Israel expands offshore exploration opportunities

Michael Gardosh

Elad Golan

Shachaf Lippman

Israel Ministry of Energy

Jerusalem

Israel launched its second offshore licensing round in late 2018 in hopes of attracting international investors capable of finding oil and natural gas resources to rival or surpass previous discoveries.

The second offshore round offered new terms, including bigger acreage units than Israel’s first offshore bid round in 2016. Operators of the first-round licenses are expected to start drilling in 2019. That first offshore bid round involved 24 blocks of up to 400 sq km each.

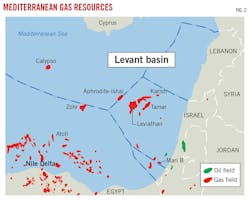

The second round built on the growing regional importance of the East Mediterranean as a hydrocarbon province, including Tamar, Leviathan, Karish, and Tanin fields.

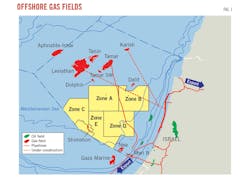

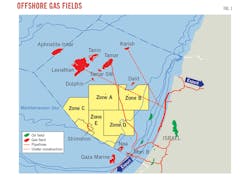

Fig. 1 shows how 19 blocks were grouped into five zones covering areas ranging between 1,085 sq km (Zone E) to 1,600 sq km (Zone A). All zones are in Israel’s central and southern economic waters, an area previously licensed and surveyed.

Bids will be submitted for zones rather than individual blocks. These larger areas will allow for more effective subsurface analysis and increased resource potential. The second round offers both identified leads and prospects yet to be drilled, including extensions of established plays and acreage featuring deeper targets and stratigraphic traps. Advances in seismic processing, analysis, and interpretation are expected to help operators tap resources.

The deadline for bid submission is June with winners expected to be announced in July.

Recognizing regional competition for finding oil and gas, Israel offers investors’ favorable geologic conditions, large prospective resources, proven success, and stable economic growth.

Fig. 2 shows how the entire Eastern Mediterranean has become an exploration hot spot, driven by Israeli gas as well as other discoveries such as Zohr field offshore Egypt and Calypso field offshore Cyprus.

On Feb. 28, ExxonMobil Corp. announced a gas discovery offshore Cyprus in the Eastern Mediterranean on Block 10. The Glaucus-1 well cut 436 ft of reservoir rock. Evaluation of the potential of Block 10 continues.

Existing fields

Israel has imported oil and gas since 1948. Discoveries in several small onshore fields have not altered the need for imports. In 1999, exploration activity shifted offshore, yielding 10 gas discoveries starting with Noa and Mari B fields.

Noble Energy Inc. of Houston discovered most of the 30 tcf in offshore resources along with its Israeli partners, Delek Drilling, Isramco Inc., and Ratio Oil Explorations. Noble operates giant deepwater Tamar and Leviathan fields.

Earlier this year, Noble signed agreements to sell 1.13 tcf of gas each from Leviathan and Tamar to Dolphinus Holdings Ltd., a consortium in Egypt involved in supplying gas for industrial and private consumers.

Discovered in 2010, Leviathan’s recoverable resources total an estimated 17.6 tcf. Noble Energy is developing Leviathan with a subsea system and fixed offshore platform. Gas sales from Leviathan are expected to begin in late 2019. The Leviathan system has a designed production capacity of up to 1.2 bcfd.

Mari B gas began arriving onshore in 2004. Tamar field, which provides enough gas for all of Israel’s current domestic consumption, was connected to the Israeli grid in 2013 in a fast-track development that took less than 3 years.

Karish field in Israel’s northern exclusive economic zone (EEZ) is scheduled to start production in 2021 using a floating production, storage, and offloading vessel (FPSO) 90 km offshore, the Eastern Mediterranean’s first FPSO.

The Israeli Petroleum Commissioner already awarded two production leases and five exploration licenses in the East Mediterranean to Energean and its subsidiaries. Energean plans to develop the Tanin field after the development of the Karish field. Karish, discovered in 2013, and Tanin, discovered in 2011, are about 40 km apart.

Energean holds five of six licenses issued in Israel’s first offshore round. Previously, Energean bought Karish and Tanin fields from Noble Energy and Delek Drillings. Four Indian companies, led by ONGC Videsh Ltd. (OVL), share one license awarded during the first offshore round.

Potential discoveries

BEICEP-FranLab consulting group submitted a 2015 study to the Ministry of Energy, estimating yet-to-find (P50) 75 tcf of gas in place and 6.6 billion bbl original oil in place within Israeli economic waters. This confirmed US Geological Survey estimates.

The study demonstrated widespread potential for dry gas, wet gas, condensate, and oil. It emphasized the existence of two major petroleum systems in the offshore Levant basin.

A biogenic system characterizes the shallower strata of Oligo-Miocene and Pliocene age. Dry gas discoveries in Leviathan, Tamar, Karish, Mari B, and other offshore gas fields have proved this system’s effectiveness.

A thermogenic petroleum system exists in deeper Mesozoic strata. Modeling done in 2D and 3D domains shows high thermal maturity below 5-6 km. Geologists believe Jurassic and Cretaceous source rocks are within the oil and gas windows.

Very light oil shows found in several wells have been associated with this system, which is capped by low permeability layers and remains largely untested by drilling.

The second offshore bid round’s zones include several types of structural and stratigraphic traps likely charged by gas and oil from the two petroleum systems. Oligo-Miocene turbidte sandstone, the reservoir rock where most of the gas was found so far offshore Israel, was identified in the bid round’s central and western sections.

Large Syrian Arc-type fold structures characterize the eastern part of the bid area where oil might be found in Jurassic fractured carbonates and Cretaceous turbidite sands. The bid zone also includes a large basement high likely capped by a Cretaceous carbonate buildup, similar in its structure to recently discovered large gas fields in Egypt and Cyprus. Extensive 2D and 3D seismic information exists for the bid area.

Bid terms

The Ministry of Energy sought to offer more attractive bid terms in the second offshore bid round. License holders have 3 years to complete exploration commitments. They must decide within 2 years where to relinquish licenses or commit to drilling a well. A second drill-or-drop decision will be required after 5 years. Israeli Petroleum law sets 7 years as the maximum time for drill-or-drop.

This 3+2+2 timetable provides operators both time to study the area and flexibility in financial commitments associated with drilling wells in as much as 1,700 m of water.

Another incentive is an enhanced data package that includes all available 3D seismic data in the bidding area and a description of potential targets with volumetric and risk assessments.

Israel manages offshore petroleum rights under a royalty and tax fiscal regime. Royalties are 12.5% of market value at the wellhead and the corporate tax is 23%. Regulators calculate an oil and gas profits levy using a progressive formula after operators get 150% return on investment.

Israel’s overall government take is 52-62%, which is lower than Norway and Egypt.

Israel recently updated its export policy, allowing for export of 100% of gas discovered in a field as large as1.76 tcf. The supply obligation to Israel’s domestic market is 50% for additional gas fields of 1.76-7 tcf.

Market potential

Israel’s population of 8.5 million now consumes 0.4 tcf/year but is estimated to consume nearly 1 tcf/year by 2042.

Meanwhile, Israel is promoting export opportunities. Agreements already signed that call for gas exports to begin in 2019-20 include a $12 billion export deal with Jordan and a$15 billion export deal with Egypt.

The Energy Commission of the European Union is considering the Eastern Mediterranean in its search for alternative gas sources to the maturing North Sea.

In 2017, energy ministers from Israel, Cyprus, Greece, and Italy signed memorandums of understanding for a 1,900-km gas pipeline connecting Israel’s Leviathan field, Cyprus’ Aphrodite gas field, and other Eastern Mediterranean fields to mainland Greece and Italy through the waters of Cyprus and Crete.

European Commission-sponsored feasibility studies confirm the EastMed pipeline as technically feasible and economically viable. The EastMed would be the longest and deepest subsea system worldwide.

The pipeline is designed to initially transport 0.35 tcf/year and ultimately 0.7 tcf/year.

IGI Poseidon SA issued a front-end engineering and design tender notice for the subsea pipeline and compressor stations in mid-2018. In September 2018, energy ministers from Israel, Greece, Bulgaria, and Serbia met in Greece to discuss expanding EastMed to the Balkan countries. Final agreements between the participating countries and the EU are expected to be signed during 2019.

Energy policy

Israel’s domestic energy demand will increase significantly in coming years as Israel moves to cleaner fuels for power generation and transportation as its population grows. In 2040, 13 million people are expected to live in Israel, making it among the most crowded western hemisphere nations. The number of vehicles is estimated at 6.4 million in 2040 and electricity demand will double. Given this, Israel is promoting several programs to reduce pollution and increase gas use.

Israel has had the second most rapid growth of natural gas use in the world, following Peru. Coal-generated power accounted for 30% of Israel’s power in 2018 compared with 60% in 2015.

The Ministry of Energy’s goal is to reach 83% use of gas and 17% renewables for electric generation by 2030, closing all coal plants. Gas is to supply 95% of the energy needed for industrial demand by 2030. Transportation plans call for a gradual transfer to electric cars and natural gas trucks with a ban on imports of gasoline cars starting in 2030. These plans are expected to reduce Israeli air pollution by 60%.

The authors

Michael Gardosh ([email protected]) has directed the Israeli Ministry of Energy’s Geology, Geophysics and Information Department since 2010. He promotes oil and gas exploration activity offshore and onshore Israel. He holds a MSc in geology (1987) from Hebrew University and a PhD in Geophysics (2002) from Tel Aviv University. He previously worked in the Geophysical Institute of Israel and the Israel National Oil Co., where he studied the geology and petroleum systems of the Eastern Mediterranean.

Elad Golan ([email protected]) directs the Israel Ministry of Energy’s Natural Resources Administration Regulation Department. He supervises upstream oil and gas regulation. Previously, he worked as a legal advisor in the Israel Ministry of Energy, and in the private sector. He earned an LLB (2011), LLM (2014), and MBA (2018) from the Hebrew University.

Shachaf Lippman ([email protected]) has worked as a senior geophysicist with the Israeli Ministry of Energy’s Geology, Geophysics, and Information Department since 2014. His work involves geophysical interpretation and supervision of exploration programs. He previously worked as a seismic processing geophysicist for Geomage Ltd and as an exploration geophysicist for Adira Energy. He earned a MSc (2010) in marine geoscience from Haifa University and BSc in geophysics and geography from Tel Aviv University (2007).