Bamaga basin emerges as potential Eastern Australia gas supply source

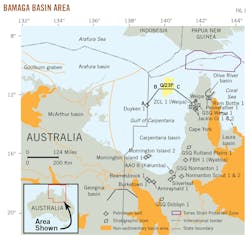

Eastern Australian politicians and industry are grappling with a looming east coast domestic natural gas supply crisis. Sydney-based Gulf Energy Ltd. has secured a leasehold over the whole of a new exploration area called Bamaga basin in the Gulf of Carpentaria, 150 km off the north Queensland coast (Fig. 1). This prospect has the potential to hold many trillions of cubic feet of conventional gas within physical and economic reach of consumers, making it a potential part of the region’s gas supply solution.

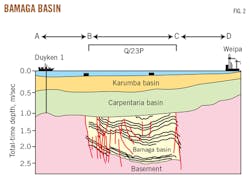

The basin, 80 km wide and 200 km long containing a succession of sedimentary rocks exceeding 4,500 m in thickness, was first postulated by Geoscience Australia (GA) in the early 1990s and named after the country’s most northerly town near the tip of Cape York peninsula.

A well in the mid-1980s named Duyken-1 hit basement at just more than 1,100 m without finding any trace of oil or gas. The petroleum industry dismissed the shallow overlying Carpentaria and Karumba basins (Fig. 2), containing Mesozoic and more recent sediments in the same region, as unlikely to contain hydrocarbons. Gulf Energy managing director Wolfgang Fischer had held similar views until he read the GA report indicating that Palaeozoic rocks (Permian and older) lay in a relatively small and discreet fault-bounded trough underneath the Mezozoic sediments to the northeast of the Duyken wildcat.

The attractions were immediately apparent. For a start, Palaeozoic rocks are known to be prolific hydrocarbon reservoirs elsewhere around the world, including North America, Europe, the Middle East and China. The water depth in the northern part of the Gulf of Carpentaria over Bamaga basin is 70 m and less, making it suitable for jack-up drilling. It is also close to growing Queensland infrastructure with connections to southeast coast markets.

Gulf Energy could apply for a permit over the prospective parts of the whole basin, a rare circumstance for a small company in Australia. This meant that in the event of a discovery in the first well, Gulf would have all follow-up potential.

Australia granted Permit Q/23P, covering more than 7,500 sq km, to Gulf in 2003. Initial programs, including aeromagnetic and gravity data analysis and a 2D seismic survey verified the basin’s existence and suggested the presence of large structures. Modelling of regional well data indicated that the basin was mature for both oil and gas generation. The presence of an active petroleum system was supported by microseep indications identified on satellite imagery.

Gulf ran a new seismic survey in 2014 that infilled the earlier 2012 data and clarified the sedimentary and structural position. It showed the likelihood of an interbedded sedimentary section 5,000 m thick in the deepest part of the basin. In addition, an array of anticlines, fault blocks, and other traps have been recognized throughout. More than 10 such features have been advanced as leads and potential drilling targets with the possibility of up to 1 billion bbl of oil or trillions of cubic feet of gas in multi-stacked reservoirs being available.

Encouraged by these results, Gulf renewed the permit for another 6 years in August 2015. The company also sought an expert second opinion from independent geological consultants Gaffney Cline and Associates (GCA). GCA’s report, received in November 2015, endorsed the view that Bamaga basin is a new and attractive exploration prospect with potential for oil and gas discoveries, most likely gas.

Gulf has selected an initial target near the center of the permit where the depth of sediment is greatest. A successful well there will be quickly followed by further drilling to evaluate the whole permit. Drilling will be confined to the winter and spring months to avoid the north Australian summer cyclone season, with the company hoping to begin its drilling campaign in 2019 or 2020.

Timing hinges on receipt of the requisite government permits and approvals. Gulf also is looking for a like-minded farm-in partner to help defray costs and is in discussion with several parties regarding this possibility.

The Bamaga basin project has the potential to provide significant volumes of conventional natural gas to eastern Australia. As Fischer points out, without new field developments there will be serious periodic shortfalls in Australian east coast domestic gas supply between 2019 and 2024. After that a tipping point could be reached when the region will be totally reliant on speculative contingent gas resources.