Rystad Energy: Operational production costs down globally, led by UK

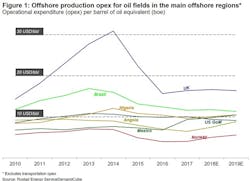

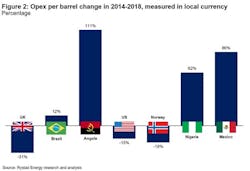

Operational production costs in the oil and gas industry have fallen across the globe, with UK emerging as a cost-cutting powerhouse among global offshore regions. A Rystad Energy analysis aimed at mitigating currency effects confirms this trend, after examining regional opex reduction per barrel, measured in local currency. The results are clear – from 2014 to 2018 the UK reduced operational production costs by 31%, followed by Norway and the US with opex reductions of 19% and 15%, respectively.

“The reduction in operating expenditure is largely the result of offshore regions – such as UK, Brazil, Nigeria, Angola, the Gulf of Mexico, and Norway – feeling the squeeze of uncertain oil prices, which in turn has driven operators and contractors to nurture operational improvements in pursuit of lower unit prices,” said Sara Sottilotta, Oilfield Service Analyst at Rystad Energy.

Secondly, with a greater focus on strategic planning, more efficient maintenance management and the increased and improved implementation of technology, opex per barrel of oil equivalent (boe) has fallen. It should be noted, however, that in times of downturn some opex reduction has historically been a consequence of maintenance deferral. This is important to bear in mind, as unplanned outages caused by equipment failure and damages have quadrupled globally since 2013.

“The UK has experienced the greatest reduction in opex per boe, falling from more than $30/bbl in 2014 to just $16/bbl in 2019. The drop is attributable to two main factors: the general increase in production, and the falling share of production from mature fields as new fields came on-stream and old fields were shut-in,” Sottilotta said.

Changing rotation cycles, the closing of older fields and lower salaries have also contributed to the reduced cost levels. A majority of UK offshore operators switched from 2-week to 3-week personnel rotations in 2015-2016, generating salary and logistics savings by reducing the number of flights required to shuttle personnel to and from offshore facilities. Still, despite this significant decrease in operational costs, the UK exhibits the highest opex per boe of all major offshore regions due to smaller field size, a fragmented operator landscape, a more mature continental shelf, and a higher number of personnel on board (POB) per produced barrel.

In absolute terms, Brazil experienced the second greatest drop in opex per boe, falling from $16 per boe in 2014 to $11 per boe in 2019. This reduction was driven primarily by a significant increase in production, especially from the giant Lula field.

Across the globe, opex per boe in Norway is among the lowest, helped by the rising exchange rate between the Norwegian Kroner (NOK) and the US dollar, which grew from an average of NOK 6.3 per $1 in 2014, to an average of NOK 8.3 per $1 in 2017. In contrast, Mexico’s operating cost per boe has risen since 2016, the result of decreasing production and an increasing share of production from mature fields.

The UK has achieved the greatest decrease in operational expenditure per production unit, even when considering expenditure in local currency (Fig. 2). Norway and US follow close behind, with each of the three leaders primarily doing business in their respective domestic currencies. It should be noted that Angola and Nigeria typically carry out operational transactions in USD. Because of this, when considering operational expenditure in local currency these countries appear to have experienced skyrocketing opex thanks to soaring local inflation, while real change in opex is likely not as great in magnitude.