Low commodity prices, large impairments led to Q1 losses

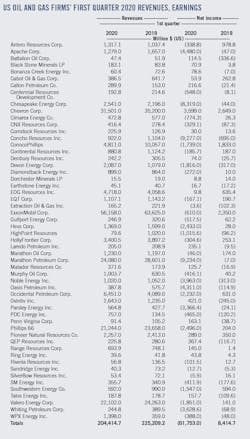

A sample of 56 US-based oil and gas producers and refiners announced a combined net loss of $61.75 billion in the first quarter of 2020, compared to earnings of $8.41 billion in the first quarter of 2019. Total revenues were $204.41 billion for the quarter, compared to $225.21 billion a year ago. Large impairment charges were incurred for the quarter.

First quarter 2020 results were impacted by significant weakness and volatility of commodity prices as a result of the COVID-19 pandemic, and producers’ initial plan to increase production when an agreement among OPEC, Russia, and several others fell apart.

Brent crude oil prices averaged $50.44/bbl in the first quarter of 2020, compared with $63.17/bbl for the same quarter a year ago and $63.41/bbl in the fourth quarter of 2019. West Texas Intermediate averaged $45.8/bbl in first-quarter 2020, compared with $54.83/bbl in the first quarter of 2019 and $56.96/bbl in fourth-quarter 2019.

The number of active oil rigs in the US dropped to 624 at the end of March 2020 from 677 at the end of December 2019, according to Baker Hughes data. This compares to 816 rigs at the end of March 2019. The oil rig count in the US had been slipping since the end of 2018 as capital-constrained shale drillers focused on completing their inventory of wells and limited their drilling activity to the most productive projects.

For first-quarter 2020, US crude oil production averaged 12.81 million b/d, compared to 11.81 million b/d in the first quarter of 2019, according to EIA. US natural gas liquids (NGL) production averaged 5.04 million b/d during the quarter, compared to 4.66 million b/d a year ago.

US commercial crude oil stock at the end of March was 484 million bbl, compared to 459 million bbl at the end of last year’s first quarter, and a 5-year average of 473.6 million bbl.

US refinery inputs were 16.36 million b/d in the first quarter of 2020, compared with 16.46 million b/d for the same quarter a year ago. Refinery utilization rate was 86.2% for the quarter, compared to 87.7% a year earlier.

According to Muse, Stancil & Co, refining cash margins in first-quarter 2020 averaged $12.13/bbl for Middle-West refiners, $10.98/bbl for West Coast refiners, $4.98/bbl for Gulf Coast refiners, $0.27/bbl for East Coast refiners. In the same quarter of the prior year, these refining margins were $13.63/bbl, $10.33/bbl, $3.25/bbl, and $1.16/bbl, respectively.

Henry Hub natural gas spot prices averaged $1.91/MMbtu in first-quarter 2020, compared to $2.92/MMbtu a year earlier. US marketed gas production for the quarter climbed to 101.79 bcf/d from 96.08 bcf/d a year earlier, according to EIA.

A sample of 11 companies based in Canada, including oil and gas producers and pipeline operators, announced a collective loss of $13.3 billion (Can.) in the first quarter of 2020. In the first quarter of last year, this group’s total income was $5.98 billion.

High crude oil inventory levels and takeaway constraints caused the average differential between WTI and Western Canadian Select (WCS) prices to widen 66% in the first quarter compared with the same period in 2019.

US oil and gas producers

ExxonMobil Corp. posted a net loss of $610 million for first-quarter 2020, compared with a net profit of $2.35 billion for the prior year’s quarter. First-quarter results included a $2.9 billion charge from identified items reflecting noncash inventory valuation impacts from lower commodity prices and asset impairments.

Oil-equivalent production was 4 million b/d, up 2% from first-quarter 2019, with a 7% increase in liquids partly offset by a 5% decrease in gas. Excluding entitlement effects and divestments, oil-equivalent production was up 5% from the prior year, with upstream liquids production up 9% on growth in the Permian basin and Guyana. Permian production grew 20% from fourth quarter 2019 and was up 56% from the first quarter of 2019.

In April, the company announced plans to reduce its 2020 capital spending by 30% and cash operating expenses by 15% (OGJ Online, Apr. 7, 2020). Capex is now expected to be $23 billion for the year, down from previous guidance of $33 billion.

Chevron Corp. reported a net profit of $3.6 billion for first-quarter 2020 as compared to a net income of $2.65 billion for first-quarter 2019. Included in this year’s first quarter was a gain of $240 million associated with the sale of upstream assets in the Philippines, favorable tax items totaling $440 million attributable to international upstream, and favorable foreign currency effects of $514 million. The company’s worldwide net oil-equivalent production was 3.24 million b/d in this year’s first quarter, an increase of over 6% from a year ago, and a new quarterly record.

Chevron’s US upstream operations earned $241 million in first-quarter 2020, compared with earnings of $748 million a year earlier. The decrease was primarily due to lower crude oil and natural gas realizations and higher depreciation expense, partially offset by higher crude oil and natural gas production. US downstream operations earned $450 million in first-quarter 2020, compared with earnings of $217 million a year earlier. The increase was mainly due to higher margins on refined product sales, partially offset by higher operating expenses and lower earnings from the Chevron Phillips Chemical Co.

Chevron’s international upstream operations earned $2.7 billion in first-quarter 2020, compared with $2.4 billion a year ago. Positive foreign currency effects, favorable tax items, the gain on the Philippines asset sale and favorable trading effects contributed to the increase. International downstream operations earned $653 million in this year’s first quarter, up from $35 million a year earlier, largely due to higher margins on refined product sales, partially offset by higher operating expenses.

ConocoPhillips posted a net loss of $1.74 billion for first-quarter 2020, compared to net earnings of $1.83 billion in first-quarter 2019. Excluding special items, first-quarter 2020 adjusted earnings were $500 million, compared with first-quarter 2019 adjusted earnings of $1.1 billion. Special items for the quarter were primarily driven by an unrealized loss on Cenovus Energy equity and price-driven non-cash impairments.

The company announced voluntarily production curtailments due to weak prices. Voluntary curtailments for the month of May are now estimated to be 265,000 b/d gross, and voluntary curtailments for the month of June will be 460,000 b/d.

Production excluding Libya for first-quarter 2020 was 1.28 million boe/d, a decrease of 40,000 boe/d from the same period a year ago. Adjusting for closed and pending dispositions, production increased 52,000 boe/d primarily due to growth in Eagle Ford, Bakken, and Permian unconventional production as well as development programs in Europe, Asia Pacific, and other Lower 48 plays. This growth more than offset normal field decline and impacts from a third-party pipeline outage on Kebabangan field in Malaysia. Production from Libya averaged 11,000 boe/d.

Concho Resources Inc. recorded a net loss of $9.28 billion for first-quarter 2020 as compared to a net loss of $695 million for first-quarter 2019. Special items impacting earnings for the quarter included non-cash impairment charges of $12.6 billion primarily related to assets and goodwill. Excluding these and other special items, adjusted net income for the quarter was $142 million, compared to adjusted net income of $144 million a year ago.

First-quarter 2020 oil production volumes totaled 209,000 b/d of oil compared with 210,000 b/d in the same period a year ago. Natural gas production for first-quarter 2020 was 699 MMcfd. Total production for first-quarter 2020 was 326,000 boe/d compared with 328,000 boe/d produced in the same period a year ago.

Concho Resources made an additional cut to its 2020 planned capital expenditures to $1.6 billion, representing a 40% decrease from original expectations, and targeting $100 million in operating cost reduction.

EOG Resources Inc. announced a net income of $9.8 million for this year’s first quarter, down from a net income of $635.4 million in first-quarter 2019. Adjusted non-GAAP net income for first-quarter 2020 was $318 million compared with adjusted non-GAAP net income of $689 million for the same prior year period.

Total company crude oil volumes of 483,300 b/d grew 11% compared with the first quarter 2019. NGL production increased 35%, supported by the increased recovery of ethane in natural gas processing operations. Natural gas volumes grew 5%.

Occidental Petroleum Corp. posted a net loss of $2.23 billion for this year’s first quarter, compared with a net income of $631 million in first-quarter 2019. First quarter pre-tax items affecting comparability included $1.4 billion of goodwill impairment charges and equity investment losses mainly related to Western Midstream Partners LP, $670 million mark-to-market loss on interest rate swaps, $580 million of impairment and charges, and $150 million of Anadarko Corp. acquisition-related transaction costs, partially offset by $1 billion of mark-to-market gains on crude oil hedges. Adjusted loss for the quarter was $467 million.

Total average daily production of 1.42 million boe/d included Permian resources production of 474,000 boe/d. International average daily production volumes was 241,000 boe/d.

Oxy cut an additional $1.2 billion from operating and corporate expenses, reducing its full-year capital budget to $2.4-2.6 billion, down 50% from its original 2020 guidance.

US independent refiners

HollyFrontier Corp. announced first-quarter 2020 net loss of $304.6 million, compared with a net income of $253 million for the prior year’s first quarter. The first quarter results reflect special items that collectively decreased net income by a total of $391.1 million. Excluding these items, net income for the first quarter was $86.5 million compared to $93.2 million for the first quarter of 2019, which excludes certain items that collectively increased net income by $159.9 million for that quarter.

The refining segment reported adjusted EBITDA of $175.9 million compared to $193.4 million for the first quarter of 2019. This decrease was primarily driven by lower product margins and higher laid-in crude costs which resulted in a consolidated refinery gross margin of $11.32/bbl, a 11% decrease from the first quarter of 2019. Crude oil charge averaged 436,360 b/d for 2020 first quarter compared to 400,430 b/d for the first quarter 2019.

Marathon Petroleum Corp. reported a net loss of $9.23 billion for first-quarter 2020, compared to a net loss of $7 million for first-quarter 2019. First-quarter 2020 results include pre-tax charges of $12.4 billion primarily related to non-cash impairments. Adjusted net loss was $106 million, compared to an adjusted net loss of $59 million for the first quarter of 2019.

Refining and Marketing (R&M) segment loss from operations was $622 million in the first quarter of 2020 compared to a loss from operations of $334 million for the first quarter of 2019. The quarter-over-quarter decrease in R&M earnings was primarily due to lower blended crack spreads, lower sweet differentials, and higher planned turnaround expenses.

Overall, the R&M margin was $11.3/bbl for the first quarter of 2020. Crude capacity utilization was 91%, resulting in total throughputs of 3 million b/d, and clean product yield was 83%.

Phillips 66 posted a net loss of $2.5 billion for first-quarter 2020, down from net earnings of $204 million in first-quarter 2019. Excluding special items of $2.9 billion in the first quarter of 2020, primarily impairments related to goodwill and the company’s investment in DCP Midstream LLC, adjusted earnings were $450 million, compared with fourth-quarter 2019 adjusted earnings of $689 million.

Refining segment’s adjusted pre-tax loss was $401 million in the first quarter of 2020, compared with adjusted pre-tax income of $345 million in the fourth quarter of 2019. The decrease was largely driven by lower realized margins and reduced volumes. First-quarter realized margins were $7.11/bbl, down 25% from the prior quarter.

Phillips 66’s worldwide crude utilization rate was 83% in the first quarter, down from 97% in the fourth quarter, reflecting maintenance activities and economic run cuts. Clean product yield was 82% in the first quarter, down from 84% in the prior quarter, due to downtime on secondary units. Pre-tax turnaround costs for the first quarter were $329 million, an increase of $97 million from the fourth quarter of 2019.

Chemicals (50% stake in Chevron Phillips Chemical Co.) first-quarter 2020 pre-tax income was $169 million, compared with $150 million in the fourth quarter of 2019. Chemicals results in both periods included reductions to equity earnings from lower-of-cost-or-market inventory adjustments.

Valero Energy Corp. reported a net loss of $1.85 billion for this year’s first quarter as compared to net earnings of $141 million for first-quarter 2019. The refining segment reported a $2.1 billion operating loss for the quarter compared to $479 million of operating income a year ago. Refinery throughput volumes averaged 2.8 million b/d in the first quarter of 2020, which is in line with the first quarter of 2019. Valero expects to invest $2.1 billion of capital in 2020, a reduction of $400 million from its prior guidance.

Canadian firms

All financial figures are presented in Canadian dollars unless noted otherwise.

Suncor Energy Inc. announced a net loss of $3.53 billion for first-quarter 2020, compared with net earnings of $1.47 billion for the prior year’s first quarter.

The net loss for the first quarter of 2020 included $1.79 billion of non‑cash after‑tax asset impairment charges, a $1.02 billion unrealized after‑tax foreign exchange loss on the revaluation of US dollar denominated debt, and a $397 million after‑tax hydrocarbon inventory write‑down. The first quarter 2020 operating loss was $309 million, compared to operating earnings of $1.21 billion in the prior year’s first quarter.

Suncor’s total upstream production was 739,800 boe/d during the first quarter of 2020, compared to 764,300 boe/d in the prior year quarter. During the first quarter of 2020, the company minimized its exposure to lower priced bitumen by maximizing bitumen production transferred to upgrading to produce higher value SCO bbl.

The company’s refinery crude throughput was 439,500 b/d and refinery utilization remained strong at 95% in the first quarter of 2020, comparable to crude throughput of 444,900 b/d and refinery utilization of 96% in the prior year’s quarter.

Suncor has cut its 2020 capital program by $1.9 billion compared to the original 2020 plan to $3.6-4 billion.

Cenovus Energy Inc. posted a net loss of $1.8 billion for first-quarter 2020, compared with net earnings of $110 million in first-quarter 2019. The decrease was primarily due to lower average realized oil prices, a series of non-cash inventory write-downs, and increased transportation and blending costs.

The company’s first-quarter results were also negatively impacted by the timing of condensate and refinery inventory use in a falling commodity price environment. Condensate blended to produce heavy oil and refinery feedstock used in the first quarter were purchased when prices were higher.

Thanks to incremental barrels shipped by rail and reduced mandatory curtailment levels, first-quarter production at Cenovus’s Christina Lake and Foster Creek oil sands projects was 387,000 b/d, up from 343,000 b/d in the same period in 2019.

Imperial Oil Ltd. reported a net loss of $188 million for first-quarter 2020, down from net earnings of $293 million in first-quarter 2019. This year’s first quarter loss included non-cash charges of $301 million.

About the Author

Conglin Xu

Managing Editor-Economics

Conglin Xu, Managing Editor-Economics, covers worldwide oil and gas market developments and macroeconomic factors, conducts analytical economic and financial research, generates estimates and forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 2012 as Senior Economics Editor.

Xu holds a PhD in International Economics from the University of California at Santa Cruz. She was a Short-term Consultant at the World Bank and Summer Intern at the International Monetary Fund.

Laura Bell-Hammer

Statistics Editor

Laura Bell-Hammer is the Statistics Editor for Oil & Gas Journal, where she has led the publication’s global data coverage and analytical reporting for more than three decades. She previously served as OGJ’s Survey Editor and had contributed to Oil & Gas Financial Journal before publication ceased in 2017. Before joining OGJ, she developed her industry foundation at Vintage Petroleum in Tulsa. Laura is a graduate of Oklahoma State University with a Bachelor of Science in Business Administration.