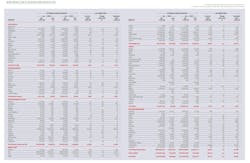

OGJ survey reveals increase in global oil & gas gas reserves

By end-2025, global proven oil reserves are projected to reach 1,773 billion bbl, up from 1,757 billion bbl the previous year, based on the preliminary annual assessment from Oil & Gas Journal (OGJ). Global proven natural gas reserves are estimated at 7,743 trillion cubic feet (tcf), compared with 7,677 tcf reported in the previous survey.

OGJ’s reserve figures rely on survey responses and official updates released by individual countries, many of which are not provided every year. OGJ changes its estimate for a country only when it receives evidence that a change is in order. Therefore, in a given reserve summary, a year-to-year change—or lack thereof—may not necessarily reflect a change that applies to the calendar year alone.

OGJ’s figures for oil reserves and production increasingly include natural gas liquids (NGLs). Some countries’ gas reserves refer to dry gas reserves after moving NGL reserves into oil reserves.

When raw oil data are reported in metric tonnes, OGJ converts the data to barrels (bbl) using conversion factors recommended by the International Energy Agency (IEA) for individual countries.

Meantime, OGJ forecasts global oil (including crude oil, condensate, and NGLs) production in 2025 to average 98.75 million b/d, compared with 96.26 million b/d in 2024.

Reserves changes

China has not yet published official 2025 proved oil and natural gas reserve figures. However, state media reporting suggests additions of around 1 billion tonnes of crude oil reserves and 1 trillion cu m of natural gas reserves, subject to revision once full reporting is released.

Australia’s most recent proven reserves update remains the 2019 assessment published in 2021 by Geoscience Australia. Proven oil reserves were 1.8 billion bbl in 2019, down from 2.45 billion bbl in 2015. Proven natural gas reserves were 96.5 tcf, down from 114 tcf in the prior assessment. No newer proven-reserves update has been issued, although 2P figures continue to be published.

According to Indonesia’s Ministry of Energy and Mineral Resources, the country’s proven oil reserves were 2.29 billion bbl as of January 2024, down from 2.41 billion bbl in January 2023. Proven natural gas reserves declined to 33.84 tcf from 35.3 tcf a year earlier.

India’s Ministry of Petroleum and Natural Gas reports crude oil reserves of 671.4 million tonnes as of April 2024, up slightly from 669.5 million tonnes a year earlier. The Western Offshore region is the largest contributor, accounting for 31.8% of the total reserves, with notable contributions from Assam, Rajasthan, and Gujarat. India's natural gas reserves were 1,094.2 billion cu m (bcm), down from 1,141.7 bcm a year earlier.

Pakistan’s oil and gas reserves improved in first-half 2025, according to the latest data release by Pakistan Petroleum Information Service (PPIS). Oil reserves increased by 3% from December 2024 to reach 239.6 million bbl by June 2025, while gas reserves grew by 5% to 19.0 tcf. This growth was driven by new discoveries in Waziristan and additions at existing fields, led mainly by Mari Energies Ltd. Some declines at other operators partially offset the gains.

New Zealand’s remaining reserves declined over the year. As of January 2025, the country’s remaining reserves were estimated at 31.0 million bbl of crude oil and condensate, 569,650 tonnes of LPG, and 746.7 bcf of natural gas. A year earlier, these figures were 38.3 million bbl, 965,000 tonnes, and 1,037 bcf, respectively. About two-thirds of the natural gas decrease was due to downward revisions in field estimates rather than production alone.

Across Western Europe, both oil and gas reserves decreased, mainly due to declines in Norway. The latest annual resource report from the Norwegian Offshore Directorate shows that Norway’s proven oil reserves at yearend 2024 were 5.92 billion bbl, down from 6.91 billion bbl a year prior and 7.64 billion bbl at yearend 2022. Norway’s natural gas reserves at yearend 2024 declined to 44.5 tcf from 48.24 tcf at yearend 2023 and 51.87 tcf at yearend 2022.

The UK’s proven oil reserves declined to 1.3 billion bbl at yearend 2024 from 1.5 billion bbl a year prior, according to the latest data from the North Sea Transition Authority (formerly the UK Oil & Gas Authority). Proven natural gas reserves declined to 0.6 billion bbl of oil equivalent (boe) from 0.7 billion boe for the previous year.

According to the Danish Energy Agency, Denmark’s estimated oil reserves decreased to 53 million cu m as of January 2025 from 58 million cu m as of January 2024. Natural gas reserves increased to 1,201 bcf as of January 2025 from 1,130 bcf in early 2024.

As reported by France's Directorate General for Energy and Climate (DGEC), the country's estimated crude oil reserves fell to 7.4 million tonnes as of Jan. 1, 2025, down from 9.1 million tonnes the previous year. This marks a decrease of about 19% year-on-year.

Meanwhile, reserves of NGLs remained stable at an estimated 1.4 million cu m as of Jan. 1, 2025. In contrast, France's natural gas reserves experienced a significant decline, dropping to 5.7 billion cu m in January 2025 from 16.4 billion cu m at the beginning of 2024, a nearly 65% decrease, probably due to reclassification.

Germany’s proven gas reserves increased to 795 bcf at yearend 2024 from about 632 bcf at end-2023, mainly reflecting updated reserve estimates in the Elbe-Weser and Weser-Ems regions.

According to the latest estimates from Natural Resources Canada (NRCan) in the Energy Fact Book 2025–2026, as of Jan. 1, 2024, Canada’s proven marketable natural gas reserves totaled 196.4 tcf and crude oil reserves were 170 billion bbl. These figures are derived from the most recent publicly available data as of August 2025. Since the final evaluation results of Alberta's oil and gas reserves by McDaniel & Associates have not yet been released, Alberta's portion has been estimated using preliminary valuation data and guidance from the Alberta Energy Regulator.

Brazil's proven oil reserves were declared at 16.84 billion bbl by end-2024, up from 15.89 billion bbl at yearend 2023, according to the Brazilian National Agency of Petroleum, Natural Gas and Biofuels (ANP). Búzios, Tupi, and Raia Manta fields contributed the most to the increase. Proven natural gas reserves were 19.28 tcf at yearend 2024, up from 18.26 tcf and 14.35 tcf recorded in 2023 and 2022, respectively.

Argentina's latest estimated proved oil reserves totaled 3.09 billion bbl in 2024, up from 3 billion bbl a year ago, according to the Argentine Institute of Oil and Gas. Proved gas reserves reached 19.29 tcf, rising from 17.15 tcf a year ago. Argentina’s proven oil and gas reserves have continued to increase in recent years, driven primarily by the expansion of shale development in the Vaca Muerta formation.

As of press time, Pemex had not updated Mexico's reserve data.

In the Middle East area, Oman’s crude oil and condensate reserves totaled 4.82 billion bbl at yearend 2024, down from the 4.97 billion bbl reported in the previous year. The estimated natural gas reserves at yearend 2024 amounted to 23.3 tcf, up slightly from the previous year’s 23 tcf.

OPEC reserves

The reserves figures reported for OPEC members are referenced from the organization’s latest (2025) annual statistical bulletin.

OPEC’s collective proven crude oil reserves stood at 1,241.5 billion bbl in 2024, a slight increase from the previous year. Venezuela, Saudi Arabia, and Iran remain the top three holders, together accounting for over 60% of total OPEC reserves. Venezuela holds 303.2 billion bbl, followed closely by Saudi Arabia at 267.2 billion bbl, and Iran with 208.6 billion bbl.

In 2024, OPEC's total proven natural gas reserves reached about 2,665 tcf, showing a slight increase compared with the previous year. Iran continues to hold a dominant position, possessing nearly half of all gas reserves within OPEC.

US reserves

The US Energy Information Administration (EIA) provides reports on US petroleum and natural gas reserves. Its latest US Crude Oil and Natural Gas Proved Reserves report, covering data for yearend 2023, indicates a decline in both crude oil and natural gas reserves from the previous year due to lower commodity prices.

Crude oil and lease condensate reserves decreased by 3.9% to 46.4 billion bbl. Natural gas reserves fell by 12.6% to 603.6 tcf, the first annual decrease in US natural gas reserves since 2020.

North Dakota experienced a 12.3% decrease in crude oil and lease condensate reserves, marking the largest annual decline (611 million bbl) reported among all states. Alaska followed with the second-largest decline, seeing an 11.4% drop equivalent to 384 million bbl. In contrast, New Mexico recorded a 6.1% increase in crude oil and lease condensate proved reserves, the largest net gain for the year at 380 million bbl. Alaska's natural gas proved reserves fell by 22.7%, representing the most significant annual decline among all states.

Meantime, according to EIA’s estimates, proved reserves of dry natural gas in the US decreased to 566.28 tcf in 2023 from an estimated 653.15 tcf in 2022. Additionally, the proved reserves of natural gas plant liquids (NGPLs) decreased to 32.22 billion bbl in 2023 from 32.58 billion bbl in 2022.

EIA is scheduled to update yearend 2024 estimates of proved reserves in June 2026.

World oil production

Global oil production is forecast to rise by about 2.6% in 2025, averaging 98.75 million b/d, compared with an estimated 96.26 million b/d in 2024.

OPEC's oil supply for 2025 is forecast to average 33.78 million b/d, an increase from 32.59 million b/d in 2024. This growth is attributed to the phasing out of voluntary production cuts. Specifically, Saudi Arabia's output is anticipated to climb to nearly 11 million b/d in 2025, up from 10.6 million b/d in 2024. Additionally, significant production increases are expected from the UAE, Nigeria, Kuwait, Libya, and Venezuela.

Non-OPEC oil supply is forecast to increase by about 2%. Much of the increase is expected to come from the Western Hemisphere, led by the US, Brazil, Canada, Guyana, and Argentina.

The US continues to lead global supply growth, reaching 20.85 million b/d in 2025, with both crude and NGLs reaching all-time highs. Productivity improvements continue to be most evident in the Permian basin.

Canada's oil production is projected to rise by 3%, surpassing 6 million b/d. This growth is driven by enhanced flow capacity from the Trans Mountain Expansion (TMX), ongoing project expansions, and improved efficiency, partly offset by maintenance and shut-ins caused by wildfires. Canadian oil sands production is anticipated to hit a record high in 2025. In the Atlantic offshore region, both Equinor and ExxonMobil are actively drilling new exploration wells.

Brazil's production growth faced challenges last year due to regulatory labor issues and several months of unplanned downtime. However, in 2025, the country is expected to see a 10% increase, reaching 3.76 million b/d, supported by continued ramp-up of floating production storage and offloading units (FPSOs) capacity. Argentina's 2025 oil production also shows a significant increase, driven by the Vaca Muerta shale play.

Guyana is forecast to boost output by 15% to 710,000 b/d in 2025 from 618,000 b/d in 2024. Growth has been driven solely by the ExxonMobil-led consortium's development of the rich Stabroek block, supported by favorable fiscal terms and a supportive government. All of Guyana’s crude production is exported, predominantly to the Atlantic Basin.

Kazakhstan is expected to post a significant 14% increase to 2.17 million b/d in 2025 as production ramps up from Chevron-led Tengiz field. Meanwhile, Russia’s output is expected to decline slightly, reflecting the combined effects of sanctions, export restrictions, and Ukrainian attacks on infrastructure.

In Asia-Pacific, oil supply is forecast to rise by about 1%, led by China, which is expected to reach over 4.3 million b/d in 2025, supported by continued investment in new and mature basin revitalization and offshore developments operated by CNOOC, which continues expanding deepwater capacity in the South China Sea. Production in Malaysia and Indonesia is expected to remain broadly steady, while Australia is likely to see a decline due to the depletion of legacy offshore fields.

Production in Western Europe is expected to increase by 3.5%, thanks to gains in Norway. Norway's oil production is projected to increase by around 3% in 2025 compared with 2024, driven by new fields coming online, most notably, the 220,0000-b/d Johan Castberg field. Türkiye and the UK are also expected to experience growth.

About the Author

Conglin Xu

Managing Editor-Economics

Conglin Xu, Managing Editor-Economics, covers worldwide oil and gas market developments and macroeconomic factors, conducts analytical economic and financial research, generates estimates and forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 2012 as Senior Economics Editor.

Xu holds a PhD in International Economics from the University of California at Santa Cruz. She was a Short-term Consultant at the World Bank and Summer Intern at the International Monetary Fund.

Laura Bell-Hammer

Statistics Editor

Laura Bell-Hammer is the Statistics Editor for Oil & Gas Journal, where she has led the publication’s global data coverage and analytical reporting for more than three decades. She previously served as OGJ’s Survey Editor and had contributed to Oil & Gas Financial Journal before publication ceased in 2017. Before joining OGJ, she developed her industry foundation at Vintage Petroleum in Tulsa. Laura is a graduate of Oklahoma State University with a Bachelor of Science in Business Administration.