MMS Lease Sale 207 attracts $487 million in apparent high bids

Apparent high bids totaling just over $487 million were offered for 319 tracts in the western Gulf of Mexico at Lease Sale 207, reported the US Department of the Interior’s Minerals Management Service Aug. 20 in New Orleans.

MMS received 423 bids totaling just over $607 million from 53 companies at the sale. This compares with 358 bids received totaling $369.5 million from 47 companies at the last western gulf sale (OGJ, Aug. 27, 2007, p. 30).

“This sale is an important next step in the journey to ensuring the nation’s energy security,” said MMS Director Randall Luthi. “The participation of the offshore oil and gas industry in this sale shows their commitment to the leasing, exploration, and production of the nation’s energy resources in the Gulf of Mexico.”

The ultradeep water was a big draw at the sale. Of the tracts receiving bids, 169 blocks were in 800-1,600 m of water, 46 were in 1,600-2,000 m of water, and 22 were in more than 2,000 m of water.

This latest sale offered 3,412 blocks covering more than 18 million acres in the western gulf’s Outer Continental Shelf planning area off Texas.

Based on the number of total apparent high bids submitted, ExxonMobil Corp. far outnumbered any other company, topping the list with 130 bids totaling more than $127 million. Hess Corp. placed the next highest amount of apparent high bids, 22, totaling a little over $14 million.

Chevron USA Inc. nearly matched ExxonMobil’s total with only 20 total high bids totaling just over $127 million.

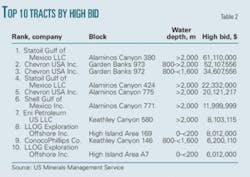

Statoil Gulf of Mexico LLC placed the highest single bid for a block: $61.11 million for Alaminos Canyon Block 380, which lies in more than 2,000 m of water.

The second and third highest single bids were placed by Chevron USA Inc. The major bid a little more than $52 million for Garden Banks Block 973 in 800-1,600 m of water and $34.6 million for Garden Banks Block 972, also in 800-1,600 m of water.

Historically, the western gulf lease sales are not as active in bidding as central gulf sales, MMS said, however noted that this sale marks the first one since US President George W. Bush lifted the executive ban on OCS leasing.

“The national focus has shifted to the potential of increased offshore energy production, which will continue to be under a strict regulatory regime of safety and environmental safeguards,” MMS said.

DOI Secretary Dirk Kempthorne earlier this month announced the initial steps of a new 5-Year OCS oil and gas leasing program that could provide a significant advantage for the next administration, offering options 2 years earlier than the current 5-year program.