UKCS reserves to sustain production for at least 20 years

Tayvis Dunnahoe

Exploration Editor

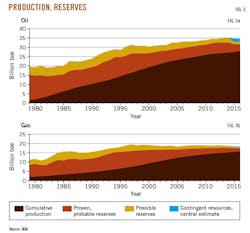

The UK Oil & Gas Authority (OGA) believes the country's petroleum reserves could sustain production for at least the next 20 years. The report, "UK Oil & Gas: Reserves & Resources," shows remaining UK resources of 10-20 billion boe. The report looked at data for the end of 2016, and OGA said the UK and UK Continental Shelf have produced a total of 43.5 billion boe to date.

Reserves, resources

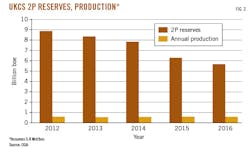

OGA estimated 5.7 billion boe of 2P reserves at the end of 2016, slightly below the 6.3 billion boe estimated in 2015. The reduction is a result of 0.6 billion boe produced in 2016.

Contingent resources include producing fields, proposed new developments, and other discoveries. OGA provides a base case of 1.9 billion boe in proposed new developments with 3.2 billion boe in other discoveries.

Contingent resources are quantities of petroleum estimated to be potentially recoverable from known accumulations. OGA collected data for contingent resources in producing fields for the first time in 2016, adding a previously unreported resource category. Within the total, OGA moved 0.4 billion boe from the other discoveries category to the proposed new developments category.

OGA's base case of prospective (undiscovered) resources is 6.0 billion boe, ranging between 1.9 and 9.2 billion boe on the upper and lower lower ends. These estimates are unchanged from those at the end of 2015.

Data sources

OGA compiled operator data for both developed fields and development projects from its annual UKCS Stewardship Survey. The survey covered 326 producing fields, 22 projects where a field development plan (FDP) had been approved but had not yet produced, and 31 other projects where FDPs were under discussion at yearend 2016. Data were not collected for unsanctioned discoveries where no development project was under discussion.

OGA used in-house data including contingent resources split between licensed and unlicensed acreage: 202 and 154 discoveries, respectively. OGA estimated prospective resources from a database of 3,000 mapped leads and prospects compiled from license round application documents and submissions to Departments of Energy and Climate Change (DECC) and Business, Enterprise, and Regulatory Reform as part of the country's fallow block process.

Resource progression

In 2016, two new field developments and seven FDP addenda for incremental projects along the UKCS resulted in 80 million boe being moved from contingent resources to reserves. Despite this addition, OGA made larger negative adjustments to the reserves estimates for producing fields (Fig. 1). Four new discoveries added 210 million boe to the country's contingent resource base.

The addition of producing-fields data to the country's contingent resource base will provide future additional volumes as operators report on potential resources in existing fields through infield drilling and entering undeveloped portions of larger fields. OGA, however, reported that these volumes will require further work before they can be considered commercial.

Projects were proposed for seven UKCS discoveries in 2016, resulting in 371 million boe being moved from OGA's other discoveries to its proposed new developments category.

Production, reserves

UK's reserve base is an estimated 7.4 billion boe. Fig. 2 shows the rate at which reserves have been replaced since 2012. The underlying reserves replacement ratio in 2016 was 13% (80 MMboe added with 600 MMboe produced in 2016).

UK's negative reserves replacement ratio in 2015 was the result of recategorizing certain types of projects from reserves to contingent resources, according to OGA. Before 2015, the UK DECC included projects that had not yet been sanctioned, but OGA now only includes as reserves projects that have been sanctioned and issued a development and production consent.

Reserves replacement and categorization led to growth in overall estimated ultimate recovery (EUR) from the 1970s through the 1990s. Low reserves replacement and recent reserves downgrades have resulted in static EUR since the oil-price decline in mid-2014 (Fig. 3).

Oil, gas reserves

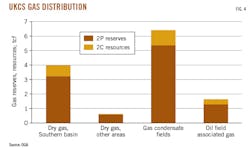

UK remaining reserves and contingent resources are two-thirds oil and one-third gas. Fig. 4 shows the breakout of UKCS gas reserves by type. Contingent resources in proposed new developments include dry gas, gas from condensate, and associated gas from oil fields. Gas condensate fields are expected to provide the largest contribution to future production.

Contingent resources in proposed new developments are smaller than the developed reserves base, but a large inventory of gas contingent resources remains in producing fields and in other discoveries where development plans are not under discussion. Further work will be required before these resources will contribute to future reserves.

UK gas reserves are predominant in the Central North Sea (CNS), Southern North Sea (SNS), and West of Shetland (WoS). The CNS is also prospective for oil and, along with WoS, contain much of the UK's oil reserves.

About one-third of the UK's contingent resources remained on unlicensed acreage at the end of 2016, 1 billion boe of the total 3.2 billion boe reported. OGA has made much of this acreage available in the 30th Offshore Licensing Round, which closed on Nov. 21, drawing 96 applications for 239 blocks in mature UKCS areas (OGJ Online, Nov. 22, 2017).

OGA's 30th round offered 813 blocks or partial blocks in mature areas of the UKCS, covering 114,426 sq km. Blocks were on offer in the SNS, CNS, Northern North Sea, WoS, and the East Irish Sea. Awards are scheduled to be announced second quarter 2018.

Prospective resources

OGA's estimate of undiscovered accumulations includes many with high geological risk. The lower-end estimate of 1.9 billion boe considers only prospects and leads having greater than a 20% geological chance of success. This estimate is based on recoverable reserves in terms of recent drilling activity. The upper-end estimate of 9.2 billion boe was obtained using a geological chance of success greater than 5%. According to OGA, this estimate could be achieved through better basin understanding and improved technology.