Upstream water management addresses ESG issues

Laura Capper

EnergyMakers Advisory Group

Houston

COVID and unstable world economies reduced productivity, output, and process improvements in oil and gas, and common wisdom predicted that lower demand for hydraulic fracturing would curtail produced water (PW) recycling programs. Significant strides, however, were made, and 2021 has been a rebound year with industry reestablishing underfunded oilfield supply chains while adhering to evolving standards for environmental, social, and governance (ESG) issues.

Traditionally viewed as a waste stream, highly saline PW was historically disposed safely and inexpensively in saltwater disposal wells (SWD). A preferred productive use for produced water is enhanced oil recovery (EOR) which optimizes recoverable reserves and simultaneously defers need for disposal. About 60% of PW is typically injected into EOR oilfields, but because the fluid is ultimately produced (again) along with oil, the fluid remains within the hydrocycle for possible future uses.

EOR application is limited to conventional oilfields, which are declining. PW EOR is not a viable standalone technology in unconventional developments due to the low porosity and permeability of tight plays. As conventional production declines, so too does PW demand for EOR programs, forcing industry to find other outlets for increasing volumes of PW.

For decades, SWD provided an ideal option for disposing PW, offering low risk, high reliability, and high-capacity outlets for the waste stream on every lease. Regulations govern protected potable water formations. With 20-20 hindsight and 50+ years of reliance on SWD, it has become clear that:

- SWD reservoir capacity is not limitless.

- SWD operation is not risk-free. Operational concerns include over-pressurization, potential interference with oil and gas production, correlations with induced seismicity in certain areas, and regulatory and financial risks (restrictions on permitted volumes and pressures).

- SWD water is permanently removed from the hydrocycle. Once injected downhole, the water resource is not economically recoverable.

With these concerns in mind, other applications for PW have been investigated, both recycling within the industry and reuse out of it.

Recycling for drilling, completions

Drilling, fracturing, and cleaning out a well bore can require as much as 300,000-500,000 bbl of fit-for-purpose fluids. Hydraulic fracturing comprises about 97% of this fluid demand, with requirements for drilling fluid a distant second. Treating PW water to create a clean brine, largely absent of solids, bacteria, oil, iron, and heavy metals, is relatively simple and inexpensive. Substituting treated PW for a frac-fluid base fulfills multiple ESG objectives.

In the Permian, reuse eliminates the need to withdraw more than a billion barrels of incremental water from groundwater wells, surface water lakes, ponds, rivers, or containment, reserving freshwater and lightly brackish water for higher-value use. It reduces fluid transportation costs and greenhouse gas emissions and eliminates discharge or disposal of more than 1 billion bbl of water otherwise permanently relegated to SWD.

Permian reuse, recycling

New Mexico state regulators and oil and gas operators are increasing activity to protect freshwater resources. Industry research towards repurposing PW and repurposing it for industries outside oil and gas (e.g., agriculture, manufacturing, mining, and industrial use) is being led by the State of New Mexico and its recently formed New Mexico Produced Water Recycling Consortium (NMPWRC), headed by New Mexico State University. The NMPWRC, funded by the US EPA and industry sponsors, is executing a 3-year work plan designed to accelerate understanding of PW, identify best methods of testing, treating, and monitoring water, and provide technical guidance for regulations and best practices to assure both safe and sustainable beneficial use and human health and safety.

On June 18, 2021, Texas formed the Texas Produced Water Consortium, led by Texas Tech University. Its mission is to study the economic impact of produced water and technology needed to reuse it. It will build and expand upon New Mexico’s Produced Water Consortium.

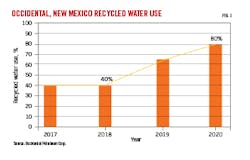

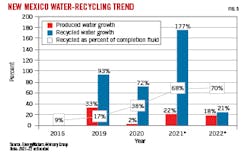

Increases in New Mexico’s recycling are not strictly mandated by regulators. Rather, area oil and gas companies took the initiative to invest in and lead new practices in sustainable recycling and are working to stay ahead of regulations. For example, Occidental Petroleum Corp. reports doubling recycled water in completion fluids from 40% in 2018 to about 80% in 2020 (Fig. 1). Hydraulic fracturing with 60%-80% recycled water is commonplace with many of the Permian’s major producers.

Business drivers for recycling are generally most intense in southeast New Mexico and include SWD supply risk, potential drought, water shortages, and a desire to preserve fresh water for higher-value use. New Mexico’s HB 546 Produced Water Act (PWA), together with follow-on rulemaking, paved the way for three critical pieces of legislation which encourage and drive operators to voluntarily improve recycling efforts:1

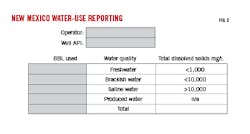

- Public reporting of freshwater consumption. The PWA tasks state regulators to gather water consumption data from operators. Effective October 2020, operators in New Mexico were required to report details of their hydraulically fractured wells within 45 days of completion. Importantly, disclosure includes not only volumes, but quality of the water in terms of total dissolved solids (TDS), the leading indicator of salinity in PW (Fig. 2). The New Mexico Oil Conservation Commission (NMOCD) collates these reports and makes them available to the public, with usage reports identified by operator and well. In a matter of minutes, water quality for completions can be queried for every hydraulically fractured well in the state, along with total volume used.

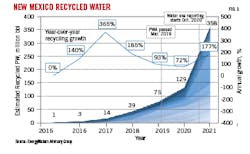

Before this legislation, there was no reliable means to gauge water consumption or quality in oilfield operations. Now that ESG principles are driving corporate behaviors, coupled with the public availability of New Mexico’s Water Use Reports, operators have a much stronger incentive to boost recycling programs and mitigate consumptive water use. Figs. 3-5 show that recycling in New Mexico surged as this new rulemaking went into effect.

- Liability transfers. Texas and New Mexico water rights are complex and were developed long before the shale revolution. PW ownership and obligations, including revenue sharing and ongoing liability for PW, is one of the more nuanced topics. Until recently, many operators felt that the lack of clarity, or subjectivity of these water rights and obligations, was a risk factor. A lack of clear liability transfer kept many producers from sharing or transferring water with other operators, even if the exchange was beneficial to all parties and the environment.

Texas House Bill 2767 adopted in 2013 was a significant step forward, clarifying PW liability transfers and providing immunity from liability to the party that transferred PW ownership. Once the recycler transfers treated product to another entity who agrees to use the product in oil and gas activities, the recycler is immune from liability for any “consequence of the subsequent use of that treated product” by the transferee or any other person, except for personal injury, death, or property damage resulting from exposure to the initial waste or treated product.

Similarly, New Mexico’s Produced Water Act vests PW ownership in the entity with possession of the water and limits liability to that entity, marking a change from previous hazardous waste laws. These laws, and related rulemaking, removed many of the concerns operators faced regarding liabilities related to water transfer and sharing.

Clear liability transfer is an integral step in developing a dynamic, efficient marketplace in which participants can trade or sell freely with each other. Development of trading standards, or water quality standards, is a second requirement to facilitate trading in a networked environment (in this case, a pipeline network). Significant headway was also made in 2020 towards a common treatment spec for PW (Oil & Gas Journal, Nov. 2, 2020, p. 28). The combination of these two advances accelerated development of PW exchanges, allowing industry to leverage resources more efficiently, with greater predictability, and lower overhead costs.

- Landowner rights versus ESG best practices. A third area of New Mexico’s PWA legislation seeks to address common practices which impede recycling, whether directly or indirectly. The legislation, which applies to contracts entered on or after July 1, 2019, addresses potential landowner-leaseholder rights which are in apparent opposition to ESG objectives. Specifically, landowner agreements entered on or after July 1, 2019 can be voided to the extent the agreement:

- Allows a private party to charge a fee for the transport of produced, treated, or recycled water on surface lands owned by the state, if the agreement does not provide for transportation services. This stops landowners from forcing freshwater sales by charging transportation fees for competing water sources.

- Requires freshwater resources to be purchased for oil and gas operations when PW, treated water, or recycled water is available.

- Relates to the purchase of water and the agreement precludes an operator from purchasing or using PW, treated water, or recycled water in the operator’s oil and gas operations when such water is available for the operations.

Without this legislation, landowners could feasibly negotiate arrangements requiring leaseholders to buy the landowner’s fresh water, even if lower quality brackish or PW were available and preferred by the operator.

New Mexico’s State Land Office announced plans in December 2020 to halt the sale of fresh water from state-trust lands. In a letter to oil and gas operators, Commissioner Stephanie Garcia Richard informed companies that easements or permits for freshwater pumping or sales to the oil and gas industry will not be renewed, nor would new permits be granted. In regions lacking a suitable substitute for freshwater (not all regions have brackish water), this new policy is expected to receive pushback.

SWD limits

The PWA rulemaking was designed to protect and reserve fresh water for high-value applications and encourage recycling of lower-value brackish water and PW. Operators, however, are embracing recycling based on early indications of potential future Permian-wide SWD-capacity decline.

For more than 50 years, the oil and gas industry has depended on EOR and SWD to discharge safely and cheaply 95+% of PW in isolated formations. Currently, EOR wells are largely relegated to waning conventional oil production, and SWD availability is under stress from increasing regulation, high uncertainty, increasing costs, and geologic capacity limitations. Operators dependent on SWD are therefore looking for another option, and reuse mitigates dependence and risk associated with SWD. Reuse has ESG benefits and, unlike disposal well limits, is infinitely scalable.

Induced seismicity

Earthquakes have been correlated to injection activity throughout Oklahoma and in regions within many oil-producing states, including the Barnett shale in Texas. In both locations, peer-reviewed research correlates SWD injection, under certain conditions, to low-magnitude earthquakes.

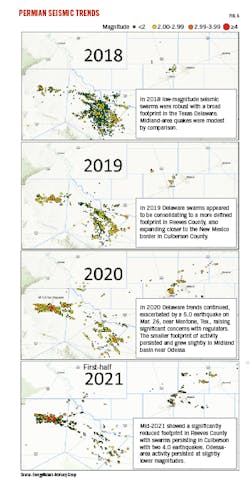

In the Texas Permian, swarms of low-magnitude earthquakes have been measured by Texnet since 2017, with footprints more recently expanding from Delaware basin up to Midland basin (Fig. 6). About 99.9% were below 4.0 on the Moment Magnitude (Mw) scale. Unfortunately, peer-reviewed research on induced seismicity causation in the basins is scarce. The few studies that have been published generally only investigated certain causal attributes (namely hydraulic fracturing and SWD injection) and not the full range of possible correlations. Earthquake causes include SWD and EOR injection, hydraulic fracturing, oil and gas production and extraction, and natural causes, among others.

In Oklahoma, restrictions on injection in Arbuckle formation reduced induced seismicity within months, confirming correlation between the two activities. No such correlation has been proven in the Permian, and in the absence of conclusive technical or causal guidance, state regulators adopted conservative policies to mitigate seismic risk potentially related to SWD injection or hydraulic fracturing.

Many states have induced seismicity permitting restrictions and red-yellow-green risk management systems for earthquakes, including Texas and New Mexico. These traffic light schemes (TLS) generally have specific seismic mitigation rules for activity related to disposal injection or hydraulic fracturing. The rules require that operators report seismic activity when encountered, halt operations for a suitable period depending on the intensity or number of seismic events and, if activity persists, either temporarily or permanently suspend operations. In the case of hydraulic fracturing, they may have the option to propose an alternate means to complete the well. Regulatory tools frequently used to help manage risk around SWD wells include injection pressure restrictions, volume restrictions, and frequent monitoring.

For an owner-operator of a disposal well, however, pressure and volume restrictions translate to restrictions on revenues and profitability, posing a new source of financial risk and impacting the overall supply chain. Without a clear understanding of seismicity origins in the Permian, these restrictions may needlessly risk operations.

Well capacities, pressurization trends

Fundamental geological attributes and injection mechanics are limiting SWD growth prospects throughout the Permian. Historically, operators inject PW from conventional fields into low cost, shallow, receptive formations. The capacity of these formations is diminishing.

On top of the conventional PW load, significantly more PW comes from unconventional wells, and unconventional water is also sent to formations that have been relied on for decades, compounding injection volumes and pressures in shallower formations. The result is increasing stress and pressure disparity between production and injection formations. Pressure disparity between formations may be a contributor to seismic risk. Reservoir depletion exacerbates the problem.

Moderate-depth injection regimes are increasingly pressurized at current injection rates, driving industry to develop new disposal well outlets at greater depths. These deeper wells provide much needed SWD capacity, but they are also more expensive to drill and operate, and there is unpredictable geologic risk related to their ability to process fluids at high injection rates. Geologic characterization and seismic surveys are not readily available at depths below productive oil formations. Some wells are effective at handling injection at 30,000 b/d or more, whereas others, even nearby, may be injecting disappointingly low volumes for their investors, and fail to provide desired returns.

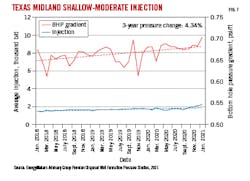

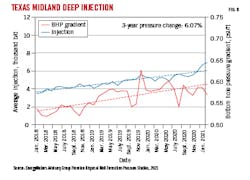

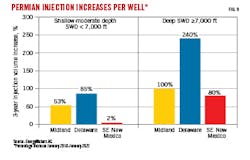

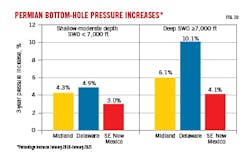

Midland basin injection

Even with modest per-well injection rates (historically less than 2,000 b/d) into long-performing formations like Midland’s San Andres, wells at less than 7,000 ft depth continue to pressurize, suggesting future capacity growth may be practically restricted (Fig. 7). Reliance on deeper SWD wells aimed to mitigate stress on shallow formations is evident based on rapidly increasing volumes injected per well. These deeper formations, however, are also showing signs of pressurization, based on current flow rates and injection trends (Fig. 8).

Pressure review of all wells injecting into the Permian shows only shallow-to-moderate wells in southeast New Mexico bucking the rising pressure trend, with a 3-year pressure change of only 3% compared with 4%-5% in other Permian injectors. This is due to New Mexico OCD having severely restricted new injection wells starting in late 2016 (Figs. 9-10) after regulators reacted to operator complaints of SWD interference with oil production from shallow-moderate injection.

The disposal well system is approaching its limits, and deep disposal wells are unlikely to be a panacea based on early performance indications. Many operators are reviewing water management, revisiting vendors, reevaluating chemistry, and working hard to scale up higher-throughput systems at a lower per-barrel cost, all with ESG metrics in mind. As typical daily recycling throughput climbs from 5,000-10,000 b/d to upwards of 100,000 b/d for volume recyclers, clean brine treatment costs have dropped from $0.50-$0.75 barrel to less than half this price, at high volumes. Clean brine treatment prices are generally tied to the quality of influent water and the treatment requirements, with higher-spec water priced at a slight premium.

Future of beneficial reuse

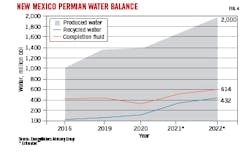

Even with increased volumes and cost reductions, only a third of PW supply (or less, depending on the area) would be used even if operators used 100% recycled PW for drilling and completions (Fig. 4). Suitable products need to be created to convert PW from a liability to a benefit, with product specifications for concentration of salinity and other analytes varying by use. Long term, the goal is to create water suitable for freshwater applications. Initial applications will require lesser quality water for non-consumptive applications like watering golf courses and certain plant species like cotton or hemp.

Further applications are not for the water itself but the salts and rare earth elements within. Desalination treatment separates clean water from the many components within (mainly salts, but also anions, cations, and metals inherent in naturally occurring PW). Additional treatment steps can be applied to further separate out the useful byproducts or commodities. Through complex separation and harvesting techniques, salts and other PW components can be used for road salt, pool chemicals, industrial feedstocks, building materials, and other applications. Of high interest are rare earth minerals like lithium, in short and threatened supply and critical to the production of batteries.

Near-term, integration with alternative (solar and wind) and waste energy (flare gas, thermal, geothermal), which also require substantial volumes of process water, should allow treatment and marketing of produced water at a progressively lower cost. Low-energy separation techniques will begin to deconstruct produced water and harvest useful components. Next-generation water treatment companies will adopt local sourcing by harvesting and selling commodity salts and minerals near the fields. The opportunity for further industrial diversification and support of new industry developments is just part of the unfolding landscape ahead for PW managers.

References

- New Mexico’s Produced Water Act House Bill 546 (HB 546), Apr. 3, 2019.

The Author

Laura Capper ([email protected]) is chief executive officer of EnergyMakers Advisory Group and CAP Resources. Laura holds a BS (1983) in electrical engineering with a minor in bioengineering and computer science from Rice University, Houston. She is active with the Produced Water Society, the Department of Energy’s Produced Water Optimization initiatives, and the New Mexico Produced Water Recycling Consortium.