical complex in Brazil's Rio Grande do Sul state.

Designed to improve receipt and distribution of electricity at the plant, the two-part project will involve improvements to the high-voltage main substations of the operating units, as well as work to modernize and optimize the plant's load-shedding system to combat situations of possible shortfalls in electricity supply from the local utility company, Braskem said.

The planned investment also will include installation of transformers and high-power panels, as well as replacement of power cables and high-voltage distribution controls.

Commissioned in 2010, Unib 2 uses a feedstock of 100% sugarcane ethanol to produce 200,000 tonnes/year of ethylene which is converted into an equivalent volume of polyethylene at other processing units within the Triunfo complex, according to Yokogawa Electric Corp., which served as main automation contractor for the plant's construction.

PGN advances Gaviao Branco development project

Fluor Corp., Construcap CCPS Engenharia e Comercio SA, and their 50-50 Brazilian joint venture CFPS Engenharia e Projetos SA have completed work on Parnaiba Gas Natural's onshore project to enable development of Gaviao Branco natural gas field in Maranhao, Brazil. The consortium, which handled engineering, procurement, construction, commissioning, and startup of an 8.5-million cu m/day gathering system and 70-km gas pipeline, has turned the project over to PGN on time, bringing Gaviao Branco field into commercial operation, Fluor said.

Alongside enabling tie-in of Gaviao Branco Sudeste field later during first-quarter 2016, the completed gathering system also will provide the tie-in point for Gaviao Caboclo and Gaviao Branco Norte fields in the future, the service provider said.

With first gas extraction occurring in early February, Gaviao Branco field has an estimated 3.24 billion cu m of gas in place and will produce at a rate of 1.5 million cu m/day, PGN said.

Gas from the gathering and production station will travel via pipeline to a gas treatment unit in Santo Antonio dos Lopes, Maranhao, before moving to the Parnaiba Thermoelectric Complex operated by ENEVA.

TRANSPORTATION — Quick Takes

Group cancels Douglas Channel LNG project

Work has ceased on the Douglas Channel LNG project near Kitimat, BC (OGJ Online, Jan. 29, 2015).

Exmar NV, EDF Trading, and AIJVLP, a joint venture of AltaGas Ltd. and Idemitsu Kosan Co. Ltd., planned a 550,000-tonne/year, barge-mounted floating facility based on natural gas moved from western Canada via the Pacific Northern Gas Ltd. system.

"The worsening global energy price levels and a challenging market environment have caused the consortium to withdraw from the project," the group said.

Framework deal signed for Horn of Africa fuel line

Partners have signed a framework agreement for the construction of a 550-km, 240,000-b/d pipeline that will transport jet fuel, diesel, and gasoline from the port of Djibouti on the Gulf of Aden to storage facilities in Awash, near the capital city of Addis Ababa in central Ethiopia.

Known as the Horn of Africa Pipeline, the system will cost $1.55 billion to build, partners say, and will ease pressure on the landlocked nation's current supply route, which requires the daily use of 500 tanker trucks.

The Horn of Africa system is being developed by Black Rhino MOGS, a joint venture of investment company Black Rhino Group and South Africa-based Mining, Oil & Gas Services Ltd. (MOGS), itself a wholly owned subsidiary of Royal Bafokeng Holdings. Global consultancy Turner & Townsend was let the contract to product-manage the line's construction.

The project is currently in the set-up phase, with detailed design and procurement due to take place over the coming months. The project, which will use 20-in. steel pipeline, includes the creation of an import facility and a buffer storage tank farm in Damerjog, Djibouti, which will be linked to a storage terminal and truck-loading facility in Awash.

Ethiopia's demand for refined oil products is rising at a rate of more than 15% year-on-year. Compared to historically similar countries in a similar development path, Ethiopia's demand for fuel is projected to rise at about 20%/year.

The Horn of Africa line is expected to be fully operational by fourth-quarter 2018.

Medallion seeks to expand Permian crude system

Medallion Pipeline Co. LLC, a subsidiary of Medallion Midstream LLC, is holding a binding open season to solicit long-term commitments from shippers for firm transportation capacity on the fourth major expansion of its existing 370-mile crude oil pipeline system. The Crane Extension is a proposed 100,000 b/d bidirectional crude oil pipeline reaching about 25 miles in a southwesterly direction from Medallion's existing Midkiff Station in northwest Upton County, Tex., to an interconnection with Magellan Midstream Partners' Longhorn Pipeline in east Crane County, Tex. Both counties are in the Permian basin south of Midland-Odessa, Tex.

An integral part of the extension is a proposed 25,000 b/d expansion of Medallion's existing Midkiff Lateral, extending in a northwesterly direction from Midkiff Station to the Garden City Station in Glasscock County, Tex. As part of the Midkiff expansion, the existing Midkiff Lateral will be reconfigured for bidirectional operations.