Energean PLC has taken final investment decision (FID) on the Karish North gas development, offshore Israel, 21-months after the discovery announcement, and plans to increase the liquid processing capacity of the Energean Power FPSO.

The Karish North discovery will be commercialized via tie-back to the Energean Power FPSO, which will sit 5.4 km away (OGJ Online, Apr. 16, 2019; Apr. 9, 2020) . First well production, expected in second-half 2023, is expected to be up to 300 MMscfd (3 billion cu m/year). The company expects initial capital expenditure to be $150 million.

To accelerate development, Energean signed an 18-month, $700 million term loan facility agreement with JP Morgan AG and Morgan Stanley Senior Funding Inc.

Following first gas from Karish North, the overall Karish project well stock will be able to produce more than the full 8 billion cu m/year capacity of the FPSO, the company said Jan. 14.

The loan also will fund the $175-million up-front consideration for the acquisition of the minority interest in Energean Israel Ltd., which becomes payable on transaction close, expected in this year’s first quarter (OGJ Online, Dec. 30, 2020).

The loan will also be used to fund some $100 million of capital expenditure required to install the second oil train and second riser on the Energean Power FPSO, which will increase liquids production capacity to 40,000 b/d of oil from 21,000 b/d and allow maximum gas production of 800 MMscfd (8 billion cu m/year, from 6.5 billion cu m/year). Both the oil train and the second riser are expected to become operational during 2022.

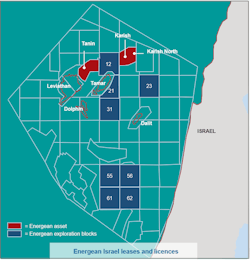

The early 2022 offshore Israel exploration and appraisal drilling program will also be funded with the loan. Plans are to drill five wells including appraisal of the potential oil rim that was identified as part of the Karish development drilling campaign plus exploration of further prospective gas and liquids volumes within the Karish lease.

In Block 12, which lies the Karish and Tanin leases and is estimated to contain gross prospective recoverable resources in excess of 108 billion cu m (3.8 tcf), the company expects a first well to target the 20-bcm Athena prospect. Success at Athena would derisk the remaining 88 bcm of prospective resources in the block, and any discovery in the block would be prioritized over development of Tanin.