Big Oil could see proven reserves run out in less than 15 years

Proven oil and gas reserves of the group of major companies referred to as Big Oil (ExxonMobil, BP, Shell, Chevron, Total, and Eni) are falling, as produced volumes are not being fully replaced with new discoveries, according to Rystad Energy.

Big Oil lost 15% of its stock levels in the ground last year, with remaining reserves set to run out in less than 15 years, unless the group makes more commercial discoveries quickly, according to Rystad’s analysis.

Discoveries are becoming more challenging as exploration investments shrink and success rates slump. Declining proven reserves could create challenges for Big Oil to maintain stable production levels in coming years, which would cause revenue to dwindle and threaten the financing of the group’s energy transition plans.

Big Oil saw its proven reserves drop by 13 billion boe in 2020 as the companies took large impairment charges. This year, the industry’s global first quarter discovered volumes totaled 1.2 billion boe, the lowest in 7 years, as high-ranked prospects failed to deliver, and successful wildcats yielded only modest-sized finds, Rystad said.

The collapse in crude oil demand and prices due to the COVID-19 pandemic and an increased focus on capital discipline has led to investment cuts that could aggravate the challenge of major operators as they look to boost proven reserves. Even for European majors, which are increasingly focusing on the energy transition, business models will continue to be dominated by the sale of oil and gas.

“The ability of Big Oil to generate future revenues will continue to depend on the volume of oil and gas the companies have at their disposal to sell. If reserves are not high enough to sustain production levels, companies will find it difficult to fund expensive energy transition projects, resulting in a slowdown of their clean energy plans,” said Parul Chopra, vice-president of upstream research, Rystad Energy.

ExxonMobil’s proven reserves shrank by 7 billion boe in 2020, or 30%, from 2019 levels, mainly due to reductions in Canadian oil sands and US shale gas properties. The operator’s proven liquids reserves in Canada were revised to less than 900 million b/o from 4.8 billion b/o, while bitumen-related reserves for the Kearl and Cold Lake oil sands projects were slashed to less than 100 million bbl from 3.8 billion bbl. In addition, liquids reserves related to some US shale plays have been reduced by 1 billion bbl.

ExxonMobil’s proven gas reserves dropped last year by 9 tcf, mostly in the US. The revisions were primarily linked to gas assets acquired from XTO in 2009.

Shell, meanwhile, saw its proven reserves fall by 20% to 9 billion boe last year. Liquids reserves accounted for one-third of total reductions and were mostly down to US and South American projects, and a lack of new discoveries elsewhere. Gas reserves accounted for two-thirds of the reductions, led by a 600 million boe revision in Australian projects.

Chevron also suffered reserve losses due to impairments, despite the addition of 2 billion boe of proven reserves to its inventory through the acquisition of Noble Energy. Similarly, BP saw its total proven reserves drop to 18 billion boe in 2020 from 19 billion boe in 2019, mainly due to the sale of existing assets and a lack of major new discoveries. Total and Eni have avoided reductions in proven reserves over the past decade.

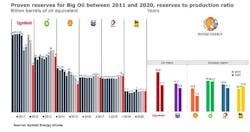

Amid the proven reserve reductions, companies are seeing a negative impact on the ratio of proven reserves to production. From 2015 through 2020, ExxonMobil, Chevron, and Shell saw the highest decline, Rystad said.

ExxonMobil’s proven-reserves-to-production ratio has not fallen below 13 years for the past 2 decades, but the 15 billion boe of reserves declared in 2020 means its volumes would run out in just over 11 years, compared to the previous expectation of more than 16 years. The reserves to production ratio for Shell, meanwhile, fell dramatically to 7.4 years in 2020 – the lowest level among all majors. The company reported its oil production peaked in 2019 and it expects an annual output decline of 1-2% until 2030.

New discovered volumes – a measurement of a company’s exploration performance – illustrates the challenge faced by oil majors to maintain reserves base and supply existing customers. Over the past 5 years, the six majors have replaced only 45% of their production through reserves from new discoveries. ExxonMobil fared better than its peers, adding more than 70% of the produced reserves thanks to 9 billion boe of discovered volumes in the offshore Stabroek block in Guyana.

Total saw exploration success last year in the Guyana-Suriname basin, while Eni had success in Africa. Chevron and Shell have struggled to register new discovered volumes. Chevron replaced only 15% of its produced volumes from 2016 through 2020, while Shell replaced 27%.