Basin-centered gas accumulation play developed for western Turkey

Tayvis Dunnahoe

Exploration Editor

Canadian Valeura Energy Inc. and partner Statoil ASA are planning a three-well delineation drilling and testing program commencing third-quarter 2018 on the Banarli and West Thrace licenses in northwest Turkey's Thrace basin, west of Istanbul and extending to the borders of Greece and Bulgaria (Fig. 1).

In the meantime, Valeura is tying the Yamalik-1 discovery on the Barnarli license in to its gas production network for further testing and long-term production and sales. Design work is under way for the production facilities and gathering pipeline at an anticipated cost of $3 million. First sales from Yamalik-1 are targeted for second-quarter 2018.

Yamalik-1 was drilled to 4,196 m and hydraulically fractured and production tested in fourth-quarter 2017. The well discovered a 1,300-m natural gas and condensate column in overpressured reservoirs below 2,900 m in the Tertiary Teslimkoy and Kesan formations. In December, the company completed four production tests from eight frac stages in the Kesan formation, yielding a 24-hr aggregate test rate of 2.9 MMcfd.

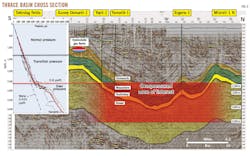

Valeura Energy has participated in numerous drilling programs throughout the southern Thrace basin since 2013 and play types have ranged from conventional shallow gas exploration prospects in the overlying Danismen and Osmancik formations to the tighter gas prospects in the Mezardere and underlying Teslimkoy and Kesan formations (OGJ Online, Mar. 22, 2016). The company's basin-centered gas concept is targeting the pervasive overpressured unconventional gas resources in the synclinal parts of the Thrace basin.

Basin-centered gas play

Valeura identified potential for a basin-centered gas accumulation (BCGA) play in Thrace basin through drilling results and regional geological modelling from 2011 to 2013. The company then captured rights to a majority of the Thrace BCGA fairway through 2016.

Yamalik-1 was the first deep exploration well in the project, and was drilled under a farm-in agreement giving Statoil 50% interest in formations deeper than 2,500 m within the Banarli and West Thrace licenses. Statoil invested $69 million in the project, according to Valeura's most recent investor presentation. Valeura holds 50% in the deep formations in the Banarli license and 31.5% in the deep formations in the West Thrace. Pinnacle Turkey Inc. holds the remaining 18.5% interest in West Thrace.

BCGA plays are among the more economically important unconventional gas systems in the world. They are made made up of pervasive, basin-wide gas accumulations trapped in low permeability rock. In the US alone, basin-centered gas accumulations provide 15% of the country's annual production, equal to 4 tcf/year.

Valeura's Thrace basin play fairway is defined by the onset of overpressures and a hydrocarbon generation window. To date, eight deep wells on the fringe of Thrace basin have displayed high overpressures below 2,500 m at 0.68-0.77 psi/ft. The Yamalik-1 measured 0.80-0.84 psi/ft at 4,100 m depth. These wells also contain increased mud gas and interpreted gas saturation in the reservoir. All tested wells have recovered gas to surface.

The play area's pressure seal covers 400,000 acres. The depth contour through Yamalik-1 at 3,100 m extends across 175,000 gross acres. The Yamalik-1 encountered almost 500 m of net sand in Teslimkoy and Kesan reservoirs. The shallower Mezardere and Osmancik reservoirs have not been tested in the basin's center (Fig. 2).

Prospect development

Dallas-based DeGolyer & MacNaughton (D&M) reported on Feb. 6 that Valeura Energy's estimated working interest unrisked mean resources were 10.1 tcf, which includes 236 million bbl of condensate. Working interest risked mean prospective resources are an estimated 5.2 tcf of gas, 165 million bbl of which is condensate. Valeura's Chief Executive Officer Sean Guest said the independent evaluation supported the company's thesis of a "large unconventional, basin-centered gas-condensate resource," but also acknowledged that exploration is in an early phase.

D&M's broad range of recoverable gas from 3.2 tcf to more than 20 tcf is a function of uncertainty related to limited stimulation and production testing from the overpressured Teslimkoy and Kesan formations in the Thrace basin.

The firm has assigned a 74% chance of development for the gas prospect based on economic field size and the application of existing fracing technology. Follow-up well depths are estimated to be about 5,000 m and therefore not excessive in cost. The Yamalik-1 well, drilled to 4,196 m, was limited by rig capability but the base of the well was still in gas-bearing sands that were successfully flow tested, Valeura said.

The company's existing infrastructure and customer base is capable of handling more than 35 MMcfd compared with current sales through the system of less than 10 MMcfd. Turkey also meets 99% of its current gas demand by imports, providing an opportunity for domestic producers.