Oil and gas companies swiftly cut back sizeable capital spending from initial plans in 2020 when market conditions deteriorated due to the COVID-19 crisis. While oil prices have recovered dramatically thanks to sharp supply cuts and anticipated widespread distribution of COVID-19 vaccines, market uncertainties linger with ample oil storage and record-high spare production capacity.

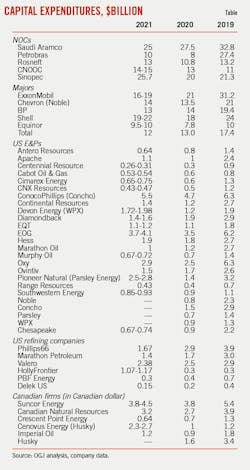

OGJ’s analysis of six supermajors, five national oil companies (NOC), and a selected sample of North American exploration and production (E&P) companies indicates that the broad industry’s capital expenditure for 2021 is largely flat versus the prior year. Most oil and gas producers’ capital budgets appear to be contained to the forseeable future. Maximizing payback, including paying off debts, and creating more free-cash flow, is the year’s theme.

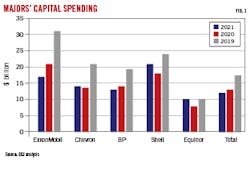

Collective 2021 capital expenditure of the six supermajors (ExxonMobil, Shell, BP, Chevron, Equinor, and Total) is some $80+ billion, largely flat with 2020, but down from $123 billion in 2019. Despite subdued capital investments, the majors, especially European majors, are scaling up low-carbon energy investments.

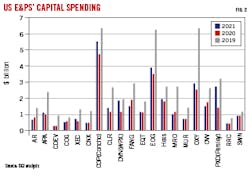

A group of 21 US-based leading E&P companies reported a combined capital expenditure of $32.5 billion in 2020, down nearly 50% from $60.6 billion in 2019. Strict capital discipline continues to hold in 2021, with most operators having messaged a “maintenance mode” capital program. Collectively, midpoint capital spending planned by the group for 2021 is $31.7 billion, a further drop from the previous year. Most producers expect 2021 oil production to be generally flat or only slightly higher than last year’s production.

Judging from current capital guidance of US E&Ps and the majors’ plans for US upstream, capital spending for US upstream this year is expected to be slightly lower than last year’s actual spending.

Countering the trend in the US, six leading Canadian oil and gas producers intend to increase combined capital spending this year versus 2020 by an estimated 11%. The spending is primarily focused in Alberta and British Columbia.

Despite a recovery in fuel demand, market conditions remain challenging for refiners. US refining spending will slide further by 10% in 2021, following a collapse of around 30% in 2020. Despite lower capital budgets, refiners are boosting investments towards renewable fuels projects.

Saudi Aramco continued to cut capital expenditure this year by 9%, while its NOC peer group is likely to increase capital expenditure this year following recovery of oil prices. However, capital discipline is still the focus, e.g., deleveraging from Petrobras, and tightening investment criteria from Rosneft. Chinese NOCs’ capital expenditures in 2020 had been quite resilient despite the COVID-19 crisis. This year, they appear to be increasing capital expenditures aggressively, prioritizing domestic drilling and gas developments.

Supermajors

ExxonMobil’s full-year 2020 capital spending of $21.4 billion was nearly $12 billion, or 35%, lower than the initial $33 billion plan. This also compared to 2019 capital spending of $31.1 billion. The reduction mainly occurred in the upstream business. US upstream spending was cut to $6.8 billion in 2020 from $11.6 billion in 2019, while non-US upstream spending was cut to $7.6 billion in 2020 from $11.8 billion in 2019.

Capital guidance for 2021 is reduced further to $16-$19 billion. Guidance for 2022-2025 is $20-$25 billion with flexibility to adjust investments in response to market conditions in any year. Spending will prioritize Guyana, Brazil, the Permian basin, and chemical performance products.

ExxonMobil’s longer-term capital plan focuses on cost-advantaged opportunities that lower breakeven oil prices even further, maximizing free cash flow generation. About 90% of ExxonMobil’s 2021-2025 upstream development capital expenditure has a cost-of-supply of $35/bbl or lower, according to the company.

With the acquisition of Noble Energy, Chevron announced a 2021 organic capital and exploratory spending program of $14 billion, compared to $13.5 billion in 2020 and $21 billion in 2019. The company will spend $5 billion on US upstream and $6.5 billion on international upstream this year. During 2020 and 2019, US upstream spending was $5.1 billion and $8.2 billion, respectively. International upstream spending was $5.8 billion and $9.6 billion, respectively. For downstream operations, Chevron has allotted $1.2 billion to the US and $900 million internationally for 2021.

Chevron also lowered its longer-term annual guidance to $14-16 billion through 2025, compared to its previous guidance of $19-22 billion, which excluded Noble Energy. During this period, as capital is expected to decrease for a major expansion in Kazakhstan, the company expects to increase investments in a number of advantaged assets, including the Permian, other unconventional basins, and the Gulf of Mexico.

BP’s total capital expenditures for 2020 and 2019 were $14 billion and $19.4 billion, respectively. BP’s upstream spending in the US was $3.3 billion in 2020, down from $4 billion in 2019. US downstream spending was $630 million in 2020, down from $913 million in 2019. BP expects 2021 total capital expenditure to be $13 billion, down 7% from 2020.

Shell’s cash capital expenditure was decisively reduced to $18 billion in 2020, from $24 billion in 2019, against a target of $20 billion. During 2020, capital expenditure on integrated gas was flat with a year ago while expenditures on upstream, refining, and chemicals were all dramatically reduced.

Shell planned near-term $19-22 billion cash capital expenditure. Of the total, renewables and energy solutions amounts to $2-3 billion, contributing to the majority of the incremental deployment.

The recently rebranded ‘Total Energies’ (Total) stated its capital expenditure will decline further to $12 billion in 2021, from $13 billion in 2020, and $17.4 billion in 2019. However, the company preserves the flexibility to mobilize additional investments. Targeted normalized capital budget is currently $13-16 billion over the 2022-2025 timeframe.LNG and renewables will be scaled up.

The company underlined its strategy to become a net zero emission company. Of the total budget of 2021, renewables account for over 20%. Renewables are also expected to comprise around 15% (vs. 5% today) of energy sold to customers by 2030, while oil products are expected to constitute 35% vs. 55% today, according to the company.

Equinor’s organic capital expenditures declined to $7.8 billion for the year ended 2020, compared to a revised guidance of $8.5 billion. Organic capital expenditures are now targeted at an annual average of $9-10 billion over the 2021-2022 period. Production for 2021 is estimated to be around 2% above the 2020 level.

US E&P companies

In 2021, Apache plans to invest $1.1 billion in upstream oil and gas capital, a 11% increase from 2020 actuals, with about $200 million allotted for exploration and $900 million for production and development activities. This capital program will be more than fully funded by internally generated cash flow under an assumed price deck of $45/bbl WTI oil and $3/MMbtu Henry Hub natural gas.

Antero Resources’ actual capital expenditure for 2020 was $785 million. The capital budget for 2021 is down to $635 million. During 2021, the company plans to operate an average of three drilling rigs and two completion crews, and to complete 65-70 horizontal wells in the Appalachian basin.

After closing its deal with Concho Resources, ConocoPhillips has set a 2021 capital budget of $5.5 billion, 17% higher than last year’s actual spending of $4.7 billion. More than half, or 55%, of the budget is allocated to the Lower 48, with the rest spread across a set of diverse global assets.

Continental Resources is projecting a $1.4 billion capital budget for 2021, net of Franco Nevada’s share of mineral costs. The company planned $1.1 billion for development and completions activities, of which about 60% is allocated to the Bakken and 35% to Oklahoma, with the remaining capital being allocated to the Powder River basin asset.

Diamondback Energy’s capital spending plan for 2021 for drilling, completion, and infrastructure is $1.4-1.6 billion, down from $1.86 billion for full-year 2020.

EOG Resources’ 2020 capital expenditures was $3.5 billion, a decreased 44% from 2019. EOG set a capital plan of $3.7-4.1 billion for 2021 and will maintain 2021 crude oil volumes of 434,000-446,000 b/d, largely flat with the fourth-quarter 2020 level. The company has no plans to increase capital expenditures or grow production volumes during 2021, even in a higher commodity price environment, it said.

Hess announced a 2021 capital and exploratory budget of $1.9 billion, of which more than 80% will be allocated to Guyana and the Bakken. Planned US upstream spending is $590 million in 2021, down from $919 million in 2020 and $1.78 billion in 2019. Spending in South America will increase to $1.1 billion in 2021. The company’s net production is forecast to average 310,000 boe/d in 2021, excluding Libya.

Marathon Oil announced a $1 billion capital expenditure budget for 2021. About 90% of the budget will go to the Bakken and Eagle Ford. Total oil production for 2021 is expected to be largely flat with the fourth-quarter 2020 exit rate.

Murphy Oil is planning its 2021 capital expenditure to be $675-725 million. Of the total, $325 million is allocated to the Gulf of Mexico, $170 million to Eagle Ford, and $85 million to Tupper Montney.

Ovintiv’s planned capital spending for 2021 totals $1.5 billion, assuming commodity prices of $50/bbl WTI and $2.75/MMbtu NYMEX. Over 90% of capital investment is earmarked for the Permian, Anadarko, and Montney.

Based on a $40 WTI price environment, Occidental Petroleum’s 2021 capital program is $2.9 billion. Of the total, $1.2 billion is allocated to the Permian basin.

Pioneer Natural Resources’ drilling, completion, and facilities capital expenditures totaled $1.4 billion for 2020. With the acquisition of Parsley Energy, Pioneer expects its 2021 capital budget to be $2.5-2.8 billion. The majority will go to Midland operations.

US refiners

US refiners’ overall capital spending will slide further this year after a fall of nearly 30% in 2020. However, the refiners are boosting investment in renewable fuels.

Valero expects to invest about $2.38 billion in 2021, down from $2.5 billion in 2020, and $2.9 billion in 2021. Of the total 2021 budget, $1.6 billion is for refining, $720 million is for renewable diesel, and $40 million is for ethanol.

Valero has invested over $3 billion to date in its renewable fuels businesses and expects invest almost $2 billion over the next 3 years to DGD (a joint venture of Valero and Darling) renewable diesel plants.

Phillips 66’s 2021 capital budget is $1.67 billion, including $305 million of Phillips 66 Partners’ planned capital spending. Capital budget for refining is $776 million, down from $816 million in 2020, and $1 billion in 2019. The budget includes $521 million of sustaining capital and $255 million for high-return, quick-payout projects. In third-quarter 2020, Phillips 66 announced Rodeo Renewed, a project to reconfigure its San Francisco refinery to produce renewable fuels.

With a much-reduced budget of $615 million, Phillips 66’s midstream growth capital is directed toward completing near-term committed and optimization projects, including the construction of Sweeny Frac 4 and the completion of the C2G pipeline.

Phillips66’s capital contributions to Chevron Phillips Chemical (CPC) will increase to $410 million this year from $284 million in 2020.

Marathon Petroleum’s capital investment plan for 2021 totals $1.4 billion. The refining and marketing segment’s capital spending is around $1.05 billion, down from $1.17 billion in 2020, and $2 billion in 2019. This amount includes $800 million of growth capital focused on ongoing projects, such as the first phase of the Martinez refinery conversion, the STAR project, and projects expected to help reducing future operating costs. The Martinez refinery is expected to start producing renewable diesel in 2022, with a build to full capacity in 2023.

HollyFrontier’s 2021 capital program is targeted at $1.07-1.17 billion, compared to $330 million for 2020. The boost in capital spending reflects surging renewables investment. Of the total, only about $200 million is scheduled for conventional refining, while $520-550 million is scheduled for renewables, including the conversion of the Cheyenne refinery to a renewable diesel plant and the construction of the Artesia renewable diesel unit.

Excluding capital expenditures of $1.17 billion for the acquisition of the Martinez refinery in first-quarter 2020, PBF Energy’s total refining capital expenditure for 2020 was about $370 million, a 50% reduction from planned 2020 expenditure. Going forward, PBF Energy expects refining capital expenditures to be $150 million for the first 6 months of 2021 and will remain flexible for the balance of the year depending on the progress of the refining environment.

PBF Energy is considering a renewable diesel project at its 190,000 b/d refinery in Chalmette, La., as it seeks to mitigate the high cost of meeting the Renewable Fuel Standard. The project would be the first renewable diesel project for PBF.

Delek US’s 2021 capital spending guidance is $150-160 million, a reduction of 35% year-over-year. Capital for refining is expected to be 52% less in 2021, while logistics capital will increase by 32%.

Canadian spending

The financial figures in this section are presented in Canadian dollars unless noted otherwise. Canadian firms are generally projecting increased capital spending for 2021.

Suncor Energy’s capital program in 2021 is expected to be $3.8-4.5 billion, compared to $3.8 billion in 2020, and $5.4 billion in 2019. Expenditures for upstream oil sands will be $2.55-2.95 billion in 2021, compared to expenditures of $2.7 billion in 2020, and $3.52 billion in 2019. Conventional E&P spending is budgeted at $350-450 million, compared to $489 million in 2020, and $1 billion in 2019. Refining and marketing spending will likely rebound to $800 million from $500 million in 2020.

After the recent transaction with Husky Energy, Cenovus Energy’s total capital budget for 2021 is $2.3-2.7 billion, including sustaining capital of about $2.1 billion and Superior refinery rebuild costs of $520-570 million. In 2021, spending for oil sands will be $850-950 million. Conventional and offshore spending will be $370-460 million. Cenovus plans to spend $1-1.2 billion on its downstream segment.

Canadian Natural Resources’ 2021 capital budget is targeted at $3.2 billion, up from $2.7 billion (excluding property acquisitions) in 2020. The capital is expected to deliver targeted production of 1.22 MMboe/d, with growth of about 62,000 boe/d from forecasted 2020 levels.

Imperial Oil’s capital and exploration expenditures were $874 million in 2020, a decrease of $940 million from 2019. In 2021, capital expenditures are expected to rebound to $1.2 billion.

Meantime, early this year, the Canadian Association of Petroleum Producers (CAPP) forecast a 14% increase in Canadian upstream natural gas and oil investment in 2021. Capital investments in conventional oil and gas and the oil sands will both increase.

NOCs

Saudi Aramco plans to cut capital expenditure to $25 billion or less in 2021, compared to an initial plan of more than $40 billion, and down from the $27 billion in 2020. Most is expected to be spent on exploration and production, at a similar level until at least 2023.

In response to the coronavirus-induced weak market scenario, Petronas lowered its 5-year capital spending guidance to $55 billion, indicating a 27% decline from the year-ago 5-year capital budget forecast. Further, Petrobras anticipates spending about $46 billion on exploration and production in 2021-2025 — 70% on presalt assets — compared with $64 billion projected a year ago. The company is planning to limit its spending approval and is now targeting projects that will produce breakeven results when oil price is trending at $35/bbl.

China National Offshore Oil Corp. (CNOOC), the nation’s main deepwater explorer, announced spending plans as part of its 2021 strategy outlook, which prioritizes domestic drilling and boosting natural gas development. Despite the collapse in oil prices, CNOOC’s capital spending increased to $13 billion in 2020 from $11 billion in 2019. This year, the company’s capital spending will continue to increase to $14-15 billion.

China Petroleum & Chemical Corp. (Sinopec), plans a dramatic increase in capital spending to $25.7 billion in 2021, compared to $20 billion in 2020. Sinopec expects to spend $10 billion on upstream exploration focusing on shale gas development in southwest China and construction of LNG terminals in coastal areas, up from $8 billion last year.

About the Author

Conglin Xu

Managing Editor-Economics

Conglin Xu, Managing Editor-Economics, covers worldwide oil and gas market developments and macroeconomic factors, conducts analytical economic and financial research, generates estimates and forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 2012 as Senior Economics Editor.

Xu holds a PhD in International Economics from the University of California at Santa Cruz. She was a Short-term Consultant at the World Bank and Summer Intern at the International Monetary Fund.