Firms report fourth quarter results amid continued pandemic impacts

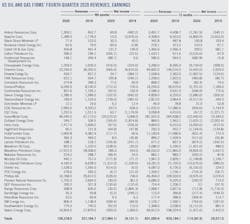

A sample of 42 US-based oil and gas producers and refiners posted a total net loss of $27.06 billion in fourth-quarter 2020, compared to net loss of $9.13 billion in fourth-quarter 2019. Total revenues were $159.38 billion for the quarter, compared to $237.16 billion a year ago.

In fourth-quarter 2020, with the continued impacts of the COVID-19 pandemic, crude oil and refined product realizations were significantly lower than the prior year quarter.

However, oil prices rallied toward the end of 2020 despite worsening COVID-19 statistics in many countries. The increase reflected improved demand outlook buoyed by the approval of multiple vaccines for the virus around the world. Expected supply also tightened as the OPEC+ group signaled they would delay production increases scheduled for first-quarter 2021. US oil and gas activities continued to rebound during the quarter.

Brent crude oil prices averaged $44.29/bbl in fourth-quarter 2020, compared with $63.41/bbl in fourth-quarter 2019 and $42.96/bbl in third-quarter 2020. West Texas Intermediate (WTI) averaged $42.5/bbl in fourth-quarter 2020, compared with $56.96/bbl for the same quarter a year ago and $40.89/bbl in third-quarter 2020.

US crude oil production in fourth-quarter 2020 averaged 10.89 million b/d, compared with 12.78 million b/d in the previous year’s fourth quarter, according to the US Energy Information Administration (EIA). NGL production averaged 5.23 million b/d during the quarter, compared to 5 million b/d in fourth-quarter 2019.

The number of active oil rigs in the US grew from 183 at the end of September to 267 at the end of December, according to Baker Hughes. This also compared to 677 rigs at the end of last year’s December.

US commercial crude oil stock at the end of December was 485 million bbl, compared to 432 million bbl a year earlier and a 5-year average of 445.6 million bbl.

For fourth-quarter 2020, US refinery inputs were 14.34 million b/d, compared with 16.86 million b/d the same period a year ago. Refinery utilization rate was 78%, compared to 89.6% for the same quarter a year ago.

According to Muse, Stancil & Co., refining cash margins in fourth-quarter 2020 averaged $7.38/bbl for Middle-West refiners, $7.45/bbl for West Coast refiners, $1.22/bbl for Gulf Coast refiners, and $1.42/bbl for East Coast refiners. In the same quarter of the prior year, these refining margins were $17.29/bbl, $16.79/bbl, $6.97/bbl, and $2.25/bbl, respectively.

Henry Hub natural gas prices averaged $2.53/MMbtu in fourth-quarter 2020, compared to $2.4/MMbtu a year earlier. US marketed gas production for the quarter decreased to 98.66 bcfd from 103.83 bcfd a year earlier.

A sample of 10 oil and gas producers and pipeline companies with headquarters in Canada recorded combined net earnings of $1.74 billion (Canadian dollar) in fourth-quarter 2020, compared to net loss of $2.18 billion in the prior year’s quarter. The improvement was mainly due to the absence of huge impairments occurred a year ago as well as favorable performance of energy infrastructure companies.

US oil and gas producers

ExxonMobil Corp. recorded a net loss of $20 billion for fourth-quarter 2020 as compared to a net income of $5.7 billion for fourth-quarter 2019. The fourth quarter loss included unfavorable identified items of $20.2 billion, primarily non-cash impairments.

ExxonMobil’s oil-equivalent production in the quarter was 3.7 million b/d, consistent with third-quarter 2020. Production was reduced by government mandated curtailments. Excluding entitlement effects, divestments, and government mandates, liquids production increased 5%, while natural gas volumes increased 2%.

During the quarter, production volumes in the Permian basin averaged 418,000 boe/d, an increase of 42% from the prior year. Meantime, ExxonMobil continued to progress major deepwater development in Guyana. Exploration, appraisal, and development drilling continues across four rigs with plans to add additional rigs in first-half 2021.

For the downstream business, industry fuels margins improved slightly from the third quarter, but remained near historic lows driven by market oversupply and high product inventory levels. Lubricants delivered strong fourth quarter and full-year performance underpinned by improved margins and cost control, despite pandemic-related challenges.

Chevron Corp. reported a net loss of $665 million for fourth-quarter 2020 as compared to a net loss of $6.6 billion for fourth-quarter 2019. Adjusted loss of $11 million in fourth-quarter 2020 compares to adjusted earnings of $2.8 billion in fourth-quarter 2019. Included in the current quarter was a charge of $120 million associated with Noble Energy Inc. acquisition costs. Foreign currency effects decreased earnings by $534 million.

Worldwide net oil-equivalent production was 3.28 million b/d in fourth-quarter 2020, an increase of 6% from a year ago. The increase was largely due to the Noble Energy acquisition, partially offset by production curtailments. Worldwide net oil-equivalent production for full-year 2020 was 3.08 million b/d, an increase of 1% from the prior year.

Chevron’s US upstream operations earned $101 million in fourth-quarter 2020, compared with a loss of $7.47 billion a year earlier. The increase was primarily due to the absence of fourth-quarter 2019 impairments of $8.2 billion, partially offset by lower crude oil realizations.

US downstream operations reported a loss of $174 million in fourth-quarter 2020, compared with earnings of $488 million a year earlier. The decrease was mainly due to lower margins on refined product sales and lower sales volumes.

ConocoPhillips posted a net loss of $772 million for fourth-quarter 2020, down from net earnings of $720 million in fourth-quarter 2019. Excluding special items, fourth-quarter 2020 adjusted earnings were a loss of $201 million, compared with fourth-quarter 2019 adjusted earnings of $831 million. Special items for the current quarter were primarily non-cash impairments related to the Alaska North Slope Gas asset and non-core assets in Lower 48, in addition to exploration-related expenses in Other International, partially offset by an unrealized gain on Cenovus Energy equity.

Production excluding Libya for fourth-quarter 2020 was 1.1 million boe/d, a decrease of 145,000 boe/d from the same period a year ago. After adjusting for closed acquisitions and dispositions, fourth-quarter 2020 production decreased 88,000 boe/d or 7% from the same period a year ago. This decrease was primarily due to normal field decline partially offset by new production from the Lower 48 and other development programs across the portfolio.

Occidental Petroleum Corp. posted a net loss of $1.3 billion for fourth-quarter 2020, compared to a net loss of $1.34 billion in fourth-quarter 2019. The fourth quarter results included a pre-tax loss of $820 million related to the sale of non-core assets in the Permian basin.

Excluding Colombia, which was sold in December, Occidental’s total average daily production for the fourth quarter was 1.1 million boe/d. Chemical pre-tax income of $192 million for the fourth quarter compared to prior quarter income of $178 million, reflecting higher vinyl margins.

US independent refiners

Marathon Petroleum Corp. (MPC) announced a net profit of $285 million for fourth-quarter 2020, down from a net income of $443 million in fourth-quarter 2019. Fourth-quarter 2020 results include net pre-tax benefits of $851 million. Adjusted net loss was $608 million for fourth-quarter 2020, compared with adjusted net income of $1 billion for fourth-quarter 2019.

Refining and Marketing (R&M) segment loss from operations was $1.6 billion in fourth-quarter 2020, compared with income of $1.1 billion for fourth-quarter 2019. The decrease in R&M earnings was primarily due to lower crack spreads, reduced throughput, and weaker crude differentials, partially offset by lower operating costs.

R&M margin, excluding the LIFO liquidation charge, was $7.42/bbl for fourth-quarter 2020, versus $16.35/bbl for fourth-quarter 2019. Crude capacity utilization was 82% (excluding idled facilities) resulting in total throughput of 2.5 million b/d. Clean product yield was 87%.

MPC’s Dickinson, ND, renewable fuels refinery is ramping operations and is on-track to reach full production by the end of the first-quarter 2021. At full capacity, the refinery is expected to produce 12,000 b/d of renewable diesel from corn and soybean oil. MPC intends to sell the renewable diesel into the California market to comply with the California Low Carbon Fuel Standard. The company also progressed activities associated with the conversion of the Martinez refinery to a renewable diesel plant.

Phillips 66 reported a fourth-quarter 2020 net loss of $539 million, compared with net earnings of $736 million for the prior year’s second quarter.

Refining had an adjusted pre-tax loss of $1.1 billion in quarter, compared with an adjusted pre-tax loss of $970 million in third-quarter 2020. Both periods reflect the continued impact of challenging market conditions. The decreased results in the fourth quarter were largely driven by higher turnaround and maintenance activity.

In refining, Phillips 66 is also advancing its plans at the San Francisco Refinery in Rodeo, Calif., to meet the growing demand for renewable fuels. The company will complete its diesel hydrotreater conversion in mid-2021, which will produce 8,000 b/d of renewable diesel.

Phillips 66’s midstream fourth-quarter pre-tax income was $223 million, compared with $146 million in the third quarter. Midstream results in the fourth quarter included $96 million of impairments related to Phillips 66 Partners’ investments in two crude oil logistics joint ventures, as well as $3 million of hurricane-related costs and $1 million of pension settlement expense.

The Chemicals segment reflects Phillips 66’s equity investment in Chevron Phillips Chemical Co. LLC. Chemicals’ fourth-quarter 2020 pre-tax income was $193 million, compared with $231 million in third-quarter 2020.

Valero Energy Corp. announced fourth-quarter 2020 net loss of $359 million, compared with net earnings of $1.1 billion a year ago. The adjusted net loss was $429 million for fourth-quarter 2020, compared to fourth-quarter 2019 adjusted net income of $873 million. Fourth-quarter 2020 adjusted results exclude the after-tax benefit from a LIFO liquidation adjustment of $70 million.

Valero’s refining segment reported a $377 million operating loss for fourth-quarter 2020, compared to operating income of $1.4 billion for fourth-quarter 2019. Excluding a LIFO liquidation adjustment and other operating expenses, the fourth-quarter 2020 adjusted operating loss was $476 million. Refinery throughput volumes averaged 2.6 million b/d in fourth-quarter 2020, which was 468,000 b/d lower than fourth-quarter 2019.

The renewable diesel segment, which consists of the Diamond Green Diesel (DGD) joint venture, reported $127 million of operating income for fourth-quarter 2020, compared to $541 million for fourth-quarter 2019. After adjusting for the retroactive blender’s tax credit in 2019, adjusted renewable diesel operating income was $187 million for fourth-quarter 2019.

Canadian firms

All financial figures are presented in Canadian dollars unless noted otherwise.

Suncor Energy Inc. posted fourth-quarter 2020 net loss of $168 million, compared with net loss of $2.33 billion for the prior year’s fourth quarter. The net loss for fourth-quarter 2020 included a $539 million unrealized after-tax foreign exchange gain on the revaluation of US dollar denominated debt, a $423 million non-cash after-tax asset impairment charge, and a $142 million after-tax transportation provision related to the Keystone XL pipeline project. The net loss in the prior year quarter included $3.35 billion of non-cash after-tax asset impairment charges.

During fourth-quarter 2020, Suncor’s total upstream production was 769,200 boe/d, compared to 778,200 boe/d in the prior year quarter. Production increased to 514,300 b/d in fourth-quarter 2020 from 456,300 b/d in fourth-quarter 2019, marking the second best quarter of Suncor production in the company’s history and resulted in a combined upgrader utilization rate of 95% in fourth-quarter 2020 compared to 83% in the prior year quarter.

Suncor’s refinery crude throughput was 438,000 b/d and refinery utilization was 95% in fourth-quarter 2020, compared to refinery crude throughput of 447,500 b/d and refinery utilization of 97% in the prior year quarter. R&M operating earnings in fourth-quarter 2020 were $268 million, compared to $558 million in the prior year quarter. The decrease was primarily due to lower refining and marketing margins.

Canadian Natural Resources Ltd. recorded a net income of $749 million for fourth-quarter 2020, compared to a net income of $597 million in fourth-quarter 2019.

In fourth-quarter 2020, the company achieved record quarterly production volumes of 1.2 million boe/d, increases of 4% and 8% from fourth-quarter 2019 and third-quarter 2020 levels, respectively. The increase in production from the comparable periods primarily reflected the completion of planned maintenance and turnaround activities combined with continued high utilization rates and operational enhancements in the Oil Sands Mining and Upgrading segment, increased natural gas activity throughout the year, and closing of the Painted Pony acquisition in fourth-quarter 2020.

Cenovus Energy Inc. posted a net loss of $153 million for fourth-quarter 2020 as compared to net earnings of $113 million for fourth-quarter 2019. Fourth quarter production increased 2% to 380,693 b/d from the same period a year earlier as the company purchased production curtailment credits to produce above the government’s output limits before mandatory curtailment ended in early December.

Cenovus Energy’s fourth quarter refining and marketing operating margin shortfall was $73 million, compared with an operating margin of $109 million in the same quarter of 2019.

Imperial Oil Ltd. reported fourth-quarter 2020 net loss of $1.15 billion, compared with a net income of $271 million a year earlier. Fourth quarter net loss included a non-cash impairment charge of $1.17 billion.

The company’s upstream production for the fourth quarter averaged 460,000 boe/d, the highest quarterly production in 30 years. Kearl total gross production averaged 284,000 b/d, a new quarterly record for the asset, surpassing its previous quarterly record by 40,000 b/d.

About the Author

Conglin Xu

Managing Editor-Economics

Conglin Xu, Managing Editor-Economics, covers worldwide oil and gas market developments and macroeconomic factors, conducts analytical economic and financial research, generates estimates and forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 2012 as Senior Economics Editor.

Xu holds a PhD in International Economics from the University of California at Santa Cruz. She was a Short-term Consultant at the World Bank and Summer Intern at the International Monetary Fund.

Laura Bell-Hammer

Statistics Editor

Laura Bell-Hammer is the Statistics Editor for Oil & Gas Journal, where she has led the publication’s global data coverage and analytical reporting for more than three decades. She previously served as OGJ’s Survey Editor and had contributed to Oil & Gas Financial Journal before publication ceased in 2017. Before joining OGJ, she developed her industry foundation at Vintage Petroleum in Tulsa. Laura is a graduate of Oklahoma State University with a Bachelor of Science in Business Administration.