Permian basin operators cut drilling time, lower expense

Permian basin operators are focused on cutting costs while increasing production for 2019 through operational efficiencies, including faster drilling, multiwell pads, longer laterals, and improved completion designs.

Covering 75,000 sq miles in West Texas and Southeast New Mexico, the Permian is the most prolific US oil-producing basin. The US Energy Information Administration’s Drilling Productivity Report forecast Permian production will reach 4.17 million b/d of oil and 14.4 bcfd of gas during June 2019.

Although the Permian has produced for decades, horizontal drilling and hydraulic fracturing contribute to current higher production and higher resource estimates. The Permian includes Midland, Delaware, and Central basins.

The US Geological Survey estimates undiscoverable, technically recoverable resources in the Wolfcamp shale and Bone Spring formation of the Delaware basin in Texas and New Mexico at 46.3 billion bbl of oil, 281 tcf of natural gas, and 20 billion bbl of NGL.1

The Delaware contains Pennsylvania, Wolfcamp, and Leonard sediments. The eastern Delaware basin includes laminated siltstone and sandstone, and carbonate deposits. The Leonard covers upper and lower Avalon shale as well as the First, Second, and Third Bone Spring formations.

The Wolfcamp is divided into Wolfcamp A, B, C, and D, depending on landing zones of horizontal wells. The Wolfcamp shale is deposited as shallow water carbonates, interbedded fine-grain organic-rich siliciclastic mud with organic-poor, clay-rich mud.

The USGS has estimated mean resources of 4.2 billion bbl of oil and 3.1 tcf of gas in the Spraberry formation of the Midland basin within the Texas portion of the Permian.2Majors in Permian

Two majors in March 2019 announced long-term Permian production goals.

ExxonMobil Corp. plans to increase its Permian production to 1 million boe/d by 2024, an 80% increase of its current production in West Texas and southeastern New Mexico. Executives anticipate Delaware basin will account for much of the increase.

The company estimates its Permian resource base at 10 billion boe, saying that estimate is likely to grow with ongoing development activities.

First-quarter 2019 results showed ExxonMobil’s companywide production at 4 million boe/d, up 2% from first-quarter 2018. Upstream liquids production grew by 5% total, which executives attributed largely to Permian production growth.

ExxonMobil did not break out production numbers for specific basins. The company estimates an average return of 10% at $35/bbl oil for its Permian production. ExxonMobil plans to end 2019 with 55 rigs working in the Permian.

The company’s strategy involves multiwell pads connected to gathering systems, which cut development costs and accelerate production growth.

ExxonMobil plans construction at 30 Permian sites to enhance processing, water handling, and ensure takeaway capacity, including central delivery points designed to handle up to 600,000 b/d of oil and 1 bcfd of gas.

The company plans to enhance water-handling capacity by using 350 miles of existing pipeline.

Chevron Corp., meanwhile, set a production goal of 900,000 b/d from the Permian by Dec. 31, 2023, up from its previous goal of 650,000 b/d by Dec. 31, 2022.

Production increases from the Permian contributed to Chevron’s overall net first-quarter production of 884,000 boe/d, up 151,000 boe/d from first-quarter 2018, executives said. They did not specify output for the Permian alone.

Chevon shut in some Permian gas production during first-quarter 2019 because of price weakness, Chief Executive Officer (CEO) Mike Wirth said on the company’s earnings call. The company’s current production mix in the Permian is about 75% liquids and 25% gas.

The company did not specify how much Permian gas production was shut in.

“I know things have been pretty ugly lately... sometimes it’s better to just keep that gas in the ground for a better market,” Wirth said, adding that Chevron has avoided gas flaring, a practice that has become increasingly widespread in the Permian.Apache, EOG updates

Apache Corp. of Houston reported its first-quarter Permian oil and gas production accounted for 248,000 boe/d, about half of the firm’s overall production.

John Christmann, Apache CEO, said Apache is moving predominantly into pad development.

Second-quarter Permian oil production likely will drop slightly because of the timing of completions, Apache executives said. But completions will increase in the second half with Apache’s 2019 Permian oil production expected to be up 5% from 2018.

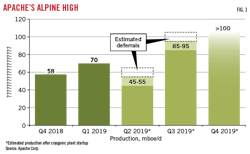

Previously, Apache emphasized the potential of its Alpine High natural gas play, but Apache temporarily deferred some production starting in March 2019 because of low gas prices. Alpine High is in the southern Delaware basin, primarily Reeves County, Tex.

Fig. 1 shows Apache’s anticipated increased Alpine High production in second-half 2019 following the May startup of Altus Midstream’s first cryogenic plant. Apache and Kayne Anderson Acquisition Corp. formed Altus in 2018.

Clay Bretches, Altus CEO, said the company’s first cryogenic processing plant was mechanically complete and on budget. The second plant is scheduled to be fully online during July with the third plant scheduled for fourth-quarter 2019.

Timothy Sullivan, Apache executive vice-president (EVP) operations support, said Apache has begun evaluating multiwell pads in Alpine High.

For example, Apache ran spacing and pattern tests on two rich-gas pads in adjacent sections on Alpine High’s Northern Flank. Crews adjusted horizontal spacing between wells, studied the vertical location within target zones, and improved hydraulic fracturing designs.

“At Alpine High, we brought on line 17 wells with the primary focus on rich gas,” Sullivan said of the first quarter.

Since 2017 to first-quarter 2019, Apache reduced Alpine High drilling costs per foot by 20%, Sullivan said. Apache cut its Alpine High completions costs by 30% per lateral foot during that same period.

He noted cost improvements came with what he called “a modest increase” in average lateral length. Fewer wells mean less expense for Apache elsewhere in the Permian where it drills oil wells.

“Our primary activity in the first quarter was an 8-well Wolfcamp B pad at Powell and a 6-well Lower Spraberry pad at Wildfire,” Sullivan said of the Midland basin.Six wells on the Mont Blanc pad producing from the Woodford A and Woodford B formations achieved 150-day gross cumulative production of 10.5 bcf of rich gas compared with 9.7 bcf production for the same time from an eight-well Blackfoot pad in the same formations.

“With two fewer wells, the Mont Blanc pad has not only outperformed but has also realized cost savings of $12.7 million as a result of fewer well bores,” Sullivan said.

EOG Resources Inc. of Houston said Delaware basin is among its fast-growing production assets. The table outlines play details for EOG’s 400,000 acres net in Delaware basin.

Ezra Yacob, EOG EVP for exploration and production, said EOG drilled and completed 78 gross wells across six Delaware targets during first-quarter 2019 using 18 rigs and seven completion crews.

That was one fewer rig and completion crew than it used in first-quarter 2018 to bring 70 wells on stream.

In the Delaware’s Wolfcamp, EOG said 58 wells brought to sales in the first quarter averaged 1,925 boe/d for the first 30 days, delivering less than a $9/boe direct finding and development cost.

EOG brought nine wells onstream in the Bone Spring, producing an average of 1,645 boe/d in the first 30 days. The company brought three wells on stream in the Leonard where average 30-day rates were well over 2,400 boe/d on 4,300-ft laterals.

Yacob said EOG constantly studies individual plays to determine the most efficient number of wells to drill and complete together as a package, particularly in stacked pays such as Delaware basin.

Each play has an optimum number of wells that both captures operational efficiencies and minimizes parent-child well productivity effects, he said.

“Our Delaware basin team…has achieved a 24% increase in stages per month per completion crew,” Yacob said, adding the use of local sand for fracturing and recycling produced water also helped cut costs.

The State Magellan 722H-28H wells in the over-pressured Wolfcamp oil window of Loving County, Tex., was an example of a seven-well drilling package where the wells were spaced 500-ft apart.

EOG reported 4,700-ft lateral wells produced 2,200 boe/d on average for the first 30-days of production. Crews completed 157 stages total on the group of seven wells and pumped more than 80 million lb of sand over 14 days.

Marathon Oil Corp. President and CEO Lee Tillman said the northern Delaware remains “still very much at that early, early phrase” with Marathon still learning about the play.

Tillman said Marathon’s northern Delaware team advanced to multi-well pad drilling “at a very rapid pace… There is a lot of delineation left to do there, it’s a big footprint.”

During the first quarter, Marathon drilled 15 company-operated wells in the Delaware, reporting a 30-day initial production (IP) rate of 1,815 boe/d (65% oil).

Marathon’s overall first-quarter northern Delaware production averaged 26,000 net boe/d.

The company reported early development and delineation drilling across both the Malaga and Red Hills areas. In Malaga, a four-well pad targeted the Bone Spring, Upper Wolfcamp, and Lower Wolfcamp. Marathon reported a 30-day IP of 2,830 boe/d (62% oil).

Other independents

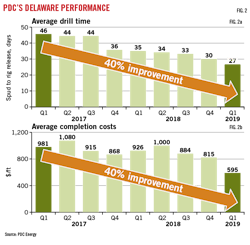

PDC Energy Inc. of Denver reported faster drill times and lower completion costs in Delaware basin where it spudded 10 wells in the first quarter with average working interests of 96%.

The wells were mid- or extended-reach laterals with average well costs 5% below budget, attributed to a 7-day improvement in spud-to-rig release drill times compared to its 2019 budget.

Fig. 2a shows PDC reduced its drill days by 40% in early 2019 since 2017 and Fig. 2b shows completion costs also fell 40%.

PDC Energy’s first-quarter included nine Delaware Basin turn-in-lines, including the extended-reach lateral Argentine S5, PDC’s first Bone Spring well. As of May 1, Argentine S5 had yet to reach a peak 30-day IP but averaged 190 Boe/d per 1,000 ft. Production was 70% oil.

Bart Brookman, PDC president and CEO, said PDC agreed to sell its Permian Basin gas and water midstream assets on May 1 in two separate agreements.

EagleClaw Midstream agreed to buy PDC’s gas-related midstream assets for $182 million. WaterBridge Resources LLC plans to pay $125 million for PDC’s water-related midstream assets. PDC retained operational control of its fresh water supply.

Rosehill Resources Inc. in April brought six wells on stream in the Southern Delaware with electric submersible pumps (ESPs) with average peak rates of 1,152 boe/d in the 24-hr IP, of which 91% was oil.

Improved efficiencies in the Southern Delaware reduced drilling times to 14.7 days/well in the first quarter, down 31% from full-year 2018. Rosehill also reduced costs for a 1-mile Southern Delaware well to $6.9 million/well compared to $8 million/well in 2018.

“We recently drilled our first 2-mile lateral in just 14 days,” David French, Rosehill’s president and CEO, said.

Devon Energy Corp. of Oklahoma City produces both oil and gas from 280,000 acreas in Delaware basin.

Executives say Devon plans to spend an estimated $900 million on the basin during 2019 with a focus on the oil-rich Delaware, Leonard, Bone Spring, and Wolfcamp formations. First-quarter Delaware production was 107,000 boe/d.

Devon ran 11 rigs in Delaware basin supported by two dedicated frac crews. Plans call for 125 wells to be spudded in 2019 with more than 100 wells to be brought on stream this year.

Devon is developing stacked pay resources in its core areas named Potato, Todd, Cotton Draw, Rattlesnake, and Thistle.

During first-quarter activities around Todd, crews drilled five wells targeting a second Bone Spring interval in southwest Lea County, NM. The five wells averaged 24-hr IP of 10,000 boe/d per well of which 80% was oil.

In the Wolfcamp, Devon is focused on its Rattlesnake area where nine wells came on stream with 30-day IP of 3,200 boe/d per well. The wells are in Lea County, NM.

Pure-play Permian

Diamondback’s Energy Inc. reported first-quarter 2019 production at 262.6 Mboe/d (68% oil), up from 102.6 Mboe/d in first-quarter 2018 and 182.8 Mboe/d in fourth-quarter 2018.

During first-quarter 2019, Diamondback drilled 83 gross horizontal wells and turned 82 operated horizontal wells to production. The average lateral length for those wells was 9,630 ft.

Diamondback’s first-quarter completions for wells it operates included 39 Wolfcamp A wells, 23 Lower Spraberry wells, 12 Wolfcamp B wells, four Third Bone Springs wells, two Second Bone Springs wells, and two Middle Spraberry wells.

Diamondback completed two Wolfcamp A wells with an average lateral length of 7,611 ft. These wells commenced production with an average peak IP 30-day 2-stream of 197 boe/d per 1,000 ft (79% oil).

In the Northern Delaware, Diamondback completed a two-well pad targeting the Wolfcamp A and the Wolfcamp B with an average lateral length of 9,752 ft. The Wolfcamp A well, the Deguello 54-7-2 A 601H, had a peak 30-day IP rate of 298 boe/d per 1,000 ft (69% oil) with the Wolfcamp B well producing 149 boe/d per 1,000 ft (67% oil) over the same period.

Parsley Energy Inc. of Austin, Tex., brought nine wells on stream in the Delaware, comprised of four pads in the Texas counties of Pecos and Reeves. All were 2-mile lateral wells reporting 24-hr IP oil rates of more than 1,400 b/d.

Parsley said its first completion using local sand saved more than $500,000/well compared with sand delivered from elsewhere. The company plans additional local sand tests in Delaware basin.

Executives said Parsley’s completion activity was weighted toward Midland basin, where crews placed on production 25 gross operated horizontal wells. Parsley expects that development activity will be more heavily weighted to Midland basin throughout 2019.

Parsley’s working interest in Permian wells placed on production was 93% with an average completed lateral length of 10,100 ft.

Concho Resources Inc. of Midland, Tex., as of Apr. 30 ran 20 rigs in Delaware basin and nine in Midland basin. Additionally, Concho used eight completion crews at that time.

In Delaware basin, excluding the New Mexico shelf, Concho added 23 wells with at least 60 days of first-quarter production. The average 30-day and 60-day peak rates for these wells was 1,817 boe/d (73% oil) and 1,647 boe/d (72% oil) respectively. Average lateral length was 9,125 ft.

In the Midland, Concho added 27 wells with at least 60 days of first-quarter production. Average 30-day and 60-day peak rates for these wells were 986 boe/d (86% oil) and 879 boe/d (85% oil), respectively. Average lateral length was 10,379 ft.References

1. Gaswirth, S., French, K., Pitman, J., Marra, K., Mercier, T., Leathers-Miller, H., Schenk, C., Tennyson, M., Woodall, C.., Brownfield, M., Finn, T., and Le, P., “Assessment of undiscovered continuous oil and gas resources in the Wolfcamp Shale and Bone Spring Formation of the Delaware Basin, Permian Basin Province, New Mexico and Texas,” US Geological Survey Fact Sheet 2018-3073.

2. Marra, K., Gaswirth, S., Schenk, C., Leathers-Miller, H., Klett, T., Mercier T., Le, A., Tennyson M., Finn T., Hawkins, S., and Brownfield M., “Assessment of undiscovered oil and gas resources in the Spraberry Formation of the Midland Basin, Permian Basin Province, Texas,” US Geological Survey Fact Sheet 2017-3029.

About the Author

Paula Dittrick

Senior Staff Writer

Paula Dittrick has covered oil and gas from Houston for more than 20 years. Starting in May 2007, she developed a health, safety, and environment beat for Oil & Gas Journal. Dittrick is familiar with the industry’s financial aspects. She also monitors issues associated with carbon sequestration and renewable energy.

Dittrick joined OGJ in February 2001. Previously, she worked for Dow Jones and United Press International. She began writing about oil and gas as UPI’s West Texas bureau chief during the 1980s. She earned a Bachelor’s of Science degree in journalism from the University of Nebraska in 1974.