Largest quarterly downstream construction cost escalation since 2000

Pritesh Patel

IHS Markit

Houston

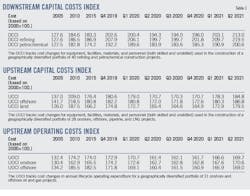

IHS Markit indices are proprietary measures of cost changes similar in concept to the Consumer Price Index (CPI) and draw upon proprietary IHS Markit tools to provide a benchmark for comparing construction costs around the world. Construction costs are tracked on a quarterly basis and then reported as an index value to show how upstream and downstream project cost have changed. Therefore, an index of 170.3 represents that construction costs have increased 70.3% since the year 2000.

Capital costs index for downstream construction projects (DCCI) increased 5% during second-quarter 2021 quarter-on-quarter (q-o-q) to 213. This marks the largest quarterly increase since 2000.

Project costs increased during the quarter due to higher raw material prices. Increased demand and supply issues resulted in rising prices for steel, equipment, and construction materials. Equipment and steel costs account for over 50% of total project spend. Prices for those markets increased 7.4% and 12.1%, respectively, over the quarter. Rising steel prices have been the norm in 2021. Equipment had a slight lag but is now experiencing higher prices as raw material price increases being passed through.

The industry is actually in short supply. Even at the smallest level, there is a shortage of fittings, which is creating a bottleneck for major equipment vendors. Suppliers are unable to fill orders, resulting in project delays. Suppliers have simply opted to not sign contracts, because they know they are unable to provide the product. For any projects in the pipeline, the focus must be on securing supply. Order changes usually need to be prevented at all cost, as switching the quantity of an item or its specifications will have a negative impact on productivity and project cost.

And yet, project activity within the downstream sector is still recovering. A limited number of new projects have been announced. Engineering and project management (EPM) charge out rates increased 0.3% during the quarter.

Specifically, the DCCI refining index increased 4.7% during second-quarter 2021 q-o-q. Steel and equipment prices skyrocketed during the quarter. The largest steel and equipment price increases occurred in North America and Asia. In our refining portfolio, those regions account for 18% and 37% of total global capex.

The DCCI petrochemical index increased 5.1% during second-quarter 2021. Petrochemical project costs

increased the most due to higher weighting of equipment. Equipment costs account for over 50% of total petrochemical project spend. During the quarter, equipment costs for petrochemical projects increased 7%. The DCCI petrochemical project portfolio is heavily weighted towards projects in the Middle East and Asia, where most of the capacity expansion is occurring. Projects costs increased 4.3% and 6% respectively for those regions during the second quarter.

The IHS Markit Upstream Capital Costs Index (UCCI), which tracks the costs of oil and gas field developments globally, increased 3.6% in second-quarter 2021. Oil prices have been on a steady rise since fourth-quarter 2020, providing some needed optimism in the energy market. Unfortunately, the effects of COVID-19 could reverse that optimism as economies reopen and increased demand on fragile supply chains ultimately push costs higher.

All upstream related costs over the second quarter increased, while most of the increase in the UCCI was again driven by the steel and equipment market, which rose 9.3% and 5.9% over second-quarter 2021, respectively. Steel prices remain elevated from historical levels in all categories since the first quarter owing to supply chain issues. Equipment costs rose significantly, driven by elevated input cost such as steel, bulk materials, and labor.

During the second quarter, as oil prices improved and economies reopened, several oil and gas projects were back on track, increasing the demand for equipment while supply chains remained strained. These have been affecting production schedules in many parts of world and forcing manufacturers to look for alternative suppliers, which resulted in massive spikes in freight costs, significantly disrupting shipping routes and hubs and ultimately shortages in some manufacturing and spare parts. EPM rates and the construction labor index also increased over the quarter. The movements were driven by changes in foreign exchange and a modest recovery in activity. Nevertheless, the application of standardized solutions is growing in importance to reduce costs, lead times, and project development timelines.

The land and offshore rig index grew over 1% in the second quarter, signaling that the drilling rig industry has started to recover. Following every downturn, there is a period of change and innovation. Both onshore and offshore drilling contractors are working to improve rates either by establishing new contracting methods or reducing fleet size.

The IHS Markit UCCI grew 8.3% over first-half 2021, erasing all the cost losses from the 2020 downturn. For 2021, the UCCI is projected to increase in total 10%, driven by steel and raw material cost.

The global Upstream Operating Costs Index (UOCI) has grown by 5% in first-half 2021. In the second quarter, UOCI grew by 2%. The increase has been primarily due to ongoing escalation in underlying raw material prices which resulted in increases for the consumables, spare parts and well materials indexes. Offshore activity improved in the North Sea, Asia, and Africa. US onshore also showed signs of improvement. The recovery in upstream operations has been boosting demand for services and contributing to upward pricing pressure.

However, the UOCI remains down slightly compared to pre-pandemic levels. With positive signals emerging in second-quarter 2021 and increasing underlying raw materials prices, we anticipate that barring further resurgence of COVID-19, the index will continue to grow through the second half, recovering to pre-pandemic levels in early 2022. Although regional trends will be mixed, the overall index is expected to continue increasing through 2025 at a rate that will likely exceed Brent pricing.