Third-quarter earnings rally on higher commodity prices, refining margins

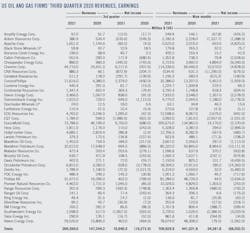

A group of 41 US-based oil and gas producers and refiners announced a total net income of $16.65 billion for third-quarter 2021, compared to loss of $16.67 billion in third-quarter 2020. Total revenues were $269.4 billion for the quarter, compared to $147.34 billion a year ago.

The improvement in earnings compared with the prior-year period was primarily due to higher realized selling prices with much improved oil market fundamentals. Brent crude oil prices averaged $73.47/bbl in third-quarter 2021, compared with $42.96/bbl a year earlier, and $68.83/bbl in second-quarter 2021. West Texas Intermediate (WTI) averaged $70.62/bbl in third-quarter 2021, compared with $40.89/bbl in third-quarter 2020, and $66.09/bbl in second-quarter 2021.

US crude oil production in third-quarter 2021 averaged 11.06 million b/d, compared with 10.79 million b/d a year earlier, according to the US Energy Information Administration (EIA). This is down from 11.22 million b/d in second-quarter 2021, primarily reflecting the impact of Hurricane Ida. Natural gas liquids production averaged 5.51 million b/d during the quarter, compared to 5.44 million b/d during the second quarter, and 5.34 million b/d for the third quarter a year ago.

Drilling activities continue to recover, bolstered by higher oil prices. According to Baker Hughes, the number of active oil rigs in the US increased to 421 at the end of September from 372 at the end of June. This compared to 183 rigs at end September 2020.

US commercial crude oil stock at end September was 420 million bbl, compared to 497 million bbl at end third-quarter 2020, and a 5-year average of 455.6 million bbl.

For third-quarter 2021, US refinery inputs were 16.18 million b/d, compared with 16.16 million b/d in second-quarter 2021, and 14.55 million b/d the same period a year ago. Refinery utilization rate was 89.2%, compared to 89.1% in second-quarter 2021, and 78.5% in third-quarter 2020.

Refining margins continue to improve on higher product demand and higher crack spreads. According to Muse, Stancil & Co., refining cash margins in third-quarter 2021 averaged $17.92/bbl for Middle-West refiners, $15.31/bbl for West Coast refiners, $10.9/bbl for Gulf Coast refiners, and $8.84/bbl for East Coast refiners.

In the same quarter of the prior year, these refining margins were $4.84/bbl, $6.02/bbl, $0.33/bbl, and $0.86/bbl, respectively. Refining cash margins in second-quarter 2021 averaged $17.4/bbl for Middle-West refiners, $14.36/bbl for West Coast refiners, $8.45/bbl for Gulf Coast refiners, and $7.12/bbl for East Coast refiners.

Natural gas prices at Henry Hub averaged $4.36/MMbtu in third-quarter 2021, compared with $2/MMbtu in third-quarter 2020, and $2.94/MMbtu in second-quarter 2021. US gas prices will likely remain elevated through the rest of the year on low inventory and strong LNG exports. US marketed gas production climbed to 102.5 bcfd from 97.28 bcfd in third-quarter 2020.

A sample of 13 oil and gas producers and pipeline companies with headquarters in Canada announced collective net income of $6.57 billion (Canadian dollar) in third-quarter 2021, compared to net income of $2 billion (Canadian dollar) in the prior year’s quarter.

Western Canada Select (WCS) averaged $57.08/bbl and $31.81/bbl for the same periods. The WTI/WCS differential averaged about $13/bbl for third-quarter 2021, up from around $9/bbl in the same period of 2020. The Canadian dollar averaged $0.79 in third-quarter 2021, an increase of $0.04 from third-quarter 2020.

US oil & gas producers

ExxonMobil reported estimated earnings of $6.8 billion for third-quarter 2021, an increase of $7.4 billion compared to third-quarter 2020 on improved demand and strong operations. Third-quarter capital and exploration expenditures were $3.9 billion, bringing year-to-date 2021 investments to $10.8 billion, as the company continued strategic investments in its advantaged assets, including Guyana, the Permian basin, and chemicals.

Oil-equivalent production in the quarter was 3.7 million b/d. Excluding entitlement effects, divestments, and government mandates, oil-equivalent production increased 4% versus the prior-year quarter, including growth in the Permian and Guyana. During the quarter, production volumes in the Permian averaged about 500,000 boe/d, an increase of about 30% from third-quarter 2020.

On the downstream side, fuels margins improved from second-quarter 2021 with increasing product demand. Lubricants continued to deliver strong performance. Overall refining throughput was up 5% from the second quarter on improved demand and lower planned maintenance activity.

ExxonMobil’s 2021 capital program is expected to be near the low end of the $16-19 billion range. In fourth-quarter 2021, the board will formally approve the corporate plan, with capital spending anticipated to be $20-25 billion annually. ExxonMobil also plans to grow investments that lower emissions, leveraging the company’s technology, scale, integration, and global footprint. Cumulative low-carbon investments are anticipated to be about $15 billion from 2022 through 2027.

Chevron Corp. reported third-quarter 2021 earnings of $6.1 billion, the highest since 2013, with record free cash flow of $6.7 billion. The company reported a third-quarter 2020 loss of $207 million.

Earnings growth was led by Chevron’s upstream segment, which netted $5.1 billion in third-quarter 2021 versus $235 million a year earlier. Of this, international upstream earnings totaled $3.2 billion as compared with $119 million in third-quarter 2020.

Net oil-equivalent production of 1.91 million b/d in third-quarter 2021 was up 55,000 b/d from third-quarter 2020. Additional production of 158,000 b/d following the Noble Energy acquisition and lower production curtailments was partially offset by unfavorable entitlement effects, normal field declines, and operational impacts. The net liquids component of oil-equivalent production decreased 6% to 915,000 b/d in third-quarter 2021, while net natural gas production of 5.95 bcfd was 13% more than third-quarter 2020.

Chevron’s capital and exploratory expenditures in the first 9 months of 2021 totaled $8.1 billion, compared with $10.3 billion in 2020.

ConocoPhillips had third-quarter 2021 earnings of $2.4 billion, compared with a third-quarter 2020 loss of $450 million, and second-quarter 2021 earnings of $2.1 billion. Excluding special items, third-quarter 2021 adjusted earnings were $2.4 billion, compared with a third-quarter 2020 adjusted loss of $300 million, and second-quarter 2021 adjusted earnings of $1.7 billion. Special items for the current quarter included a contingent payment from Cenovus associated with the 2017 Canadian disposition and a non-cash impairment credit, partially offset by a loss on asset sales and transaction and restructuring expenses.

ConocoPhillips’ production excluding Libya for third-quarter 2021 was 1.5 MMboe/d, an increase of 441,000 boe/d from the same period a year ago. After adjusting for closed acquisitions and dispositions as well as impacts from the 2020 curtailment program, third-quarter 2021 production increased 26,000 boe/d or 2% from the same period a year ago. This increase was primarily due to new production from the Lower 48 and other development programs across the portfolio, partially offset by normal field decline. Production from Libya averaged 37,000 boe/d.

Occidental Petroleum (Oxy) had net income the quarter of $628 million and adjusted income of $836 million compared to a net loss for the prior quarter of $97 million and adjusted income of $311 million.

Oxy’s total average global production from continuing operations of 1.16 MMboe/d for the third quarter exceeded the midpoint of guidance. Third-quarter chemical pre-tax income of $407 million exceeded guidance by $17 million.

EOG Resources reported net earnings of $1 billion for third-quarter 2021, compared to a loss of $42 million for the prior-year’s third quarter. Total company crude oil production of 449,500 b/d was above the high end of the guidance range due to better well productivity. Increased extraction of ethane boosted NGL production 14% higher than second-quarter 2021 while contributing to slightly lower natural gas production, along with declines related to plant downtime in Trinidad. Total company equivalent volumes increased 2% compared with second-quarter 2021.

Independent refiners

Phillips66 announced third-quarter 2021 earnings of $402 million, compared with earnings of $296 million in second-quarter 2021, and loss of $800 million in third-quarter 2020. Excluding special items of $1 billion, primarily an impairment of the Alliance Refinery following Hurricane Ida, the company had adjusted earnings of $1.4 billion in the third quarter, compared with second quarter adjusted earnings of $329 million.

Refining had a third-quarter 2021 pre-tax loss of $1.1 billion, compared with a pre-tax loss of $729 million in second-quarter 2021. Refining results for third-quarter 2021 included a $1.3-billion impairment of the Alliance Refinery.

Adjusted pre-tax income was $184 million in the third quarter, compared with an adjusted pre-tax loss of $706 million in the second quarter. The improvement was primarily due to higher realized margins, reflecting higher market crack spreads, lower RIN costs, and improved product differentials.

Crude utilization rate was 86% in the third quarter, down from 88% in the second quarter due to hurricane impacts. Clean product yield was 84% in the third quarter, up 2% from the second quarter.

Marathon Petroleum reported net income of $694 million for third-quarter 2021, compared with a net loss of $886 million for third-quarter 2020. Adjusted net income was $464 million for third-quarter 2021.

R&M segment income from operations was $509 million in third-quarter 2021, compared with a loss of $1.6 billion for third-quarter 2020. Segment results include a LIFO liquidation charge of $256 million in third-quarter 2020. R&M margin was $14.51/bbl for third-quarter 2021, versus $8.28/bbl, excluding the LIFO liquidation charge, for third-quarter 2020. Crude capacity utilization was 93%, resulting in total throughput of 2.8 million b/d. If adjusted to include capacity idled in 2020, utilization would have been about 88%.

Valero Energy reported net income of $463 million for third-quarter 2021, compared to a net loss of $464 million for third-quarter 2020. Adjusted net income was $500 million for third-quarter 2021, compared to an adjusted net loss of $472 million for third-quarter 2020.

The refining segment reported $835 million of operating income for third-quarter 2021, compared to a $629 million operating loss for third-quarter 2020. Refinery throughput volumes averaged 2.9 million b/d in third-quarter 2021, which was 338,000 b/d higher than third-quarter 2020.

Valero’s renewable diesel segment, which consists of the Diamond Green Diesel (DGD) joint venture, reported $108 million of operating income for third-quarter 2021, compared to $184 million for third-quarter 2020. The lower operating income and sales volumes in third-quarter 2021 are primarily attributed to plant downtime due to Hurricane Ida.

Canadian firms

All financial figures are presented in Canadian dollars unless noted otherwise.

Suncor’s net earnings were $877 million in third-quarter 2021, compared to a net loss of $12 million in the prior year quarter. Net earnings for third-quarter 2021 were impacted by a $257 million unrealized after-tax foreign exchange loss on the revaluation of US dollar denominated debt, a non-cash after-tax impairment reversal of $168 million against the Terra Nova assets, and others. The net loss in the prior year quarter included a $290 million unrealized after-tax foreign exchange gain on the revaluation of US dollar denominated debt.

Suncor’s total upstream production increased to 698,600 boe/d in third-quarter 2021, compared to 616,200 boe/d in the prior year quarter, reflecting continued strong performance from the company’s In Situ assets and increased production volumes at Syncrude, partially offset by the impact of the significant planned turnaround at Oil Sands Base Plant Upgrader 2 and planned maintenance at Firebag, which was completed in the quarter.

Refinery crude throughput increased to 460,300 b/d and refinery utilization was 99% in third-quarter 2021, compared to refinery crude throughput of 399,700 b/d and refinery utilization of 87% in the prior year quarter, reflecting strong utilizations across all refineries. The prior year quarter reflected reduced rates due to the completion of an 8-week planned turnaround at the Edmonton refinery and lower demand for refined products.

Imperial Oil recorded net income of $908 million in third-quarter 2021, up from net income of $3 million in the same period of 2020. The company’s upstream business recorded net income of $524 million in third-quarter 2021, compared to a net loss of $74 million in the same period of 2020. Downstream recorded net income of $293 million in third-quarter 2021, compared to net income of $77 million in the same period of 2020. Improved results primarily reflect higher margins of about $280 million. Refinery throughput averaged 404,000 b/d, up from 341,000 b/d in third-quarter 2020. Capacity utilization was 94%, up from 81% in third-quarter 2020.

Cenovus generated net earnings of $551 million in the third quarter, more than doubling second‐quarter net earnings of $224 million, with the improvement largely driven by higher operating margin.

Cenovus achieved total production of 804,800 boe/d, driven by record quarterly average daily oil sands production of more than 242,500 b/d at Christina Lake and more than 187,000 b/d at Foster Creek. Total upstream operating margin was $2.4 billion, up from $1.9 billion in the second quarter.

In the company’s downstream operations, the Lloydminster Upgrader and Lloydminster Refinery achieved an average third‐quarter crude oil utilization rate of 98%. The US refineries, with a crude oil utilization rate of 89%, continued to ramp up throughput to 445,800 b/d during the third quarter.

About the Author

Conglin Xu

Managing Editor-Economics

Conglin Xu, Managing Editor-Economics, covers worldwide oil and gas market developments and macroeconomic factors, conducts analytical economic and financial research, generates estimates and forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 2012 as Senior Economics Editor.

Xu holds a PhD in International Economics from the University of California at Santa Cruz. She was a Short-term Consultant at the World Bank and Summer Intern at the International Monetary Fund.

Laura Bell-Hammer

Statistics Editor

Laura Bell-Hammer is the Statistics Editor for Oil & Gas Journal, where she has led the publication’s global data coverage and analytical reporting for more than three decades. She previously served as OGJ’s Survey Editor and had contributed to Oil & Gas Financial Journal before publication ceased in 2017. Before joining OGJ, she developed her industry foundation at Vintage Petroleum in Tulsa. Laura is a graduate of Oklahoma State University with a Bachelor of Science in Business Administration.