Oil demand is often viewed as being determined by the state of the global economy. Given that crude oil is storable, the real price of oil also depends on the demand for storage. But limited attention has been put on the role of inventories in smoothing oil consumption and in providing speculative trading opportunities.

As speculative demand movements cannot be inferred directly from what's observable, an important question in practice is how to distinguish the speculative demand component of real crude oil prices from the normal flow of everyday demand and supply.

These speculative demand forces, or shocks, can be identified within the context of structural econometric models. Lutz Kilian and Dan Murphy, two professors at the University of Michigan, developed a four-variable structural vector autoregression (SVAR) model of the global crude oil market using sign restrictions in 2010, which explicitly allows for shocks to the speculative demand for oil as well shocks to flow demand and flow supply.1

The speculative component of the real price of oil is identified with the help of data on oil inventories. As elaborated by Kilian and Murphy, the accumulation of inventories is accomplished by a reduction in oil consumption (reflected in lower global real activity) and an increase in oil production, as the real price increases. Both flow demand shocks and speculative demand shocks have an expectational component. The feature that distinguishes flow demand shocks from speculative demand shocks is that positive flow demand shocks necessarily involve an increase in the demand for consumption in the current period, whereas speculative demand shocks do not.

So why not include the oil futures spread? According to Kilian and Murphy, this is because there is an arbitrage condition linking the futures and spot markets for crude oil. To the extent that speculation drives up the futures price, arbitrage will ensure that oil traders buy inventories in the spot market in response. Thus the analysis can focus on quantifying speculation in the spot market with the help of the oil inventory data without loss of generality.

The structural model of the global oil market may be written as

. Let yt be a 4×1 vector of endogenous variables including the percent change in global crude oil production, a measure of global real activity, the real price of crude oil, and the change in global crude oil inventories above the ground. εt is the vector of orthogonal structural innovations, and Bi denotes the coefficient matrices. The vector εt consists of four structural shocks: flow supply shock, flow demand shock, speculative demand shock, and a residual shock. Flow demand shock refers to the demand for crude oil and other industrial commodities that is associated with fluctuations in the global business cycle.

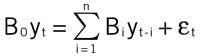

Different from traditional short-run restriction methods, the proposed SVAR model is identified by sign restrictions on impact responses and boundaries on the implied price elasticity of oil demand and oil supply. Sign restrictions involve the assumption of impulse responses to structural shocks (Fig. 1).

Prices in 2015

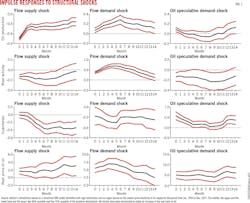

A historical decomposition exercise based on the model (Fig. 2) shows that speculative oil demand once rebounded during 2015 to support real oil prices, after dropping dramatically since mid-2014. This might reflect stockpiling in some oil-importing countries.

The inclusion of oil inventory data to VAR variables can improve forecasting performance, as inventories provide important forward-looking information.

Alquist et al. demonstrate that a VAR model with global oil supply, Kilian's dry cargo shipping rate index (a measure of global real economic activity), and crude oil inventories outperforms the futures forecast and other models for short forecast horizons up to 9 months.2 This result also holds in real time, as shown by Baumeister and Kilian.3 These VAR forecasts are found to be robust to various changes in model specification and estimation methods, including Bayesian estimation. Although a study from IMF shows that there could be forecasting instability related to small alternations, it still supports the overall strength of the 4-variable VAR model.4

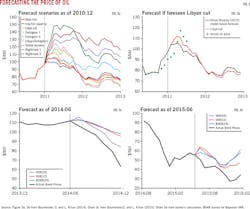

In particular, Baumeister and Kilian provide evidence that, using the four-variable VAR with 24-month lags (Fig. 3c), more than half of the observed decline in the price of oil was predictable in real time as of June 2014.5 As another experiment, the VAR forecast predicts the pattern of the evolution of the real price of oil from late 2015 to early 2016 (Fig. 3d).

Importantly, the structural VAR model paves the path for conducting scenario forecasts and risk analysis.

Forecast scenarios

The baseline forecast of a reduced-form VAR model corresponds to the expected change in the real price of oil conditional on all future shocks being zero. Departures from this benchmark can be constructed by feeding specified sequences of future structural shocks into the VAR model and projecting the dependent variable into the future.

Baumeister and Kilian illustrated the use of these tools through an application to real-time data for December 2010.3 Forecast scenarios as of December 2010 involve the unexpected return of Iraqi oil, Libyan production shortfall, global economic recovery, and a couple of others (Fig. 3a). They show how alternative forecast scenarios could have generated very different outcomes. Correct judgments can improve forecast accuracy (Fig. 3b).

Risk analysis

These forecast scenarios can be weighted by their respective probabilities, allowing the construction of a probability-weighted predictive density for the real price of oil.

References

1. Kilian, L., D. P. Murphy, "The Role of Inventories and Speculative Trading in the Global Market for Crude Oil." Journal of Applied Econometrics, 2014, 29: 454-478.

2. Alquist, R., L. Kilian, and R. J. Vigfusson, "Forecasting the Real Oil Price," the Handbook of Economic Forecasting, 2013, Amsterdam: North Holland.

3. Baumeister, C., L. Kilian, "Real-Time Forecasts of the Real Price of Oil," IMF Economic Review, 2014, vol.62(1), pages 119-145, April.

4. Benjamin Beckers, Samya Beidas-Strom, "Forecasting the Nominal Brent Oil Price with VARs-One Model Fits All?" IMF Working paper, 2015, WP/15/251

5. Baumeister, C., L. Kilian, "Understanding the Decline in the price of Oil since June 2014", the Journal of the Association of Environmental and Resource, 2016, 3(1), 131-158.

About the Author

Conglin Xu

Managing Editor-Economics

Conglin Xu, Managing Editor-Economics, covers worldwide oil and gas market developments and macroeconomic factors, conducts analytical economic and financial research, generates estimates and forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 2012 as Senior Economics Editor.

Xu holds a PhD in International Economics from the University of California at Santa Cruz. She was a Short-term Consultant at the World Bank and Summer Intern at the International Monetary Fund.