Mixed bag towards the end of 2020 for construction costs

Pritesh Patel

IHS Markit

Houston

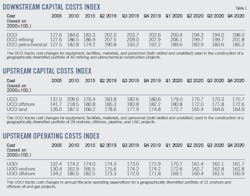

IHS Markit indices are proprietary measures of cost changes similar in concept to the Consumer Price Index (CPI) and draw upon proprietary IHS Markit tools to provide a benchmark for comparing construction costs around the world. Construction costs are tracked on a quarterly basis and then reported as an index value to show how upstream and downstream project cost have changed. Therefore, an index of 170.3 represents that construction costs have increased 70.3% since the year 2000.

Capital cost index for downstream projects (DCCI) increased 1.2% quarter-on-quarter during fourth-quarter 2020. Project costs increased due to higher raw materials prices and rising wage rates. The industry has been suppressed throughout 2020 due to the pandemic. The recent uptick in project costs is a result of currency exchange rate fluctuations. Labor costs in Asia rose in US dollar terms during the quarter. Asian project costs increased 2% during the quarter, this is a direct result of higher labor costs. The DCCI portfolio is heavily weighted towards the Asian projects. A significant increase for Asian project costs will result in rising DCCI.

The year 2020 was marked by project delays and cancelations. Although existing facilities have returned to normal operations, the same cannot be said for projects under construction. Delays have occurred owing to lockdown measures and social distancing requirements. Future construction start dates have been wrecked by financial distress and weak demand figures. Construction costs have declined, but the impact on project costs has been minimal. Bottlenecks within the supply chain are causing delays, leading to higher project costs. Labor productivity is another issue within the downstream sector. Although wage growth has not changed much, “hands-on-tools time” has shifted. These are issues on site as well as at manufacturing facilities of vendors.

Specifically, the DCCI refining index increased 1% to 201.8 during fourth-quarter 2020. Owing to lackluster demand recovery, the global crude utilization outlook has been reduced and remains flat through second-quarter 2021. Global utilization is expected to stand at 74% and 76% in fourth-quarter 2020 and first-quarter 2021, respectively. Relative to the September Global Refining and Marketing Short-Term Outlook 2020, global crude utilization is now about 2% lower over the same quarterly periods. Since Jan. 1, 2020, more than 2.3 million b/d has been closed or under review, including the recent Galp Matosinhos announcement.

The DCCI petrochemical index increased 1% to 185.3 during fourth-quarter 2020. All construction markets had higher costs for petrochemical projects this quarter. The largest increases were in the labor and EPM markets. These markets increased 2.1% and 3.1%, respectively. Wages and charge out rates were higher this quarter due to currency fluctuations. Petrochemical project costs were held in check by equipment. Equipment demand is still low due to the pandemic. Equipment costs account for 57% of petrochemical project costs. Due to declining equipment costs, the overall petrochemical project index rose only 1%.

The IHS Markit Upstream Capital Costs Index (UCCI), which tracks the costs associated with the development of oil and gas fields, increased 0.2% quarter-over-quarter to 171 during fourth-quarter 2020. However, the index was still 5.5% below the year-ago level.

Upstream markets began to recover in second-half 2020 from the major disruptions experienced due to COVID-19 and concomitant low oil prices. However, the offshore rig market continues to be in oversupply coupled with falling demand kept negotiating power squarely in buyers’ hands, which led to lower rates. Offshore rig contracts are being renegotiated, and several contracts have been suspended, canceled, or deferred.

Meantime, steel prices increased during fourth-quarter 2020. Steel consumption and production both fell sharply over second-quarter 2020 as the COVID-19 virus forced lockdowns, but over second-half 2020 demand recovered faster than production. However, the tightness of the steel market is unlikely to last due to more than ample production capacity.

The bulk materials index also trended positive over the fourth quarter. Bulk materials are very sensitive to project activity and demand, and so their markets suffered doubly from the pandemic. As economic activity picked up in second-half 2020 so did bulk costs, though foreign exchange fluctuations are another important factor in this upstream market. Most bulk material segments ended down in 2020 in the US dollar index while experiencing miniscule growth in local currencies.

The UCCI’s counterpart, the IHS Markit Upstream Operating Costs Index (UOCI), which measures the operating costs for those projects and their facilities, has fallen by 6.4% year-on-year, to an index value of 162.

The fourth quarter movement also represents a slight decrease, -0.2%, on the third quarter index value. The decrease is owing to appreciation against the US dollar of local currencies, particularly in Asia, but also in the UK, South Africa, and Colombia. Underlying market conditions remain poor, but after removing the impact of foreign currency the index is unchanged from third-quarter 2020 value. Rather than hinting at imminent recovery, this is likely a consequence of current day rates being so low that further decline in pricing would be unsustainable for many markets. Operators and service companies alike will have to work to lower their cost base in order to achieve further savings.

In fourth-quarter 2020, the diesel index increased just 0.2% quarter-on-quarter despite Brent price continuing to inch upwards, and the labor index increased by 0.7% driven by an increase in Asia. Vessel indexes have been remarkably stable despite the usual fourth-quarter lull, a mark of just how low day rates currently are.