Operators commit to investment in deepwater Gulf of Mexico

The deepwater US Gulf of Mexico (GOM) is attracting renewed investment for exploration-development activities as demonstrated by Shell Offshore Inc. and Murphy Oil Corp.’s recent final investment decisions (FIDs) on separate deepwater projects.

Michael Murphy, Wood Mackenzie Ltd. GOM analyst in Houston, told OGJ that operators are reporting shorter cycles between discovery and production, greater efficiency gains, and lower project breakevens.

“It’s not the same Gulf of Mexico as it was 5 years ago,” Murphy said. “Capex/boe has declined 50% since 2014.” The average total development investment for a field calculated against expected reserves is $12/boe in 2019 compared with $25/boe in 2014.

Operators have achieved lower capex/boe partially through lower service costs, he said.

WoodMac expects 25 exploration wells will be drilled in US GOM during 2019 compared with 13 exploration wells drilled in 2018. WoodMac forecasts US GOM development wells, including sidetrack wells, at more than 50 in 2018 compared with more than 30 in 2017.

Murphy described a trend in which majors are embracing subsea tiebacks that offer quicker cycles from discovery to production. He cited Shell’s FID for its PowerNap field, which he estimates will have a development breakeven in the lower $30/bbl.

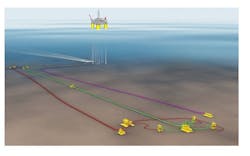

Subsea technology allows operators to efficiently tie back new discoveries to existing company- and third party-owned host platforms on shorter project schedules. Tiebacks enable operators to pursue smaller prospects by enabling quicker returns.

PowerNap development

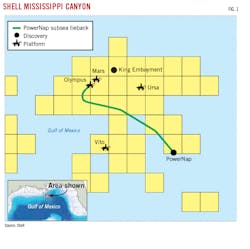

Shell Offshore., a subsidiary of Royal Dutch Shell PLC, will develop PowerNap as a subsea tieback to the Olympus production hub, also operated by Shell. BP Exploration and Production Inc. owns 28.5% interest in the production hub.

The Mars pipeline will move PowerNap production to market. Shell Pipeline Co. LP and Shell Midstream Partners LP together hold 71.5% of Mars while BP Midstream Partners LP holds 28.5% (Fig. 1).

PowerNap is in 4,200 ft of water and contains an estimated 85 million boe in recoverable resources. Shell plans to bring PowerNap on stream late 2021 with anticipated peak production of up to 35,000 boe/d (Fig. 2).

The FID for PowerNap, on Mississippi Canyon Block 943 about 150 miles from New Orleans, comes after Shell brought Kaikias’ subsea tieback on stream in 2018. Kaikias has an estimated development breakeven in the lower $30s/bbl, Murphy said.

Murphy Oil anticipates Nearly Headless Nick will come on stream by Dec. 31, 2019, which is about 1 year after discovery. Nearly Headless Nick would be tied back to the Delta House FPS. LLOG Exploration Offshore drilled Nearly Headless Nick, which is now operated by Murphy Oil.

The Nearly Headless Nick discovery on Mississippi Canyon Block 387 encountered oil pay in Upper Middle Miocene sandstone reservoirs. BP PLC is a partner along with Kosmos Energy Ltd., and Ridgewood Energy.

Murphy Oil’s assets

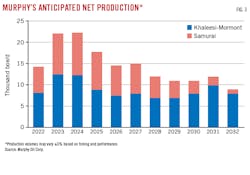

Murphy Oil Chief Executive Officer Roger Jenkins said Murphy is an oil-weighted company with what he calls a “long runway” of high rate-of-return projects to provide production and cash flow for years (Fig. 3).

The independent in El Dorado, Ark., produces over 85,000 boe/d from 13 operated and 5 non-operated GOM fields. It holds interest in more than 120 GOM blocks.

Jenkins told analysts during an Aug. 8 conference call that Murphy Oil is focused on its US and Canadian onshore and offshore assets. Murphy Oil recently sanctioned development of Khaleesi-Mormont and Samurai discoveries.

King’s Quay floating production system (FPS) will receive and process up to 80,000 b/d of oil net to Murphy Oil from Khaleesi-Mormont and Samurai. The FPS, being built in Korea, is expected to be in service mid-2022.

Khaleesi-Mormont are two adjacent fields that Murphy Exploration & Production Co. USA acquired in 2019 from LLOG Exploration Offshore LLC and LLOG Bluewater Holdings LLC, which discovered them in 2017 in 3,064 ft of water. A subsalt Miocene oil discovery, Khaleesi-Mormont involves multiple oil-bearing horizons. It is a seven-well development project, of which four wells have been drilled and cased.

Murphy Oil, which holds 50% interest in the FPS, is analyzing options to lease the FPS’ spare capacity to third parties. Jenkins said leasing options are highly sought after by midstream companies.

Samurai is within 10 miles of Khaleesi-Mormont and King’s Quay FPS. Khaleesi is on Green Canyon Block 390, Mormont on Green Canyon Block 478, and Samurai on Green Canyon Block 476. The fields will be developed as tiebacks to King’s Quay.

“We expect to flow Samurai development and the Khaleesi-Mormont fields to the facility with first oil anticipated in the first half of 2022,” Jenkins said. Murphy holds 34% interest in Khaleesi-Mormont fields and 50% interest in Samurai.

BHP Billiton Ltd. holds 50% non-operated interest in Samurai, a prospect in a northern extension of the Wildling sub-basin. Murphy Oil spudded the Samurai-2 exploration well in April 2018 and encountered hydrocarbons across multiple horizons undetected by the Wildling-2 exploration well. Anadarko Petroleum Corp. discovered Samurai in 2009.

Fig. 4 shows anticipated production net to Murphy from Khaleesi-Mormont and Samurai developments.

Jenkins said Murphy Oil plans to spend $325 million/year over a 5-year period on the US GOM.

In Mexico’s Gulf of Mexico waters, Murphy’s 2020 plans call for exploration in Block 5 where it has a joint venture calling for its Mexican subsidiary to be the operator with 30% interest. Partners are a subsidiary of Petronas 23.34%, Ophir Energy 23.33%, and Sierra Offshore Exploration, 23.33%.

Block 5 is in Salinas basin covering 2,600 sq km in 700-1,100 m of water. Terms with Mexico call for an initial exploration period of 4 years, including a one-well commitment.

Pending finalization of the 2020 budget, Jenkins said Murphy Oil tentatively plans to drill two Block 5 wells and has other prospects there.

Fast-track developments

LLOG Exploration Offshore has developed deepwater Miocene projects and is helping develop an ultra-deepwater Lower Tertiary project using a strategy that emphasizes preplanning, repeatability, and standardization.

In 2018, LLOG operated five of a total of nine GOM deepwater fields brought on stream. LLOG kept ownership of some fields after selling other assets to Murphy Oil.

LLOG brought on stream LaFemme, Blue Wing Olive, Red Zinger, Crown, and Anchor within 24-36 months of discovery. The fields have subsea tiebacks to Delta House FPS on Mississippi Canyon 254.

Claiborne field in Mississippi Canyon 794 used equipment rated to 15,000 psi. Claiborne is tied back to Coelacanth platform, operated by Walter Oil & Gas, on Ewing Bank 834.

During 2019, LLOG plans to bring four development wells at existing fields on stream, all bysubsea tiebacks to existing LLOG or third-party platforms. LLOG executives said this strategy helps reduce project breakevens.

Rick Fowler, LLOG chief operating officer, has said tiebacks give LLOG a lower reserves threshold to pursue smaller, often lower-risk developments that might be passed over by majors looking for bigger projects.

Equinor to drill Monument

Equinor has expanded its holdings in the US GOM since 2005. In first-quarter 2019, Equinor’s GOM equity production was 110,000 b/d.

“Later this year, we will be drilling the Equinor-operated Monument prospect, which has the potential to further develop our position in the Gulf of Mexico,” said Christopher Golden, Equinor’s senior vice-president of development and production international, North America Offshore.

The Paleogene Monument prospect is on Walker Ridge Blocks 271 and 272. Drilling contractor Pacific Drilling has said Equinor has arranged for the Pacific Khamsin drillship to work on Monument.

In May, Equinor acquired an additional 22.45% interest in Caesar Tonga oil field from Shell Offshore for $965 million.

The additional interest increased Equinor’s holding in Caesar Tonga to 46%. Equinor’s share of production from Caesar Tonga is 18,600 boe/d (net to Equinor).

Caesar Tonga field, 180 miles south-southwest of New Orleans in Green Canyon Blocks 683, 726, 727, and 770.

About the Author

Paula Dittrick

Senior Staff Writer

Paula Dittrick has covered oil and gas from Houston for more than 20 years. Starting in May 2007, she developed a health, safety, and environment beat for Oil & Gas Journal. Dittrick is familiar with the industry’s financial aspects. She also monitors issues associated with carbon sequestration and renewable energy.

Dittrick joined OGJ in February 2001. Previously, she worked for Dow Jones and United Press International. She began writing about oil and gas as UPI’s West Texas bureau chief during the 1980s. She earned a Bachelor’s of Science degree in journalism from the University of Nebraska in 1974.