EIA: Norway investment cuts affect exploration more than production

Total investment in oil and natural gas extraction in Norway was 21% lower in this year’ first half compared with first-half 2015, a decline of about 20.9 billion kroner. Investment cuts have affected exploration drilling more than production drilling, according to an analysis from the US Energy Information Administration.

Since 2009, exploration drilling has accounted for about 12% of Norway’s total investment in oil and gas extraction. About 31% has been directed toward production drilling, with the remainder directed toward other activities.

“Recently, investment in exploration drilling has experienced greater declines, with investments in the first half of 2016 more than 50% lower than in the first half of 2015. In comparison, investment in production drilling is down just 9% in kroner terms over the same period. Other types of investment related to oil and natural gas extraction and pipeline transport (including onshore activities, field services, and shutdown and removal) declined 21% in the first half of 2016 compared with the first half of 2015,” EIA said.

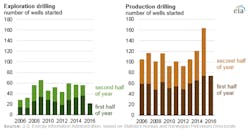

The total decline in investment reflects a combination of less activity and reductions in cost. The reduced activity is most apparent in exploration drilling. The number of new exploration wells started in the first half of 2016 was almost 40% lower than in the same period in 2015. Changes in production drilling investment, meanwhile, are more indicative of ongoing industry cost savings. While investment in production drilling has generally been decreasing since the second half of 2013, the number of new wells started has been flat or increasing.

Cost reductions also are apparent in recent and ongoing projects. The Gullfaks Rimfaksdalen gas-condensate project, which started production in August, was completed more than 20% under budget. Estimates of the cost to develop Johan Sverdrup field were about 20% lower in August than the estimated costs in the development plan submitted to the Norwegian government in February 2015.

The Norwegian Petroleum Directorate (NPD) estimates that the cost to develop a field on the Norwegian shelf has declined by more than 40% since 2014. The NPD attributes much of the savings to more efficient drilling and to the simplification and standardization of well designs.

With the continued high levels of production drilling, EIA expects oil production in Norway to grow modestly in 2016, then return to its prior trend of gradual decline as the number of new fields coming online decreases.

“Lower levels of exploration drilling may result in a decrease in future production. However, the Johan Sverdrup field is scheduled to come online near the end of the decade with full production of up to 650,000 b/d—more than a quarter of Norway’s current total petroleum and other liquids production. Production from this new field should delay the onset of any deep decline in Norway's aggregate production,” EIA said.