Gambia approves FAR’s farm-in to offshore blocks

The Gambian government has approved an agreement in which FAR Ltd., Perth, will acquire 80% interest and operatorship of Houston-based Erin Energy Corp.’s offshore A2 and A5 blocks. Erin Energy will retain 20% working interest.

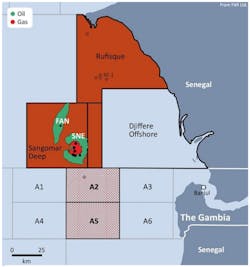

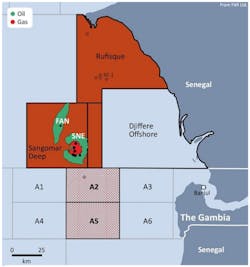

Blocks A2 and A5 are adjacent and on trend with FAR’s 2014 SNE-1 oil field discovery offshore Senegal (OGJ Online, May 19, 2017). The blocks cover 2,682 sq km within the emerging Mauritania-Senegal-Guinea-Bissau basin and lie 30 km offshore in 50-1,200 m of water.

The blocks together have potential to contain prospective resources of more than 1 billion bbl of oil, FAR says. From 1,504 km of modern 3D seismic data acquired in the blocks, FAR has identified large prospects similar to the “shelf edge” plays the firm is targeting in Senegal. FAR has mapped three potentially drillable prospects and leads.

FAR and Erin Energy expect to undertake 3D seismic reprocessing and interpretation this year to mature prospects for drilling an exploration well by yearend 2018.

Under the terms of the agreement, FAR will pay Erin Energy $5.18 million and carry $8 million of Erin Energy’s share of costs in the planned exploration well. If Erin Energy’s share of the well is less than $8 million, the balance is to be paid in cash. FAR’s share of the well’s cost is expected to be $25-30 million.

Erin Energy has held interest in the two blocks since 2012. The firm in 2015 received a 2-year extension for the blocks until Dec. 31, 2018 (OGJ Online, May 15, 2015).

FAR in March signed an area of mutual interest agreement with CNOOC UK Ltd. that covers Blocks A2 and A5 as well as permits offshore Senegal (OGJ Online, Mar. 31, 2017). The AMI, which has a 2-year duration, enables the firms to enact agreed arrangements to partner in evaluating, bidding, negotiating, and managing joint ventures on farm-in and open acreage opportunities.

FAR is currently in arbitration to resolve a joint operating agreement dispute regarding the firm’s right to preempt the sale of ConocoPhillips’ interest in three blocks off Senegal, including one containing the SNE oil discovery (OGJ Online, June 21, 2017).