Emphasis on urban areas affects drilling in Ohio

Effective Sept. 16, 2004, a law went into effect that gives the Division of Mineral Resources Management sole authority in Ohio to regulate the permitting, locating, drilling, and operating of oil and gas wells and production facilities.

The law was adopted with the understanding that the regulation of oil and gas activities is a matter of general statewide interest that requires uniform statewide regulation. Previously, different standards were in effect throughout the state.

The law created a designation of urban areas and defined them as all municipalities and unincorporated civil townships with a population greater than 5,000. Urban areas are subject to greater rules and conditions than nonurban areas.

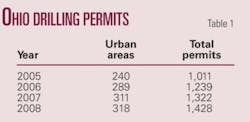

Allowing drilling in urban areas has affected both drilling and production. Since the law went into effect, about 23% of all wells drilled have been in areas defined as urban. In 2008, 318 of the 1,428 drilling permits issued were in urban areas (Table 1). The rise in proportion of drilling in urban areas has contributed to a turnaround in an otherwise downward trend in production in Ohio.

Permitting and drilling

The number of permits issued in 2008 was 8% more than in 2007.

The majority of these permits targeted the Clinton sandstone (72%), followed by the Devonian shale (12%) and then permits below the Cambro-Ordovician Knox unconformity (11%).

Sixteen permits were issued to the Marcellus shale formation. Permits were issued in an average of 13 days of being filed.

For the second consecutive year and only the third time since 1991, more than 1,000 wells were drilled. An estimated 1,049 oil and gas wells were drilled in 2008, a decrease of 16 wells or 1.5% from 2007. This is the first decrease since 2002 (Fig. 1). Wells were drilled in 44 of Ohio’s 88 counties, six fewer counties than in 2007.

Well completions

At the time of this writing in late February, Ohio oil and gas owners had submitted 811 well completion reports, representing 77% of the wells drilled in 2008.

These reports showed that 756 wells were productive and 55 were dry holes, for a 93.2% completion rate. Total depths ranged from 420 ft in the Big Injun sandstone in Perry County to 8,897 ft in Precambrian granite in Guernsey County.

An estimated 4,057,429 ft of hole were drilled, a decrease of 104,273 ft from 2007. Well depth averaged 3,868 ft, a decrease of 40 ft/well.

Targeted formations

Completion zones ranged from a Pennsylvanian coal (for coalbed methane) to Precambrian basement.

The Clinton sandstone was the most actively drilled zone accounting for 61% of all wells drilled. An estimated 638 wells were drilled, 30 fewer than in 2007. Clinton sandstone wells averaged 4,089 ft in depth and were drilled in 25 counties. The most active counties were Cuyahoga 67 wells, Geauga 66, and Licking 53.

An estimated 151 wells were drilled to the Ohio shale, a decrease of 6 wells. Sixteen of these wells were horizontally drilled. It is too early to know whether this technology has been effective. Ohio shale drilling occurred in 11 counties. Monroe led with 74 wells followed by Noble with 28.

Drilling to the Knox formations totaled 102 wells, 2 fewer than in 2007. Of those, 33 were dry holes, resulting in a productive rate of 68%. The majority of these wells, 45, were drilled to the Beekmantown dolomite.

Most active counties

Monroe County was ranked first for the fifth consecutive year with 75 wells drilled, and the majority of these wells were drilled to the Ohio shale.

Urbanized drilling accounted for almost every well in the next most active counties, Cuyahoga (69) and Geauga (67) (Table 2).

Directional drilling

This technology is generally being used to access oil and gas in the following ways: under environmentally sensitive areas or densely populated areas and horizontally in the Devonian shale.

In 2008, 71 directional drilling permits were issued to drill directional wells in 13 counties. This included 26 permits to horizontally drill in the Devonian shale, and many of these were radials from the same vertical boreholes. These were located in Gallia (19) and Jackson (7) counties. The majority of the rest of the permits were issued to the Clinton sandstone in northeastern Ohio. The most active counties were Summit (11) and Cuyahoga (8).

Exploratory wells

Wells in Ohio are classified as “development wells” or “exploratory wells” based on American Association of Petroleum Geologists guidelines.

A well completed in a known oil and gas bearing formation within 1 mile of any well completed in the same formation is classified as a “development well.” A well is classified as “exploratory” if it is completed in a formation not usually known to be oil and gas bearing or is located more than 1 mile from the nearest well completed in the same oil and gas bearing formation.

Exploratory drilling continues to decline as a percentage of the total number of wells drilled (Fig. 2). Seventy-five wells (7%) of all wells completed were classified as exploratory, which is comparable to 2007. Of these, 51 were productive and 24 were dry, representing a 68% success rate.

Exploratory wells were drilled in 28 counties. Gallia and Guernsey counties each had nine exploratory wells.

Wells drilled to the Devonian shale (25) and below the Knox unconformity (26) accounted for the majority of exploratory activity. Drilling to the Devonian shale continues to expand geographically each year as new areas are explored. All of these wells were reported as productive. A hurdle in some of these areas is the lack of pipeline access.

Wells drilled to formations below the Knox unconformity, such as the Beekmantown dolomite, Rose Run sandstone, and Trempealeau dolomite are almost always seismic prospects. Half of these wells were dry holes.

Production overview

Ohio’s total reported crude oil production was 5,554,235 bbl, an increase of 1.83% from 2007 (Fig. 3).

In 2008, production averaged 15,217 b/d compared with 14,944 b/d in 2007. Through 2008, Ohio wells have produced 1,126,734,443 bbl.

Ohio wells produced 84,858,015 Mcf of natural gas in 2008, a decrease of 3.67% from 2007 (Fig. 3). Gas production figures include an estimated 840,178 Mcf of gas used on leases.

In 2008, production averaged 232,488 Mcfd compared with 241,355 Mcfd in 2007. Through 2008, Ohio wells have produced a cumulative 8,353,152,305 Mcf of gas.

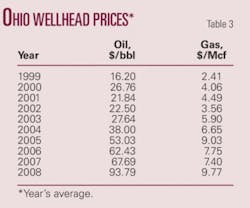

Crude oil production valued at $520,949,200, increased 41.1% from its 2007 value. The average price per barrel was a record $93.79, a 38.6% increase from 2007’s average (Table 3).

Posted oil prices ranged from a high of $138/bbl on July 4 to a low of $28.25/bbl on Dec. 10.

The market value of natural gas increased 27.2% to $829,126,591. The price paid in 2008 averaged $9.77/Mcf, an increase of $2.37/Mcf from 2007 (Table 3). The Appalachian price index, based on a weighted average between Columbia and Dominion, ranged from a high of $13.73 in July to a low of $6.83 in November.

Ohio’s combined oil and gas market value increased by 32.2%. The total dollar value of $1,350,075,791 is the highest on record. It exceeded the $1 billion mark for the fourth straight year and only the fifth time ever, the first time having been in 1984.

The author

Mike McCormac ([email protected]) is a geologist and manager of the oil and gas permitting section with the Ohio Division of Mineral Resources Management. He also administrates the orphan well program. He has authored the division’s summary of Ohio oil and gas activities since 1985 and has been employed with Ohio Department of Natural Resources since 1980. He has a BA in geology from Capital University.

HungaryHungarian Horizon Energy Ltd., a subsidiary of Aspect Energy LLC, Denver, plans fast-track development of the mid-2008 Hajdunanas discovery in the Pannonian basin in northeastern Hungary.

First commercial gas production is expected by mid-2009, 50% participant JKX Oil & Gas PLC said in January. JKX estimated a preliminary 12 bcf of gas in place in Pannonian sands.

The Hajdunanas-2 appraisal well went to TD 1,467 m and cut several Miocene Pannonian gas bearing intervals at 990-1,080 m. The productive Miocene volcaniclastic sequence found in the discovery well was tight, and a deeper Miocene target was not pursued.

The appraisal well flowed 7.4 MMcfd of gas with 1,250 psi flowing wellhead pressure on a 14-mm choke from a 25-m upper zone and 8.5 MMcfd with 1,308 psi on a 16-mm choke from a 5-m lower zone.

Further drilling is needed to define the commercial significance of the underlying Hajdunanas Miocene volcaniclastic interval and the deeper Miocene formation, JKX said.

The discovery is on the Hernad I and II licenses that total 5,420 sq km.

IraqNiko Resources Ltd., Calgary, began shooting seismic on the 846 sq km Qara Dagh block southeast of Sulaymaniya in Iraqi Kurdistan, said partner Vast Exploration Inc., Calgary.

The 4-5 month program is for a minimum of 350 line-km of 2D seismic using a combination of vibrator and dynamite sources. It could be extended to 390 line-km if more data are required.

NetherlandsA group led by Cirrus Energy Corp., Calgary, said the L11-13 directional well in the Netherlands North Sea stabilized at 30.6 MMcfd of dry gas on a 48/64-in. choke with 2,900 psig flowing wellhead pressure.

The well was drilled from the L11b-A production platform into the unitized L8-D field, which potentially straddles blocks L8a, L8b, and L11b. Results are being integrated with existing data from L8-D field, where the 2004 L8-16x discovery well drillstem tested at rates up to 16.1 MMscfd from the same Permian Rotliegend Group sandstones.

Bottomhole locations of L11-13 and L8-16x are 5.9 km apart.

Unit interests are Cirrus 25.479%, EBN 41.9%, TAQA 15%, EWE AG 13.4%, DSM Energie BV 2.88%, and Energy06 Investments BV 1.341%.

PolandPolish Oil & Gas Co. and FX Energy Inc., Salt Lake City, reported a commercial discovery at the Kromolice-2 well in the Fences area in Poland.

Production tests are to start shortly. The well cut 114 ft of gross pay in Permian Rotliegend sandstone with porosity as high as 28% and averaging 15.1%.

The Sroda-4, Kromolice-1 and 2, and Winna Gora wells “provide the critical mass” for a central gathering system, FX Energy said.

Production facilities are under construction at the Roszkow well farther southeast in the Fences area.

SomalilandThe ministry of water and mineral resources in Hargeisa launched Somaliland’s first hydrocarbon bid round on Feb. 19, 2009.

On offer are eight land and offshore blocks totaling more than 89,624 sq km.

The ministry noted striking geological similarities between Yemen’s Balhaf graben and Somaliland’s Berbera basin. Other indicators of hydrocarbon potential are oil and gas seeps at Dagah Shabel, and most historical wells in the area contain multiple zones with shows.

In preparation for the round, TGS-NOPEC Geophysical Co. ASA shot 5,300 line-km of seismic, gravity, and magnetic data offshore and 34,700 line-km of high resolution aeromagnetic data over all known petroleum basins. This is the first new geophysical data acquired in almost 30 years.

Bids are due Aug. 15, and concessions are to be awarded on Dec. 15, 2009.

LouisianaEXCO Resources Inc., Dallas, completed its first Haynesville shale horizontal well in northwest Louisiana in December 2008.

The Oden 30H-6 in DeSoto Parish flowed at an initial rate of 22.9 MMcfd of gas and produced 1 bcf in its first 64 days on production. It was making more than 12 MMcfd in late February. EXCO’s interest is 100%.

EXCO spud its second and third operated horizontal wells late in the year. It has completed one of the two, the Lattin 24-4 in DeSoto, made an initial 24.2 MMcfd with 7,350 psi flowing pressure on a 26/64-in. choke. EXCOs interest is 92.8%.

The third well is in completion and should be on line in early March 2009.

TexasEast

Berry Petroleum Co., Denver, identified more than 100 drilling locations and 75 recompletion opportunities on East Texas properties it acquired in July 2008 for $668 million.

The drilling locations target stacked pay in various productive zones including Pettit, Travis Peak, Cotton Valley sands, Cotton Valley lime, Bossier sands, and Haynesville and Bossier shales on the 4,500 net acres in Limestone and Harrison counties.

The acquisition included a gathering system that is expected to take all current and future production from the properties.

Berry is drilling with one rig and plans to start horizontal drilling in the Haynesville shale in Harrison County in the third quarter of 2009

VirginiaInitial production rates have averaged 1.1 MMcfd at seven horizontal wells completed to date from Upper Devonian Huron shale in Nora field in western Virginia, said Range Resources Corp., Fort Worth.

Range has drilled nine horizontal Huron wells to date, including four in the last quarter of 2008. Initial rate was 1.5 MMcfd at a horizontal well completed in Mississippian Berea sandstone.

The company’s 2009 plan is to drill 220 coalbed methane wells, 60 tight sand gas wells, and 20 horizontal Huron shale wells in Nora field, in which Range’s working interest is 50%.