Ranger posts first-quarter net loss, adds Eagle Ford inventory

Ranger Oil Corp., Houston, increased the mid-point of its 2022 outlook for sales volumes while maintaining its full year 2022 drilling and completion (D&C) capital investment guidance of $375-425 million.

The company is remaining committed to “preserving the strength of our balance sheet, making disciplined capital investments, and generating free cash flow…to allow for the return of cash to shareholders,” said Darrin Henke, Ranger president and chief executive officer, in a May 4 earnings release.

The company authorized a $100-million share repurchase program and plans to initiate annualized dividend of $0.25/share ($0.0625/share quarterly) beginning third-quarter 2022.

The company reported a first-quarter 2022 net loss of $20.7 million, primarily related to derivative losses of $167.9 million. Adjusted net income was $98.7 million, primarily due to non-cash derivative loss adjustments of $118.9 million.

D&C spend during the quarter was $82.8 million, below the mid-point of guidance. Total operating expenses for the quarter were $101.0 million.

Oil sales during the quarter were 26,980 b/d, at the upper end of guidance. Total sales volumes for the quarter exceeded the mid-point of guidance and were 37,752 boe/d (71% crude oil, 86% liquids).

Outlook

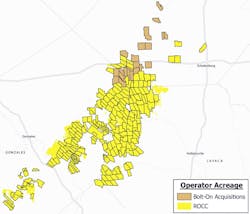

Ranger said its shift to longer lateral wells (full year 2022E/2023E avg: 11,000 ft) is expected to result in an increase in sales volumes in second-half 2022. Total sales volumes for the year are guided to 39,000-41,000 boe/d, excluding any impact from agreements to acquire three oil producing properties in the Eagle Ford shale contiguous to the company’s existing assets in South Texas. The $64-million transactions, reported by the company May 3, are expected to close in third-quarter 2022. Full-year guidance will be updated.

The deals add some 17,000 net acres—with production around 1,000 boe/d (65% oil, 87% liquids)—a 10% increase in net acres from yearend 2021 to more than 155,000.

A May 4 investor presentation noted the company’s plan to operate two continuous drilling rigs, “with an occasional spot rig to maximize efficiencies.”

D&C spend of $110-125 million is expected in this year’s second quarter.

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.