Surge in commodity prices driving cost escalation in 2021

Pritesh Patel

IHS Markit

Houston

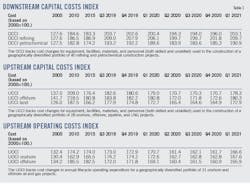

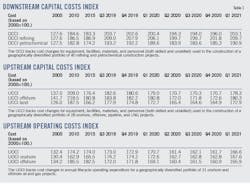

IHS Markit indices are proprietary measures of cost changes similar in concept to the Consumer Price Index (CPI) and draw upon proprietary IHS Markit tools to provide a benchmark for comparing construction costs around the world. Construction costs are tracked on a quarterly basis and then reported as an index value to show how upstream and downstream project cost have changed. Therefore, an index of 170.3 represents that construction costs have increased 70.3% since the year 2000.

In first-quarter 2021, the IHS Markit Upstream Capital Costs Index (UCCI), which tracks the costs of oil and gas field developments globally, increased by 4.5% quarter-on-quarter (down 0.4% year-over-year), erasing most losses from last year’s downturn. Most of the upstream markets monitored by the cost service increased during this quarter, with only two showing slight drops. Development costs shot up not due to the improved upstream activity witnessed this quarter but driven by the surge in raw material prices brought about by the volatility caused by the pandemic’s impact on global supply chains.

Much of the increase in the UCCI was driven by the steel market, which rose by 22% over the first quarter. The sharp rise in steel prices was caused by two major factors: rising raw material prices and low mill utilization rates. As economies slowed due to COVID-19 in 2020, steel mills reduced capacity in response to low demand. At the end of the year, steel demand began to increase, but the response from mills was not quick enough to prevent a price spike. Capacity is coming back online in most parts of the world, although North America still has some catching up to do.

The bulk material market also showed a strong increase of 4%. Most of the rise was due to growing demand coupled with limited supply and rising raw material prices. To help prop up economic recovery from the pandemic, governments issued stimulus measures and increased spending, contributing to the rise in global bulk material demand and thus prices. Raw material prices have been recovering from their pandemic slump for the past 10 months, leading to increases in intermediate and final goods prices.

Engineering and project management (EPM) and the construction labor index also increased over the quarter, but the movements were mainly driven by changes in foreign exchange rates. In local currency terms, both indexes were only slightly positive.

The land rig index grew by 2% over the first quarter, showing signs that the land rig industry has started to recover. Following every downturn is a period of change and innovation. This downturn is no different. Drilling contractors are determined to establish new contracting methods to ensure long-lasting success.

For 2021, the UCCI is projected to increase by 6.5%, driven by rising steel and raw material costs. The offshore, deepwater, and land portfolio indexes are expected to increase. Through 2021, the deepwater index will rise more because it is more heavily weighted toward steel products and offshore rigs. Most of the underlying markets are projected to grow in 2021. Bulk material and steel cost will have the greatest effect on future portfolio movements with their projected indexes increasing 6.1% and 23%, respectively. Rig day rates, both onshore and offshore, are projected to recover in 2021 as well. In 2021, project costs are likely to stabilize and begin recovering, but no significant increases are expected until 2022.

The global Upstream Operations Index (UOCI) increased 3% in first-quarter 2021 (down 2.4% year-over-year). Local currency appreciation was responsible for roughly a third of the first quarter uplift, underlying market factors were responsible for the remaining 2% increase. The effects of currency appreciation were most notable in Europe owing to a combination of high exposure to local currency, as a result of the extensive and well-established service industry, and significant appreciation of both the British pound and the Norwegian Krone.

Over the course of 2020 the UOCI fell by 6% as operators cut back on both capex and opex spending and restrictions put in place to fight the pandemic resulted in lower industry activity. Maintenance and offshore services suffered.

With positive signals emerging in first-quarter 2021, some sort of recovery is imminent. The downturn has not been as severe as that of 2014 when the UOCI lost 18% over 2 years although the index currently sits just 0.2% above that last minimum value. Further growth in the UOCI is expected this year as upstream activity levels respond to the newly buoyant oil price. However, the recovery of the UOCI will not be as dramatic as that of Brent pricing. UOCI is expected to recover to pre-pandemic levels in 2022.

Capital costs for downstream projects increased 3.6% during first-quarter 2021 (up 1.3% year-over-year). This is the second quarter in a row where costs increased. Key drivers for increasing project costs are rising raw material prices and higher wages. 2020 was a rough year, with global economies struggling due to COVID-19. Rising costs are just one piece of the picture. Lower demand levels have led to decisions regarding future investments. Downstream project activity and spend declined in 2020 due to demand issues. While we are seeing market costs increase, there are a limited number of projects under construction. Moving forward, lower demand levels, higher market costs, and rising feedstock prices will hinder future construction activity.

Most markets tracked within the index rose around 3%. The outlier was steel, which rose 22%. Project costs increased the most in Asia. Steel was a big factor, but there was also pricing pressure from higher EPM rates. Asia is the one region where project activity is returning to normal.

The DCCI refining index increased 3.9% during first-quarter 2021. Rising steel prices resulted in higher refining project costs for all regions. The largest quarterly increase was 6% in Russia and CIS region. Costs rose in part to currency fluctuations. Labor costs in the region have been up 5% since the end of 2020. Project activity in the region is still low, resulting in EPM charge out rates only rising 0.2%.

The DCCI petrochemical index increased 3% during first-quarter 2021. Most regions experienced higher project costs. Cost in Europe and Asia increased more than 3% during the quarter. The increase in Europe was related to currency fluctuations leading to higher wage rates and pricing for electricals and instrumentation, and civils and construction materials. As there is limited project activity in the region, these market increases did not have a strong impact on the overall petrochemical cost index. The story was different for Asia. The increase in Asia was related to supply and demand. There is stronger project activity in the region, leading to increased costs. The petrochemical cost index is heavily weighted towards Asia, due to the amount of capacity being brought online in the region.