Construction costs increased again in third-quarter 2021

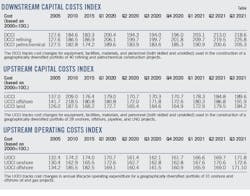

IHS Markit indices are proprietary measures of cost changes similar in concept to the Consumer Price Index (CPI) and draw upon proprietary IHS Markit tools to provide a benchmark for comparing construction costs around the world. Construction costs are tracked on a quarterly basis and then reported as an index value to show how upstream and downstream project costs have changed. An index of 170.3 means that construction costs have increased 70.3% from the base year in 2000.

Capital costs index for downstream projects (DCCI) increased 2.6% quarter-on-quarter (q-o-q) during third-quarter 2021. Material costs were the biggest drivers during the quarter. Steel costs increased 12%, and equipment costs increased 3%. Equipment manufacturers were passing higher costs through to buyers. The largest equipment price increases were in North America. This coincided with higher steel costs in North America compared to other regions. Total project costs didn’t increase at a greater rate due to how steel is weighted within the DCCI portfolio model. Wages and engineering charge out rates declined 0.1% and 0.9% respectively. Downstream project activities were still limited due to lower expenditure levels.

Supply chain issues continued to be a thorn in the side of rising project costs. Premiums have been placed on orders to account for rising supply chain costs. Regardless of these premiums it still took longer to deliver goods, which had a knock-on effect to project scheduling. Supply chain problems are expected to persist until early 2023.

Specifically, the DCCI refining index increased 2.9% q-o-q during third-quarter 2021. Procurement of steel and equipment increased due to higher raw material costs, supply shortages, and supply chain issues. Equipment manufacturers were struggling to rehire labor after cutting workforces at the start of the pandemic.

While demand for most refined products is expected to reach pre-pandemic levels in 2022, refiners in most regions are aware that the global refining industry is facing a surplus of refining capacity, a reality that was evident even before the onset of the COVID-19 pandemic. Although global EPC spending is now expected to recover from losses in 2020 and grow by 27% in 2021, reaching $32.3 billion, much of the spending increase in 2021 had been supported by cost growth. We are expecting a steady decline in spending through to 2024, and we are tentatively predicting the beginning of another capacity build-up cycle in 2025 based on current project forecasts, although this will be smaller than the previous cycle.

The DCCI petrochemical index increased 2.3% q-o-q during third-quarter 2021, driven by higher steel costs and nonferrous metal costs. The latest petrochemical construction cycle resulted in a 19% increase in total nameplate capacity between 2017 and 2021, and a total investment of $556 billion. While petrochemical investment is expected to slow down over the forecast period, we are still expecting total investments of around $427 billion between 2021 and 2025. Driven by an approximately 14% increase in total demand, nameplate capacity will increase by 10.6% between 2021 and 2025.

The cost of developing upstream oil and gas assets, as tracked by the IHS Markit Upstream Capital Costs Index (UCCI), increased 2.6% q-o-q in third-quarter 2021, spelling an overall rise of more than 11% year-on-year (y-o-y). While elevated oil prices have supported a recovery in the hydrocarbon sector, the increase in costs has been driven almost entirely by the rise in material prices, especially steel. Steel prices increased by over 15% this quarter due to persistently high raw material costs, supply-chain issues, and disruptions due to pollution control measures implemented in Mainland China.

Apart from steel, the equipment market was the only other UCCI upstream category to show an increase in costs of over 2% for the quarter. Both rising steel costs and supply-chain disruptions drove this rise in costs. Manufacturers faced production schedule delays and bottlenecks and were forced to search for alternative suppliers. Higher material costs and schedule disruptions also led to increased costs in the subsea equipment and fabrication yard markets.

The optimistic outlook for oil prices has led to an increase in rig demand, both offshore and onshore. Deepwater rigs drove the increase in offshore rig day rates, while land rigs benefited from operators’ preference of using super-spec rigs despite the higher rates.

Bulk materials, offshore installation vessels, and engineering and project management (EPM) rates all increased by only 0.1% in third-quarter 2021. Bulk material prices exhibited stronger growth in the local currency index. The offshore vessel market was still recovering from the effects of the 2020 downturn. Utilization rates for fleets were slowly improving, but the speed was different in different regions. For EPM, contracting activities for the quarter remained weak despite higher oil prices. Six contracts for front-end engineering and design (FEED) were awarded in the third quarter, helping to support overall EPM rates and employment.

For 2021, the UCCI is projected to increase with most of the growth driven by steel and raw material costs. In the next 5 years, the UCCI compounded annual growth rate (CAGR) will be over 2%, though longer-term projections are considerably milder. Supply chain issues, raw material costs, and steel prices are having the greatest impacts on the portfolio movements in the short term. Elevated oil prices should continue to support project activity over the next few years and lead to higher costs.

The global Upstream Operating Costs Index (UOCI) increased by 6% in the first three quarters of 2021. The recovery was primarily due to underlying raw material price increases over the course of 2021 with fuel, production chemicals, spare parts, and well materials all making significant gains. By far the largest increase in UOCI has been observed in Europe where recovering North Sea activity kept pace into third quarter, boosting demand for services and materials and enabling suppliers to ask for higher rates.

The UOCI growth is expected to slow in fourth-quarter 2021 but will continue into 2022 and beyond, subject to ongoing resilience of oil price and the reopening in the face of the ongoing pandemic.