Construction costs end 2019 on a surprising note

Pritesh Patel

IHS Markit

Houston

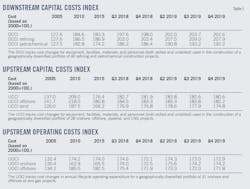

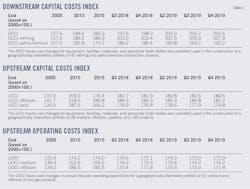

IHS Markit indices are proprietary measures of cost changes similar in concept to the Consumer Price Index (CPI) and draw upon proprietary IHS Markit tools to provide a benchmark for comparing construction costs around the world. Construction costs are tracked on a quarterly basis and then reported as an index value to show how upstream and downstream project cost have changed. Therefore, an index of 203.7 represents that construction costs have increased 103.7% since the year 2000.

Downstream and upstream capital and operating costs all slightly decreased in fourth-quarter 2019 from the previous quarter. Positive movement occurred for the equipment, subsea, offshore rigs, engineering and project management, and construction labor markets on a US dollar basis. The steel and land rigs segments, however, experienced negative growth on a US dollar basis.

In fourth-quarter 2019, the IHS Markit Downstream Capital Costs Index (DCCI) decreased 0.5% with an index value of 202.6 from the end of third quarter to the end of fourth quarter. The project portfolio experienced a decline due to lower steel and equipment costs. The labor and Engineering Project Management (EPM) markets displayed signs of growth, rising 0.2% and 0.4%, respectively. The project portfolio is weighted towards equipment, so despite wage inflation, the overall DCCI trended negative. Five of the six regions within the DCCI had lower project costs during the fourth quarter, with Russia as the outlier. Wage growth for construction labor and EPM offset lower costs for other markets. South America experienced the biggest project cost decline during the quarter due to lower labor and EPM rates.

The DCCI refining index decreased by 0.5% with an index of 207.9 during fourth-quarter 2019, with the decline driven by the fall in steel costs. The global steel segment fell by a staggering 16.3% in 2019 in the US dollar index. Steel prices were artificially inflated owing to protectionist measures. The underlying data regarding end-user demand and raw materials prices continues to trend negative. Global construction activity trended downward at yearend 2019, leading to lower costs for equipment and construction materials during the fourth quarter. Wage inflation is still present in the industry due to labor shortages, but higher construction labor and EPM costs were not enough to offset declines in the other markets.

The DCCI petrochemical index decreased by 0.5% to 192.2 during fourth-quarter 2019. Lower steel costs weighed heavily on the petrochemical portfolio index, with costs declining 6% during the quarter. EPM costs increased the most at 1.1%, but the EPM market is only responsible for 9% of petrochemical project costs. Increased spending and project activity will keep pressure on supply chains and labor rates.

The IHS Markit Upstream Capital Costs Index (UCCI), which tracks the costs associated with development of oil and gas fields, fell by 1.1% between the end of the third and fourth quarters 2019 to an index score of 180.6. Market cost changes were slightly positive except for the steel market, which experienced sharp declines. Tepid demand and booming production exacerbated an already oversupplied steel market, and this imbalance is expected to continue well into 2020. Equipment costs fell slightly for the first time in 3.5 years thanks to improved efficiencies in manufacturing processes, as well as the adoption of new technologies by suppliers. Costs for offshore installation vessels and bulk materials also fell slightly, while those for offshore rigs, engineering labor, and subsea equipment increased.

The UCCI’s counterpart, the IHS Markit Upstream Operating Costs Index (UOCI), which measures the operating costs for those projects and associated facilities, fell by 0.1% in fourth-quarter 2019. Despite the slight fourth-quarter decline, the UOCI experienced an overall increase of 0.5% for 2019 to an index value of 173.4. The strong US dollar had a large impact on the UOCI, which in local terms grew by 0.7% in fourth-quarter 2019 and increased 2% overall for the year.

While capital and operating costs fell jointly during the first few years of the downturn, operating costs are beginning to recover as spending returns for the maintenance of existing projects. Low oil prices and a pessimistic industry outlook have so far precluded any investment in new projects, leaving the markets that rely on capital in a struggle for their survival. IHS does not expect these markets to recover until operators begin reinvesting in upstream development, an unlikely prospect given current industry sentiment.