SEC, industry discussion illuminates reserves reporting issues

A recent industry meeting that attempted to clarify US Securities and Exchange Commission (SEC) reserves definitions focused on reservoir formation data and wireline flow testers as a substitute for full production tests, application of seismic to determine downdip hydrocarbon limits, pressure testing to determine gas-water contacts, and oil prices to use in nontraditional fiscal and operating schemes.

The unprecedented interest in petroleum reserves reporting issues coupled with expectations of increased surveillance and enforcement by the SEC drew a record audience to the Society of Petroleum Evaluation Engineers (SPEE) Third International Forum. About 170 engineers, geologists, and financial specialists presented their interpretations of SEC reserves definitions to the agency's petroleum engineering staff and manager on Oct. 22, 2002.

The industry developed cases from actual circumstances altered to protect the identity of the cited properties. The SEC representatives both supported and challenged industry's interpretations based upon their understanding of reserves-reporting guidelines.

In several cases, a recurring quandary arose over corporate governance issues and SEC-regulated reporting practices in light of recent geoscience and engineering advances in the petroleum industry.

The prevailing SEC reserves definitions have remained virtually unchanged since 1978.

Formation tests

In the months preceding the forum, most US publicly traded companies had become aware that the SEC was investigating the current proved reserves booking practices in the deepwater Gulf of Mexico. This came in the form of questionnaires sent in early October to gulf operators.

The agency was aware that some publicly traded companies operating in the deepwater environment had taken the position that a conclusive formation test as used in the 1978-vintage SEC reserves definitions does not necessarily equate to a traditional production flow test. Indeed, many gulf producers believe that a conclusive test may be the results of analyses of a combination of log data, core data, and information gained through wireline testing.

Aside from the arguable technical merits, operators supporting this latter view did so with an acute awareness of field economics. They cited prohibitive costs and potential environmental risks as the main obstacles to performing an extended flow test in a deepwater environment. They also claimed that analyzing a combination of wireline testing and sampling data may yield greater conclusiveness than analyzing traditional flow test data.

In spite of this, the SEC engineers steadfastly interpreted the regulatory requirements of a conclusive formation test to be a production flow test to surface. Production and testing requirements are mandated by Regulation S-X, Rule 4-10, which states "...reservoirs are considered proved if economic producibility is supported by either actual production or conclusive formation test."

The focus on traditional flow testing in the gulf deepwater was not only brought about by cost issues but by the fact that logs and cores from this region typically show permeabilities in the 300-400 md range and higher, making petrophysical analysis a key subsurface evaluation tool.

Bob Wagner of Ryder Scott Co. LP and Thomas Harris of PetroSolutions Ltd. argued for establishing reasonable certainty and booking proved reserves without a production test. To show that industry is not alone in this view, they pointed out that the US Energy Information Administration (EIA), a government agency separate from the SEC, shares an opinion similar to industry's and has modernized its proved-reserves definitions.

In the agency's Annual Survey of Domestic Oil and Gas Reserves, it states, "Ureservoirs are considered proved if economic producibility is supported by actual production or conclusive formation test (drill stem or wireline), or if economic producibility is supported by core analysis and/or electric or other log interpretations."

Additionally, Wagner and Harris presented statistics showing that only 13% of all fields in the deepwater gulf were flow tested before development and the most common method of "evaluation testing" was a repeat formation tester (RFT)-wireline formation tester (WFT) coupled with log and core data.

The presenters showed the history of three deepwater discovery projects in which operators used various combinations of log, core, and wireline testing to make development decisions and book the reserves as proved. All three discoveries are now producing. In these cases, the results demonstrate that the operators were justified in being reasonably certain that the volumes would be produced.

During this presentation, an unscientific yet telling show of hands among the panelists and audience underscored the difference of opinion between industry and the SEC engineers. Wagner presented a case in a deepwater Green Canyon block and showed data that the operator reviewed in stages. He posed questions to the audience at various points.

Wagner showed that the log data on two wells drilled on the structure indicated that the interval had 30% porosity, relatively low water saturation, and more than 100 ft of pay in each well (Figs. 1 and 2).

He then asked for a show of hands from those who would book the volumes as proved based on the log data alone. Only a few raised their hands.

Next, Wagner presented the core data, and it confirmed the log interpretation, showing the reservoir sand to be highly permeable and oil saturated. He asked the audience members whether they would book the volumes as proved and a few more than before raised their hands.

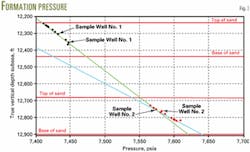

Finally, he presented the wireline test data from both wells, the numerous oil samples retrieved from the two wells, and the multiple pressures that established an oil gradient (Fig. 3). The fluid samples represented 31° gravity oil, and the pressures confirmed that both wells were in communication.

The permeability calculations from the wireline test data correlated to the core data and both indicated a highly permeable reservoir.

After presentation of this data, practically all hands were raised, except those of the two engineers from the SEC, who declined to agree that enough information was yielded to call the example case proved by SEC standards.

Several industry representatives in the audience explained why they believed that the wireline testing tools combined with log and core data yielded information superior to a production test.

Ultimately, the SEC engineers conceded that a good case was made in the last example for booking volumes as proved. They said that they were not prepared to concede that modifying the requirement for flow testing was in the best interests of the investing public, however.

They reiterated that their chief concern was to ensure the protection of the investing public. They also said that they were gathering data to make an informed decision on how to handle this and other similar cases involving gulf fields and reservoirs. At press time, the agency had not made a public announcement on flow-test requirements.

Seismic

The case of seismic for defining proved reserves limits focused on using seismic data to determine downdip limits of a hydrocarbon reservoir to quantify proved reserves.

Industry has drilled exploration wells on 3D seismic bright spots for years, often finding oil and gas high on the reservoir structure. Frequently, these discoveries require only a few development wells or even one to characterize and develop the reservoir.

Those familiar with Regulation S-X, Rule 4-10 recognize that one of the criteria in defining proved limits is "...in the absence of information on fluid contacts, the lowest known structural occurrence of hydrocarbons controls the lower proved limit of the reservoir." So is it possible to know if there are instances in which seismic data are yielding reliable enough information on fluid contacts to stand up to the SEC test of reasonable certainty?

Rod Sidle of Shell E&P Co. presented a case of a small reservoir typically developed with one or two subsea wells tied back to a neighboring infrastructure. The operator calculated the reserves by using the lowest penetrated pay on the well log as the reservoir limit. That reserves volume from the log pay calculation was only about half of those calculated based on a water contact obtained from seismic data.

Clearly there is a significant incentive to find what attributes make seismic sufficiently reliable to define a water contact, he said. To do this, he assigned different cases to two teams and challenged them to develop objective criteria to determine if seismic is sufficiently reliable for determining proved reserves. The two cases developed were the "pretty picture" and "long-on-science" cases.

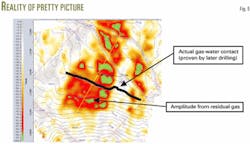

The "pretty picture" case involved a well containing a thick, clean sand interval with gas saturation to the base of the reservoir and with similar seismic lower on structure in the reservoir conforming to the mapped structural contours (Fig. 4).

The project team proposed a proved drainage area based on high-quality seismic defining an apparent gas-water contact. The project team supported the proposal by citing modern high-quality 3D seismic, good well logs with an excellent tie to seismic, clear evidence of a flat spot, and excellent fit to structure of downdip amplitude termination.

The seismic response lower on structure is similar to that which is tied to the commercial hydrocarbon saturation in the reservoir's discovery well.

This case seems compelling enough that a competent reserves evaluator may place a high degree of confidence in seismic analysis as a predictor of a hydrocarbon contact, said Sidle.

The "long-on-science" case involves data that do not create a "pretty picture," but a great deal of technical corroborative evidence tended to increase confidence in the seismic.

The project team undertook an analytical process to determine the characteristics needed so that the seismic could be relied upon as an indicator of a downdip contact. The team recognized that proof was necessary to validate the process, so it proceeded to hindcast its findings to actual cases in which the results were known.

The team noted that for this approach to work, it needed to:

- Apply it to a limited geological region such as Gulf of Mexico Pliocene-Miocene turbidites.

- Have ample, high-quality data (3D seismic, modern logs).

- Realize that the only important seismic amplitude influence is from the fluid content.

- Have sufficient data to distinguish reliably between brine, pay, and residual hydrocarbon based on amplitude responses

To validate the case, the team formulated an 18-item checklist covering five general areas that included quality control, stratigraphy, structure, sensitivity analysis, and other items. The hindcasting analysis revealed that for cases that satisfied all 18 criteria, the method was found to be 100% accurate in reliably predicting a downdip contact using seismic indicators. Very few reservoirs, however, met this standard.

The "long-on-science" approach was then applied to the "pretty picture" case that an evaluator might be tempted to consider reasonably certain.

The sensitivity analysis revealed that an evaluator could not predict with confidence the difference in seismic response between pay and residual hydrocarbon saturation with just the "pretty picture" data and analysis. In fact, in this case, what was thought to be a contact was actually a paleocontact caused by a partial leakage of the reservoir (Fig. 5).

The engineers from the SEC said that although they believed that this technological approach might work from time to time, exploration and production companies would have to make compelling arguments that would be considered on a case-by-case basis before any exceptions to the traditional application of the guidelines would be permitted in a filing.

Pressure limits testing

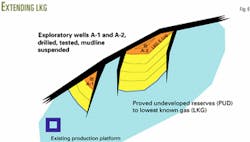

The case, presented by Fred Goldsberry of WaveX Inc., proposed using pressure-limits testing to extend a proved reservoir limit downward in a reservoir below a log-derived lowest known gas level to the apparent gas-water contact (GWC) from the pressure-limits test. The presentation gave a plausible reason for the necessity of lowering a proved contact in an offshore gulf gas reservoir (Fig. 6).

Drilling a producing well downdip from the discovery well is considered neither commercial nor necessary to drain the reservoir. The operator, however, in this case was seeking to increase the borrowing base to fund additional development and questioned whether a downdip well had to be drilled to prove up reserves used as collateral.

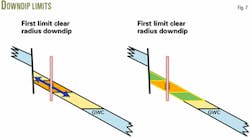

Goldsberry discussed how deep the proved limit can be pushed below lowest known gas by pressure-limits testing. He proposed testing the well in radial flow and using the distance of a radius of investigation that encounters no reservoir limits to be accepted as the minimum distance to a GWC. The acceptance of the radius of investigation as the minimum distance to a GWC creates a lower lowest-known gas contour (Fig. 7).

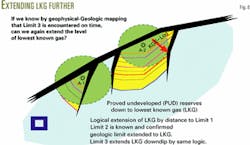

The concept of pushing the proved GWC lower using pressure-limits testing was pursued further when the presenter discussed an elimination check of the geologic map.

Goldsberry reasoned that if the mapped distance to each succeeding boundary change is known, perhaps the evaluator can successively identify map features with increasing radii and extend LKG downdip on the map. The idea is that as long as the evaluator confirms the limit with a slope shift in the pressure data plot at the appropriate radius of investigation, it is logical to assume that a downdip limit has not been encountered.

The various limits inferred by slope changes in the drawdown test data confirmed the accuracy of the geologic map and seismic data. After confirming that several observed reservoir limits closely corroborated the map data, another boundary was seen that tied with a seismic anomaly believed to be a gas-water contact.

The questions posed to the SEC engineers were:

Can the clear radius of investigation be used to push the LKG downdip?

How many additional limits can be used to extend the LKG and what kind of corroborating evidence is necessary (Fig. 8)?

In response to the proposed use of pressure limits tests to push the proved contact below the lowest known gas from the log data, one SEC engineer stated he would be "...very uncomfortable with lowering the LKG based on seismic and pressure transient analysis." He reasoned that although an evaluator may be able to determine the contact, he still doesn't know anything about the reservoir below the lowest known gas, including saturations, porosity, and net pay.

The SEC engineer said that the presenter demonstrated a very good method of determining probable reserves but that this case does not rise to the level of certainty of proved reserves by SEC standards.

Oil price

D. Russ Long of Long Consultants Inc. presented two cases on the correct oil prices to use in SEC filings.

With the trend toward more financially complicated oil and gas deals, this topic is often not easily addressed.

The first case involved an offshore project in which oil was sold from a floating, production, storage, and offloading (FPSO) vessel once every 3 months. The price paid was based on the most recent quotations of a 6-week average.

Discussion among the SEC engineers and the audience indicated industry confusion. The SEC representatives affirmed their interpretation of the regulations requiring prices and costs as of the date the estimate is made to be the price that is received for the oil and gas flowed on the last day of the reporting period.

The SEC engineers reminded the audience that "...a monthly average is not the price on the last day of the year." The only exceptions to this pricing guidance are to be changes in price that are contractually specified. The SEC engineers stated that the appropriate price to use in this case would depend on the language of the oil sale agreement or contract.

This case provides a good example of the difficulties industry often faces applying these regulations.

The case of an international risk service contract presents a scenario where the reserves calculated from the economic interest method (total revenues divided by prevailing hydrocarbon price) actually exceed the total reserves. In this case, the SEC would limit the reserves to the lesser of the working interest reserves or the reserves calculated from the economic interest method.

The SEC engineers were clear that in no instances should the total reserves reported exceed 100% of the gross reserves volume.

Other SEC engineer comments

In addition to providing their comments on each of the cases and to responding to questions from the floor, the SEC engineers reminded the audience of their positions on several other issues including the following:

- Under no circumstances is it appropriate to report revenues from any source other than the sale of hydrocarbons in a reserves report or to use such nonhydrocarbon revenues to offset or reduce operating costs.

- Reserves and revenues from any property subject to a net profits interest (NPI) must be reduced by the respective reserves and revenues attributable to the NPI.

- Lease and field operating costs must include their proportionate share of indirect overhead charges and the techniques to allocate such charges should reflect a reasonable methodology.

Acknowledgments

The authors thank members of the SEC staff who participated in the forum, members of the SPEE Forum steering committee, and B.K. Starbuck Buongiorno for her work at the forum. The authors also thank Mike Wysatta for his help in editing and preparing this article for publication.

The authors

D. Ronald Harrell is chairman and chief executive officer of Ryder Scott Co. LP, Houston. He has managed reservoir engineering and geological studies worldwide, including property evaluations for acquisitions and divestitures, financing, reservoir management, gas supply analysis, gas storage studies, and litigation support. Harrell holds a BS in petroleum engineering from Louisiana Tech University. He is a member of SPE and SPEE.

Thomas L. Gardner is vice president at Ryder Scott Co. LP and has evaluated international petroleum properties for 17 years. He has managed multidisciplinary evaluation teams and prepared independent studies for acquisitions and divestitures, financing, and reservoir management. He also consults on regulatory compliance in reserves reporting. He previously worked for Exxon Corp. Gardner holds a BS in petroleum engineering and an MBA, both from Texas A&M. He is a member of SPE and SPEE.