NGSA forecasts record-high gas supply, demand this winter

Natural gas supply and demand are expected to reach historic highs this winter, according to the Natural Gas Supply Association in its 19th annual Winter Outlook forecast of the wholesale winter gas market.

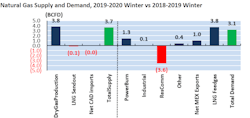

NGSA evaluates the combined impact of weather, economic growth, demand from domestic and export customers, storage inventories, supply activity, and “wild card” factors on the direction of gas prices for the winter of 2019-20 compared with last winter.

According to the forecast, record demand will be driven by LNG exports, pipeline exports to Mexico, and domestic demand growth in the electric sector. Meanwhile, record production will ably satisfy demand, and the combination of abundant supplies, warmer weather, and healthy storage is expected to result in downward pressure on gas prices compared with last winter.

“All signs point to good news for natural gas consumers this winter,” said Orlando A. Alvarez, NGSA chairman and head of BP PLC’s North American gas marketing and trading business. “The forecast for warmer weather and abundant supply in NGSA’s outlook should enable US natural gas to stay even more affordable and reliable this winter while satisfying growing demand for cleaner-burning electricity, manufacturing, and heating here and around the world.”

Demand

In total, the NGSA outlook projects customer demand to reach a record 109.3 bcfd this winter compared with last winter’s 106.2 bcfd.

The NGSA outlook projects 8.3 bcfd in LNG exports and 5.8 bcfd in pipeline exports to Mexico this winter, for a record 14.1 bcfd in US gas exports—an overall increase of 52% compared with last winter.

The anticipated increase in gas flow via the Mexico Sur de Texas-Tuxpan pipeline is expected to increase gas demand in South Texas since late September. In terms of LNG, three new trains—Elba Island Phase 2 (0.1 bcfd), Freeport Train 2 (0.7 bcfd), and Cameron Train 2 (0.7 bcfd)—are expected to start up this winter, bringing total LNG export capacity to 8.5 bcfd by March 2020.

NGSA forecasts a combined domestic demand of 87.9 bcfd this winter, from the electric, industrial, and residential and commercial sectors. Gas-fired electric power generation will represent the greatest contributor to US demand growth this winter. About 7,000 Mw of gas-fired generation are estimated to have come online this year, contributing to electricity demand of 27 bcfd—about a 5% increase compared with last winter.

Industrial gas usage is expected to rise minimally this winter, by about 0.1 bcfd, as the result of a slowing global economy and business uncertainty about the impact of tariffs. However newbuilds and capacity expansions in the gas-intensive petrochemical and fertilizer industries continue to contribute to the industrial sector’s demand for gas. According to NGSA, 47 major gas-intensive projects are planned over the 2018-23 time period, consuming an estimated 2 bcfd more of gas annually by 2023.

Residential and commercial demand is expected to decrease by 2 bcfd, as the National Oceanic and Atmospheric Administration’s (NOAA) forecast that this winter is 4% warmer than last winter.

Supply

In total, NGSA’s outlook projects gas supply (production, Canadian imports, and storage) to average a record 109 bcfd this winter.

Dry gas production is forecasted to average 92 bcfd this winter, which will represent 3.8 bcfd (~4%) of growth winter-over-winter. However, it pales in comparison to the remarkable increase of more than 10 bcfd that occurred last winter.

This winter, associated gas production from the Permian will contribute to the largest gain since production is likely to ramp up quickly as the 2 bcfd Gulf Coast Express pipeline and cross-border Mexico export pipelines are currently commissioning or recently entered service. Elsewhere, production from the Marcellus, Utica, Haynesville shales will grow further to meet regional demand and fill takeaway capacity.

Gas storage is expected to enter winter near the 5-year average with about 3.7 tcf, considerably more than last winter’s 3.2 bcf levels. Production growth is expected to respond quickly to demand gains, resulting in lower-than-average storage withdrawals for the coming winter.

Expected gross domestic product growth is 2.1%, which is similar to last winter’s 2.6% and represents neutral pressure to gas prices.