Permian basin gas operators seek flexible options for processing

Ben Owens

Honeywell UOP LLC

Des Plaines, Ill.

As the largest and fastest-growing oil production region in the world, the Permian basin is producing sufficient associated gas to shift both the US energy landscape and the global market.

With increasing demand for ethane, Permian basin operators have sought new technologies to boost ethane supply, specifically processing systems designed to maximize NGL recovery while allowing the operator to switch between ethane recovery and full or partial ethane rejection while simultaneously lowering energy requirements.

As part of its plan to expand gas processing, an operator in the Permian basin compared the gas subcooled process (GSP) traditionally used by US operators to Honeywell UOP LLC’s supplemental rectification with reflux (SRX) process. The comparison concluded that the SRX process enabled extraction of the highest level of propane and heavier components (propane+) while retaining both flexibility of NGL recovery in either ethane rejection or recovery modes and high-energy efficiency.Background

Led by the Permian basin, the shale revolution has restored the US as the world’s leading oil producer and catapulted into position as a top-tier LNG producer. US shale, once viewed as a high-cost resource, is becoming a competitive global reserve where costs have been driven down by technology innovations.

Today’s midstream gas processing market has shifted away from “fast gas,” in which the primary value was derived from bringing gas processing plants online quickly to optimize internal rates of returns and towards flexible, low-cost production.

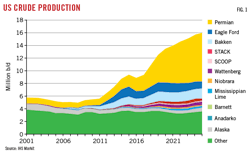

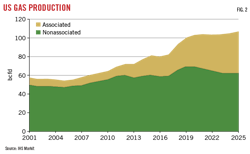

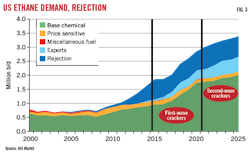

In a recent study, IHS Markit said it expects 45% production growth of NGLs in the US over the next 5 years, with total production to reach nearly 6 million bbl by 2023. The Permian basin is the most profitable US shale basin with the largest inventory of low-cost wells. Permian wells are profitable at West Texas Intermediate (WTI) pricing as low as $45/bbl. Permian oil production exceeded 4 million bbl in March 2019 and remains above that level. Drilling in the region has focused on oil with large volumes of associated gas often rich in NGL (Fig. 1). Associated gas’s volume and pricing have enabled both the subsequent petrochemical renaissance and the emergence of the US as a global LNG player (Fig. 2).Ethane is an ideal petrochemical feedstock but can often bottleneck higher-value liquids recovery due to pipeline capacity constraints. The investment in cost-competitive ethane crackers domestically and the ability to export ethane internationally are increasing the demand for liquid ethane (Fig. 3). Ethane, however, remains the swing NGL, and pricing continues to be volatile, driven up by the petrochemical renaissance but held back due to value relative to other liquids and transportation constraints. Ethane price volatility lends itself to flexible gas plants that can realize optimal recovery for maximized returns (ethane rejection or ethane recovery modes).

Due to the Permian’s proximity to the Gulf of Mexico and associated petrochemical complexes, flexibility to operate in either ethane rejection and recovery mode while maximizing propane+ recovery and energy efficiency is critical.

Midstream technology shift

As the US midstream gas processing market consolidates and matures, a technology shift is occurring in natural gas processing plants, which are focusing on higher recoveries with more operational flexibility and lower compression-energy requirements. These plants increasingly are shifting to NGL recovery solutions that efficiently shift between ethane recovery and rejection, enabling operators to maximize their profits with volatile ethane pricing. This is especially the case as operators look holistically at products flowing from the well.

Volatility in the price of ethane creates profit opportunities for flexible gas processors. High volatility requires that swings in ethane rejection or recovery adjust to changes in netback value. At the same time, operators require full recovery of propane and high-energy efficiency to maximize profits during ethane rejection.

The bulk of US-installed gas processing capacity uses GSP technology developed in the 1970s by Ortloff Engineers Ltd., Midland, Tex., which—as an already longtime partner—Honeywell UOP acquired in 2018 to become a key part of its gas processing business.

While for decades the standard practice for US gas processors has been to use GSP technology—which uses modularization to enable “fast gas”—GSP’s use amid rising demand and production of NGLs has caused a major loss of valuable propane in rejection mode and has prevented recovery of high levels of ethane.

Permian basin study

As a result of GSP’s lack of flexibility as well as its limited ability to recover all NGLs, an operator in the Permian basin seeking to select a processing technology for its operations conducted a study comparing traditional GSP technology to Honeywell UOP’s suite of SRX technologies. The technologies were applied in a wet gas field containing large volumes of high-btu gas. The selected wet gas play—the economics of which are driven by low-cost oil but also have the benefits of additional, valuable NGLs—represented a typical field found in the Permian basin region.

Alongside GSP and SRX, other technologies tested in the study also included the following Honeywell UOP and Ortloff-patented processes: supplemental rectification with compression (SRC), supplemental rectification process (SRP), single column overhead recycle (SCORE), and recycle split vapor (RSV).

The purpose of the study was to evaluate solutions that could maximize ethane recovery flexibility, improve propane+ recoveries, and minimize energy consumption with the goal of improving return on capital in a volatile ethane price environment.

Based on results of the study, SRX technology—which incorporates ways to efficiently create reflux, enabling the process to achieve any level of ethane recovery while maintaining ultrahigh recovery of propane+—reached ultrahigh recovery rates, achieving nearly total ethane recovery while in recovery mode. When operating in full ethane rejection, SRX technology also maintained full recovery of NGL products with lower energy consumption (Table 1).

In rejection mode, SRX technology continued to recovery nearly all propane+ with 24% less energy, while GSP only recovered 87% of propane+ with no reduction in energy (Table 2). If the GSP plant was not constrained by energy consumption the system could have recovered up to 95.5% of propane+; however, energy consumption would have increased by 21% above recovery mode operations. In rejection mode, SRX used 24% less compression than GSP while still recovering more propane+.

As determined by the study, SRX cryogenic facility’s flexibility allowed the operator to capitalize on ethane recovery and rejection since the technology enabled the operator to adjust ethane recovery to match demand and manage across the entire ethane recovery range while sustaining NGL recovery. SRX further maximized processing economics via lower energy consumption and higher propane recoveries during rejection.Technology options

Following the study, Honeywell UOP is deploying SRX technology throughout the Permian basin. Alongside new SRX capacity being added in increments of up to 300 MMcfd, Honeywell UOP also is implementing modular solutions to retrofit existing GSP units to near-SRX performance. The modular execution of these projects is streamlining overall project schedules and enabling the units to be customized for the unique gas composition in the region.

As part of their plans to ensure long-term profitability and competitiveness, some operators also are opting to address other common challenges—including unplanned downtime, underperformance of assets, management of human capital, and adherence to emission regulations—by coimplementing SRX technology with Honeywell UOP’s Connected Plant Services (CPS), a cloud-based service that monitors, predicts, and improves plant performance by connecting plant data with Honeywell UOP analytical expertise. As part of the package, Honeywell UOP works with operators to address complex interactions within the process; identify leading indicators or potential issues that might cause downtime; determine adjustments needed as feeds change or as economics shift; provide actionable information to employees; and meet energy and emission regulations.

With implementation of SRX technology and CPS projects still in the early stages, detailed results of these projects will be forthcoming.

The author

Ben Owens ([email protected]) is vice-president and general manager of Honeywell UOP LLC’s gas processing technologies business. Previously, he served as vice-president and chief commercial officer at Honeywell Performance Materials & Technologies as well as vice president and chief marketing officer for Honeywell Industrial Safety. He also has held roles across Honeywell in strategic and product marketing, acquisitions and integrations, commercial excellence, and operations management. Before joining Honeywell, Owens served in the US Army as a captain and infantry officer, where he was awarded the Bronze Star Medal for meritorious service. He holds a BS (2003) in mechanical engineering from the United States Military Academy at West Point, NY, and an MBA (2017) from the University of Texas at Austin.