The impact of COVID-19 on gas demand and LNG exports in the US

Adrian Sookhan

Gas Exporting Countries Forum (GECF)

Doha, Qatar

Mahdjouba Belaifa

GECF

Doha, Qatar

The novel coronavirus (COVID-19), which originated in Wuhan, China, at the end of 2019, has become a global pandemic spreading across all regions and to more than 200 countries globally. As of May 10, there were around 4.1 million reported cases and more than 280,000 COVID-related deaths globally.

The epicenter of the virus shifted from China to Europe (Italy, Spain, France, and Germany) and now to the US.

The US—the world’s third most populated country—has seen its cases grow exponentially from mid-March to mid-May with around 1.35 million cases. The country currently accounts for around 33% of the global COVID-19 cases and 28% of global COVID-related deaths. Similar to many countries across the globe, the US has taken lockdown and social distancing measures, shut non-essential businesses, and restricted movement across its borders to curb the spread of the virus. These measures have negatively affected energy demand and economic growth due to the closure of schools, businesses, industrial plants, and lower transportation activity.

Natural gas consumption

The US is by far the largest natural gas consumer globally with gas accounting for more than 31% of its primary energy mix. As such, the negative impact of COVID-19 on energy demand is expected to drag gas demand downward. During the first 4 months of 2020, gas consumption has fallen across all major sectors, except the power sector, in comparison to 2019 (Fig. 1).

The residential sector recorded the largest drop in consumption, declining by 12.4% y-o-y, followed by the commercial (-8.8%) and the industrial (-0.1%) sectors. In contrast, gas consumption for power jumped by 12.3% y-o-y. Although COVID-19 lockdown measures may have contributed to the decline in gas consumption, a relatively mild 2019/2020 season in the US was the major driver for the drop in residential and commercial gas consumption. Between January and April 2020, the heating degree days (HDDs) fell by 11% y-o-y to 2,456, which curbed gas demand for heating.

Considering the impact of lockdown measures on gas consumption in the US, between Mar. 15 and Apr. 30, it is estimated to have increased by 6.0% y-o-y to 99 bcm compared to the same period in 2019. It should be noted that gas consumption is estimated to have grown across all major sectors, including the power (+12% y-o-y), residential (6%), and commercial (4%) sectors, while consumption in the industrial sector is estimated to have stagnated. Despite the lockdown measures in some US states, higher heating degree days (HDD)—which increased by 27% y-o-y in April 2020—supported the uptick in gas consumption in the residential and commercial sectors during the period in question.

The power sector is likely the most impacted by COVID-19 lockdown measures. Power generation fell by 7% y-o-y between Mar. 15 and Apr. 30, 2020, despite a 31% y-o-y increase in cooling degree days (CDD) in March and April combined. Although electricity generation was lower since the implementation of lockdown measures, higher gas burn (+7% y-o-y) and renewables output (+5%) offset lower power generation from coal (-31%), hydro (-18%), and nuclear (-7%). Gas is the dominant fuel in the US power sector with a 38% share followed by nuclear (22%), coal (16%), renewables (12%), hydro (8%), and others (4%).

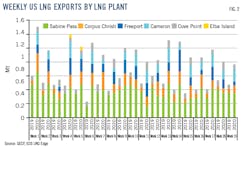

Despite the COVID outbreak, which has dented global gas and LNG demand, US LNG exports have been resilient in 2020 thus far. As shown in Fig. 2, US LNG exports have risen significantly in 2020 compared to 2019. During the first 19 weeks of 2020, exports surged by 99% y-o-y to 20.5 million tonnes (Mt), supported by the start-up and ramp-up of new LNG facilities in the country.

Gas, LNG prices

In terms of the futures gas and LNG prices, if shipping and liquefaction costs are considered as “sunk-costs,” US LNG is uneconomical for delivery to Europe through October 2020 since the price spreads between Europe and the US are negative during the period (Fig. 3).

Although the JKM-HH price spreads are positive from July 2020 to April 2021, North East Asia may be unable to absorb the significant growth in global LNG supply in 2020, which is expected to come mainly from the US. Under such market conditions, off-takers of US LNG are highly likely to cancel cargoes since they will have to incur further financial losses if these LNG cargoes are sold at a loss in the European market.

As reported in April 2020, around 20-30 US LNG cargoes for loading in June 2020 were cancelled due to the weak market fundamentals. The cancelled cargoes are equivalent to 1.4-2.1 Mt of LNG, which is almost half of US monthly LNG exports. LNG marketers, such as Cheniere, may choose to remarket the cancelled LNG cargoes, however, the low-price environment may deter such action. If LNG off-takers choose to remove a similar amount of monthly cargoes between July and September 2020, around 6-8 Mt of LNG supply could disappear from the market. Under such circumstances, this would lead to shut-ins or underutilization of some US LNG facilities, which could offer some support to global spot gas and LNG prices in the short-term.

The authors

Adrian Sookhan is a gas market analyst at the Gas Exporting Countries Forum (GECF) and Mahdjouba Belaifa is head of the gas market analysis department at GECF in Doha, Qatar.