Oil Market 2020: Struggle to balance

Global oil demand in 2019 suffered from the headwinds of the global economy, US-China trade war, shrinking global car sales, and rising civil unrests. Growth in the first half was the slowest pace for this period since 2008.

With slowing oil demand growth and rapid production expansion of non-Organization of the Petroleum Exporting Countries (non-OPEC), the Organization of Economic Co-operation and Development (OECD) commercial oil inventories had been consistently rising in the first half of 2019. This situation was reversed modestly in the second half, with the normalization of oil demand growth and further production reduction from OPEC.

Oil demand growth in 2020 is expected to accelerate. The latest forecast from the International Monetary Fund (IMF) called for a modest recovery of global economic growth. The International Marine Organization (IMO) tailwinds and lower oil prices will also provide support. However, downside risks remain high.

The recent Vienna meeting in December started another round of cuts. Obviously, the market is overwhelmingly reliant on the intervention of OPEC, namely a combination of proactive production cuts from Saudi/GCC and embargoed barrels from Iran and Venezuela.

With a cluster of large-capacity start-ups in Norway, Brazil, and Guyana, oil production from non-OPEC countries is expected to grow at record speed in 2020, challenging attempts by OPEC and Russia to balance the global oil market.

Although the US still tops the list of non-OPEC countries with quickest production growth in 2020, the pace of US oil output growth is slowing as operators continue to scale back activity to generate free cash flow and improve investor returns.

The decelerating US production growth, however, should moderate the strong expansion of international non-OPEC production and help accommodate to the rate of assumed expansion for demand in 2020.

However, combined, oil inventories will continue to build strongly in early 2020 due to over-supply. Crude oil prices will remain depressed.

Meantime, geopolitical tension remains acute, as demonstrated by recent attacks to Saudi Arabia, and rising violence in Libya and other Middle East countries.

Global oil demand

Global oil demand increased to 100.24 million b/d in 2019, a growth of 960,000 b/d, or 0.97%, from 2018, according to latest IEA data. This compares to growth of 1.16 million b/d (+1.18%) in 2018, and 1.74 million b/d (+1.81%) in 2017.

The oil demand growth of 960,000 b/d in 2019 was marked by an 80,000 b/d decline in OECD countries, the first annual fall since 2014, and a 1.04 million b/d increase in non-OECD countries. In OECD, declines in Japan and Europe offset increase in the US. In non-OECD, China demand grew 630,000 b/d, contributing to 66% of the growth in the world.

The fall in oil demand growth in 2019 was certainly a consequence of the ongoing global macro headwinds. The global growth fell sharply in 2019, along with a broad-based slowdown in manufacturing and global trade.

According to the latest CPB World Trade Monitor, global trade volume contracted by 1.1% in September 2019 from a year ago. This represents the fourth consecutive month of annual decline, marking the weakest period for global trade results since 2009.

In its latest World Economic Outlook (October 2019), IMF forecast economic growth of 3% in 2019, the lowest level since 2008 and a serious slowdown from 3.8% in 2017. IMF also forecasts the global economic growth to rebound modestly to 3.4% in 2020, based on expected but precarious recoveries or shallower recessions in stressed emerging markets. These predictions have been continuously revised down from the previous ones. The forecasts in April of 2019 called for 3.3% growth in 2019 and 3.6% in 2020.

The economic indicators published since the IMF October report point to some recent stabilization or even improvement. The JP Morgan Chase Global Index posts 50.3 in November 2019, a 7-month high. China’s November purchasing managers index rose slightly to 50.2, over 50 for the first time since April.

That said, the level of the PMI is consistent with only a slight improvement in overall operating performance. In China a broader slowdown in the economy will likely prove stickier.

As a major barometer of oil demand growth, global passenger vehicle sales experienced sharp contraction in 2019, mostly in China. Aside the drag from the economy, some of the forces pulling down Chinese car sales were policy related. Their impacts are temporary and should have begun to ebb over into 2020.

Global oil demand growth will rebound modestly in 2020, by 1.22 million b/d, according to IEA’s most recent forecast. The forecast is based on IMF’s economic outlook for 2020. However, the outcome range could be wide.

On the one hand, global manufacturing activity display signs of stabilization/improvements, the new IMO regulations should provide some tailwinds, and global oil demand appears to have normalized from the low of the first half of 2019. On the other hand, persistent US/China trade war and rising geopolitical tensions (e.g. unrest in Hong Kong) could further disrupt supply chains and hamper confidence, investment, and growth.

According to IEA, OECD oil demand will regress back a little bit (+0.6%) to 48.05 million b/d this year. Growth for advanced economies is projected to stay at 1.7% in 2020, according to IMF.

Demand in OECD Americas will increase by 140,000 b/d, or 0.55%, this year. OECD European oil demand will grow 0.63%. Demand in OECD Asia will increase by 50,000 b/d, following a decrease of 130,000 b/d last year.

Non-OECD demand will grow 930,000 b/d this year, following 1.04 million b/d growth in 2019 and 890,000 b/d in 2018. The growth rate for emerging market and developing economies is forecast to rise to 4.6% in 2020, compared to 3.9% in 2019, according to IMF.

Oil demand growth in China is expected at 400,000 b/d this year, a slowdown from 630,000 b/d last year, and 500,000 b/d in 2018. The Chinese economy is expected to slow down to 5.8% in 2020 from 6.1% in 2019.

India oil demand growth is expected to be 180,000 b/d this year, compared to 140,000 b/d last year and a decline of 140,000 b/d in 2018. Indian economic growth is forecast to accelerate to 7% this year from 6.1% in 2019.

World oil supply

Total world oil supply averaged 100.3 million b/d in 2019. The growth was basically zero for the year, as OPEC+ production cuts offset the non-OPEC production growth. This compares to a global growth of 2.7 million b/d in 2018.

In 2019, OPEC crude production was around 30 million b/d, down nearly 1.9 million b/d from 2018.

Saudi Arabia’s crude production was down from 10.33 million b/d in 2018 to 9.83 million b/d in 2019, a reduction of 500,000 b/d. Involuntary cuts from Iran and Venezuela totaled around 1.77 million b/d, comprising most of the reduction.

Production from Iraq, Nigeria, and UAE in 2019 were higher from a year ago, with a combined increase of 300,000 b/d. Production in Libya, excluded from cuts, increased 110,000 b/d.

On Dec. 6, 2019, OPEC and its non-OPEC partners agreed on further production cuts of 500,000 b/d bringing the total production cuts to 1.7 million b/d from 1.2 million b/d. Saudi Arabia once again volunteered an additional reduction of 400,000 b/d. The production cuts will last through the first quarter of 2020 and OPEC will meet again on March 6 to decide on next steps.

In 2019, total non-OPEC oil production increased 1.9 million b/d, down from 2.9 million b/d in 2018. The movement of non-OPEC production was largely driven by the US. US oil production increased 1.67 million b/d in 2019, down from 2.25 million b/d in 2018.

2020 global oil supply is forecast to grow 1.5 million b/d, as the increase of non-OPEC production more than offsets the expected reduction in OPEC production. Total non-OPEC oil supply will increase 2.12 million b/d.

International non-OPEC supply growth will be well above-average in 2020 with an expected growth of 1 million b/d, or 245%, supported by major project starts-ups. These include a cluster of large-capacity start-ups in Brazil (8 FPSO start-ups since April 2018, 1.2 million b/d), the Johan Sverdrup project in Norway (November 2019 start, 440,000 b/d capacity, currently >350,000 b/d), and the first FPSO start in Guyana (Liza-1, December 2019 start). Canada should also allow for incremental growth in 2020 with the exemption of rail volume from the curtailment.

In the recent Vienna meeting, Russia agreed to cut production by an additional 70,000 b/d from January, but successfully lobbied for excluding condensates from targets. Gas condensate production is expected to rise in 2020 as Novatek’s Yamal LNG plant ramps up. Over the past year, Russia met its production target for only 3 months under the OPEC+ deal when the Druzhba pipeline was contaminated.

In the US, Lower-48 production is decelerating, reflecting factors including lower oil prices and stricter capital disciplines. However, the US still tops the non-OPEC countries with an expected 1.1 million b/d growth.

US economy, energy consumption

US economic growth is also decelerating, with real GDP growth slowing down from 3.1% in first-quarter 2019 to 2.1% in the third quarter, according to the US Bureau of Economic Analysis.

The ISM Manufacturing PMI in the US edged down to 48.1 in November 2019 from 48.3 in October, well below market expectations of 49.2. This reading pointed to the fourth straight month of declining manufacturing activity amid a steeper decline in new orders.

However, it has nonetheless displayed relative resilience with the strongest job market in 50 years and solid consumer spending. The latest US jobs report showed that 266,000 jobs were added in November 2019 vs. a 187,000 estimate. Unemployment reached a 50-year low of 3.5%. That said, labor force participation rate also edged down. Labor compensation growth remained moderate.

US GDP growth will slow to 2.0% in 2020 from 2.2% in 2019. This is according to the most recent forecast released at the Federal Open Market Meeting on Dec. 11, 2019.

US energy consumption will grow 2% this year to 102 quadrillion btu (quads), OGJ forecasts. Fossil fuels continue to account for the bulk of US energy consumption, and their share of the total has continuously increased since 2017.

US oil consumption

US petroleum liquids consumption is estimated at 20.58 million b/d in 2019, a growth of 70,000 b/d (+0.3%), according to EIA data. This compares to a growth of 546,000 b/d (+2.7%) in 2018.

For all of 2019, US regular gasoline retail prices averaged $2.60/gal, compared to $2.73/gal in 2018. Vehicle miles travelled (VMT) during the first 10 months of 2019 increased 1% y-o-y, as reported by the Office of Highway Policy Information. However, estimated US gasoline consumption averaged 9.3 million b/d in 2019, 0.3% lower from a year ago. This may relate to higher vehicle efficiencies and increased sales of hybrid/electric cars.

In 2019, estimated US distillate consumption was 4.11 million b/d, a decline of 0.9% from the 2018 level, reflecting the weakness in manufacturing activity/industrial production, and less oil and gas drilling activities.

In 2019, jet fuel demand is estimated to have averaged 1.75 million b/d, up 2.6% from a year ago. US revenue passenger miles in 2019 increased 4.3% from a year ago.

LPG and ethane consumption averaged 3.18 million b/d in 2019, up 5.9% from the year-ago level, driven by growth of US petrochemical projects/production.

Residual fuel oil demand averaged 291,000 b/d in 2019, down 8.6% from a year ago, due to less trade volumes and new IMO regulations.

OGJ forecasts US oil demand growth this year to accelerate to 0.9%, or 177,000 b/d, mainly driven by LPG and ethane.

Risks of oil demand growth relate to the development of the economy, the price environment, fuel substitution, and vehicle efficiencies.

US oil production

US crude oil production is estimated to have averaged 12.25 million b/d in 2019, up 11.5% from 10.99 million b/d in 2018. The compares to a growth of 17.5% in the previous year.

Due to persistent lower commodity prices and stricter capital disciplines, the number of oil rigs in operation has been on the decline since the beginning of 2019. For the week ended Dec. 20, 2019, there were 685 oil-directed rigs working, 198 fewer than one year ago.

With a $50-$55/bbl WTI pricing framework, OGJ forecasts US crude oil production to grow 6.2% in 2020 and average 13 million b/d. The growth volume is around 750,000 b/d, down from 1.6 million b/d in 2018 and 1.25 million b/d in 2019.

According to Rystad Energy, shale investments declined by 6% to around $129 billion in 2019 and are expected to fall another 11% in 2020 due to the industry’s focus on cash flow discipline and free cash flow generation.

Similarly, Simmons Energy estimates E&P companies’ capital expenditures will continue to bend lower by 10% to 15% this year. The company also commented that the public operators would need to observe sustained spot prices above $60/bbl WTI coupled with an attractive 24-month strip before they begin to materially increase activity.

Regarding well performance, well productivity across the key basins other than the Delaware has peaked and a flat/declining productivity is expected moving forward, according to an analysis by Simmons.

Several companies that have already provided guidance for 2020 point to further declines in spending compared with 2019. Many independent players are now expecting a slower pace of growth. However, not all companies are scaling back. Pioneer and EOG are still planning for strong US oil supply growth in 2020. ExxonMobil and Chevron continue to step up activity in the Permian basin.

Oil production from the Gulf of Mexico, which has grown every year since 2013, is set for another year of record oil production in 2020, supported by Big Foot and Crosby fields, and infill drilling in legacy producing fields. Appomattox field is also ramping up.

US natural gas liquids (NGL) production climbed 11.7% in 2019 to 4.88 million b/d and will increase 6.6% to 5.2 million b/d this year, OGJ forecasts.

US total oil field production is expected to increase 1.1 million b/d, or 6.3%, in 2020.

US refining operations

Unplanned outages, heavy maintenance, and dwindling heavy oil supplies contributed to reduced US refinery activity.

US refinery runs have increased each year since 2009, most recently reaching a record high of 17.3 million b/d in 2018, according to EIA data. However, refinery runs declined 2% in 2019 to 17 million b/d, marking the first decline in 10 years.

Refinery utilization as a percentage of operable capacity averaged 90.3% in 2019, down from 93.1% 2018. US refinery capacity was at a record high of 18.8 million b/d as of Jan. 1, 2019 and remained around that level throughout the year.

In June 2019, the Philadelphia Energy Solutions (PES) refinery in South Philadelphia, which has the largest refining capacity among East Coast refineries (335,000 b/d), discontinued operations due to an explosion.

According to Muse Stancil & Co, refining cash margins from January to November of 2019 averaged $15.02/bbl for the Midwest, $17/bbl for the West Coast, $6.08/bbl for the Gulf Coast, and $2.84/bbl for the East Coast. The average cash refining margins for these refining centers averaged $14.76/bbl, $25.87/bbl, $8.24/bbl, and $2.91/bbl respectively in 2018.

In 2020, OGJ expects US refining activity to ramp up with increases in both refining capacity and utilization, thanks to the tailwinds of new IMO regulations and less unplanned outages.

US oil trade

US crude oil exports set a record of 2.9 million b/d in 2019, an increase of nearly 42%, or 850,000 b/d, from 2018, according to OGJ estimates. US crude imports averaged 6.96 million b/d in 2019, down over 10% from the 2018 average of 7.77 million b/d. Accordingly, US crude net imports fell to around 4 million b/d in 2019 from 5.7 million b/d a year ago, a decrease of 43%.

US crude oil exports rose to average 2.9 million b/d in the first half of 2019, and set a record-high monthly average in June 2019 at 3.2 million b/d. However, due to the narrowing of the Brent-WTI price spread, along with headwinds from the 5% tariff imposed on US crude by China, US crude exports slowed in the third quarter of 2019.

The top regional destination for US crude oil exports was Asia and Oceania. Over the first 9 months of 2019, US crude oil exports to South Korea, India, and Taiwan increased 163%, 84%, and 35%, respectively. China has been an exception as US crude oil exports to China in the first 9 months of 2019 averaged 169,000 b/d, down from 300,000 b/d over the same period in 2018.

US crude oil exports to Western European destinations also increased dramatically. Over the first 9 months of 2019, crude exports to the Netherlands increased 151%, and exports to the UK increased 43% compared with the same period of 2018.

On the import side, US imported more than 3.86 million b/d of crude oil from Canada in 2019, two times more than the volumes from OPEC. Crude imports from OPEC members decreased by 1 million b/d, or 41%, from a year ago. Imports from Saudi Arabia, Venezuela, and Iraq contributed to the largest declines.

With US crude production expected to increase further in 2020, and with domestic refineries nearly maxing out capacity, US crude oil exports will continue to balloon in 2020. This is also bolstered by new infrastructure coming online along the Gulf Coast. Meantime, the attacks on oil facilities in Saudi Arabia and overall rising tensions in the Middle East urge international buyers to diversify their import sources.

OGJ forecasts that US crude exports will increase a further 35% to 3.9 million b/d in 2020, while crude imports will rebound by 8% to 7.5 million b/d. US crude net imports will be reduced to around 3.6 million b/d in 2020.

OGJ estimates that US exported an average of 5.6 million b/d of petroleum products in 2019, largely flat with the 2018 level. This represents a slowdown from the previous year’s growth of 6.4%, reflecting lower US refinery activities in 2019 compared with a year ago and slowing global economic growth, which is limiting demand for petroleum products.

Distillate remained the largest US petroleum product export. Over the first 9 months of 2019, distillate exports averaged 1.35 million b/d, an increase of 92,000 b/d (7.3%) compared with the same period of 2018. Mexico was the largest destination for US distillate exports, receiving 284,000 b/d, or 21% of total US distillate exports. Aside from Mexico, US distillate exports go mostly to Central and South America, and Europe, mostly to the Netherlands.

Propane was the second-largest US petroleum product exported. Over the first 9 months of 2019, propane exports increased 132,000 b/d, or 14.4%, from the same period of 2018. Most propane exports are destined to Asia and Europe for use as a petrochemical feedstock.

Over the first 9 month of 2019, US exported around 770,000 b/d of motor gasoline, a decrease of 6.7%. This compares to an increase of 21% a year ago. The decline is contributable to a broader contraction of global passenger vehicle sales.

US residual fuel exports declined the most in 2019 as the international bunker market was preparing for new IMO regulations.

Product imports increased by 5.6% in 2019 to 2.3 million b/d, due to lower domestic refiner runs. Combined, US product net exports declined in 2019 to 3.26 million b/d from 3.38 million b/d a year ago.

OGJ forecasts that, in 2020, products exports will rebound with expected higher refinery runs. This, combined with continuously decreasing US crude oil net imports, will result in US becoming a petroleum net exporter for the first time on an annual basis.

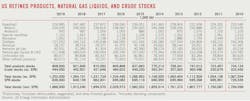

Year-end oil stocks

Crude oil commercial inventories closed out 2019 at 444 million bbl, 0.3% higher from a year ago and 1.3% higher than the 5-year average.

Total petroleum product stocks stood at 808 million bbl at yearend 2019, down 1.66% from a year ago and 1.3% lower than the 5-year average.

The amount of crude oil in the SPR stood at 636 million bbl at the end of 2019, compared to 649 million bbl at yearend 2018.

US natural gas

Natural gas spot prices at Henry Hub averaged $2.6/MMbtu in 2019, compared with $3.15/MMbtu in 2018. Record high production in the US means that supply will keep pace with demand, putting a cap on gas prices.

US consumption of natural gas in 2019 grew by 4.2% from a year earlier to average 86 bcfd, according to latest estimates from EIA.

Natural gas consumed by the power generation sector increased nearly 7% year-over-year in 2019 to 30.98 bcfd, accounting for 36% of total domestic gas consumption. After first surpassing coal-fired generation on an annual basis in 2016, gas has been continuously making up the highest share of power generation.

The residential and commercial gas consumptions averaged 14.16 bcfd and 9.79 bcfd in 2019, respectively. They were 3.06% and 1.35% higher compared with their 2018 levels.

Natural gas consumption in the industrial sector averaged 23.27 bcfd in 2019, 1.35% higher compared with the 2018 level and accounting for about 27% of total domestic gas consumption.

US natural gas consumption in 2020 is expected to rise 1.6% from a year ago, averaging 87.21 bcfd, OGJ forecasts. This compares to annual growths of 4.2% in 2019 and 10.7% in 2018. The decrease mainly reflects expected higher winter temperatures and lower residential/commercial sector demand. Demand growth in the power sector also will be slower.

Heating degree days during January and March in 2020, based on the latest forecast of the National Oceanic and Atmospheric Administration (NOAA), are expected to be 4.38% less than last winter and 2% less than the 10-year average.

US marketed gas production and dry gas production in 2019 hit record highs of 98.98 bcfd and 92.04 bcfd, respectively. These represent growth of 10.1% and 9.85% from their year-ago levels.

Gas production in the Appalachia region climbed 12.82% in 2019 from a year ago to 32.2 bcfd, according to EIA’s Drilling Productivity Report. Permian gas production increased to 15 bcfd in 2019 from 11.48 bcfd in 2018, an increase of nearly 31%.

The US is expected to have added between 16 bcfd and 17 bcfd of natural gas pipeline capacity in 2019. More than 40% of the newly added capacity is aimed to provide additional takeaway capacity out of the Permian basin. These include Kinder Morgan’s 2 bcfd Gulf Coast Express Pipeline, which connects the Waha Hub to the Gulf Coast, and the 2.6 bcfd Valley Crossing Pipeline, which connects to the newly built Sur de Texas-Tuxpan pipeline and transports US gas to the southern Mexican state of Veracruz. The largest projects in the Northeast already completed in 2019 are Millennium Pipeline’s Eastern System Upgrade Project and Transcontinental Gas Pipeline Company’s Rivervale South to Market Project.

Gas production in the Federal Gulf of Mexico has been declining for nearly two decades. However, 18 new natural gas production fields starting in recent years are reversing the long-term decline in the region. Marketed natural gas production in the Gulf of Mexico averaged 2.73 bcfd in 2019, compared with 2.67 bcfd in 2018.

OGJ forecasts US marketed gas production to increase 3.4% in 2020. The growth rate slows down due to lower drilling activity with low gas prices as well as lower associated gas production growth.

Increases in both production and LNG exports helped make the US a net exporter of natural gas on an annual basis in 2017—for the first time in nearly 6 decades. US net gas exports averaged 4.91 bcfd in 2019, up 149% from 1.97 bcfd a year ago. OGJ expects US net gas exports to average 7.5 bcfd in 2020, as exports are supported by increased production, stable domestic consumption, newly added LNG exports facilities, and pipeline infrastructures, while imports from Canada will continue to decrease.

Total US exports of LNG in 2019 were 4.9 bcfd, 65% higher compared with 2018, amounting to around 10% of the global market. OGJ forecasts that US LNG exports will jump to 6.5 bcfd in 2020.

Cameron LNG Train 1 in Louisiana and Corpus Christi LNG Train 2 in Texas came online in the first half of 2019. The first train at Freeport LNG in Texas, and the first 10 trains at Elba Island in Georgia, have come online in the second half. These new LNG export facilities, along with the completion of Cameron LNG, will increase US LNG export capacity to 8.9 bcfd by the end of 2020 from 4.9 bcfd at the end of 2018.

Although US LNG exports have grown substantially, most US natural gas trade is transported via pipeline across shared borders with Canada and Mexico.

Natural gas demand in Mexico will continue growing with new electrical generation capacity additions. That demand will be primarily satisfied by more imports from the US. Supported by new projects such as the Texas-Tuxpan pipeline, Mexico imported 5.03 bcfd of US natural gas by pipeline during the first 9 months of 2019, compared with 4.56 bcfd for the same period in 2018.

US pipeline export capacity to Canada grew in the last few months of 2018 when the second phase of both the Rover pipeline and the new NEXUS pipeline entered service, transporting gas from the Appalachian basin to the St. Clair point. US gas exports to Canada through pipeline averaged 2.52 bcfd during the first 9 months of 2019, compared with 2.11 bcfd over the same period of 2018.

The amount of natural gas held in storage in 2019 went from a relatively low value of 1,185 bcf at the beginning of April to 3,761 bcf at the end of October because of near-record injection activity during the natural gas injection, or refill, season (April 1–October 31). Inventories as of Oct. 31 were 37 bcf higher than the previous 5-year end-of-October average and 525 bcf higher (+16%) than the same period a year ago. On Dec. 6, 2019, working stocks in underground storage amounted to 3,411 bcf, up by 618 bcf (+22%) compared with the same period a year ago.

About the Author

Conglin Xu

Managing Editor-Economics

Conglin Xu, Managing Editor-Economics, covers worldwide oil and gas market developments and macroeconomic factors, conducts analytical economic and financial research, generates estimates and forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 2012 as Senior Economics Editor.

Xu holds a PhD in International Economics from the University of California at Santa Cruz. She was a Short-term Consultant at the World Bank and Summer Intern at the International Monetary Fund.

Laura Bell-Hammer

Statistics Editor

Laura Bell-Hammer is the Statistics Editor for Oil & Gas Journal, where she has led the publication’s global data coverage and analytical reporting for more than three decades. She previously served as OGJ’s Survey Editor and had contributed to Oil & Gas Financial Journal before publication ceased in 2017. Before joining OGJ, she developed her industry foundation at Vintage Petroleum in Tulsa. Laura is a graduate of Oklahoma State University with a Bachelor of Science in Business Administration.