Operators accelerate exploration efforts across Australia’s basins

Operators are increasing exploration efforts offshore Australia and resuming onshore shale gas activities in the Northern Territory (NT) since officials lifted a 3-year moratorium on hydraulic fracturing during 2018.

Rystad Energy Pty. Ltd. forecast 60-70 exploration wells will be drilled across Australia during 2019, of which most will be coal seam gas focused in Queensland.

Santos Ltd. received NT regulatory approval in July 2019 to drill in McArthur basin after the Australian independent revised its wastewater management and spill management plans for shale drilling. Drilling is expected to start by November.

Others interested in NT drilling are Origin Energy, with holdings in Beetaloo basin, Empire Energy Group, and Armour Energy Ltd., which both have McArthur basin holdings.

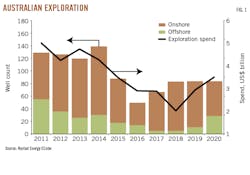

Fig. 1 shows exploration activity and spending in past years along with Rystad Energy’s forecast that operators will ramp up exploration in 2020 compared with 2019. Rystad expects offshore Western Australia will account for increased activity during 2020.

“There has certainly been an uptick in exploration in Australia since reaching basement levels in 2016,” Daniel Levy, Rystad senior exploration and production analyst, told OGJ. “While I would stop short of saying we are in the midst of a renaissance, the wells being drilled in the next 3 years have the potential to start one, particularly if the NT shale exploration wells are successful.”

The Australian government offered 64 areas in its 2019 offshore petroleum acreage release, covering more than 120,000 sq km. Officials say it’s the largest release since 2000. Bidding for work programs close Mar. 5, 2020.

The areas involve five sedimentary basins, with the heaviest concentration off northwest Australia. Analysts expect some interest as well in the southeast.

ExxonMobil Corp.’s subsidiary Esso Deepwater received regulatory approval in June 2019 to drill ultradeepwater Sculpin-1, an exploration well on VIC-P70 license in the Gippsland basin, 90 km off the East Gippsland Victorian coast.

Sculpin-1, in 2,300 m of water, would be the deepest water depth for a well drilled offshore Australia, Wood Mackenzie Ltd. said.

ExxonMobil reported two other wells drilled in the same area as Sculpin-1 as dry holes. Hartail-1 and Baldfish-1 wells did not intersect commercial hydrocarbon volumes. The Ocean Monarch semisubmersible drilled those wells.

Levy said Sculpin-1 holds the potential for a new gas source close to Australia’s East Coast. “Exxon will be hoping for a discovery on the trillion-cubic-feet scale,” Levy said. “Existing fields have proved the petroleum system exists, it just comes down to how confident operators are in their seismic interpretation and petroleum system modeling.”

Corvus gas

Offshore Western Australia, Santos and partner Carnarvon Petroleum Ltd. announced a natural gas discovery at the Corvus-2 appraisal well in Carnarvon basin on the WA-45-R permit 90 km northwest of Dampier. Corvus-2 reached 3,998 m TD, Santos said.

The well intersected a gross interval of 638 m, which Santos called one of the largest columns discovered on the North West Shelf. Santos confirmed 245 m of net pay in the North Rankin and Mungaroo formations.

Kevin Gallagher, Santos chief executive, said anticipated Corvus production could be tied back to Devil Creek or Varanus Island gas plants. Corvus-2 is 28 km from the Reindeer platform.

Based on limited information, Wood Mackenzie senior analyst Daniel Tolemen said initial estimates put resources at 2.5 tcf gas and 25 million bbl condensate. If at least 2 tcf proves accurate, Toleman suggests Santos could export gas as LNG.

Rystad’s Levy said it’s too early to know resource numbers for Corvus, but preliminary estimates indicate over 2 tcf of gas and significant condensate.

Dorado appraisals

Carnarvon Petroleum, said Dorado-2 appraisal well results and Dorado-3 drill stem tests will help determine a final investment decision by late 2020 regarding development of Dorado oil discovery on WA-437-P. The field is about 160 km north of Port Hedland.

Santos holds operatorship with 80% interest and Carnarvon holds 20% interest. Dorado is in the Bedout basin offshore Western Australia. Santos in July 2018 announced Dorado-1 encountered light oil, gas, and condensate in Baxter and Milne sands.

The Dorado-3 appraisal well, expected during 2019, will obtain fluid samples that Santos and Carnarvon need to design Dorado development plans, which include drilling deviated wells using a jack up. Wells will be tied back to a floating production, storage, and offloading vessel (FPSO).

Results from the Dorado-2 appraisal well indicated liquids and gas like the light oils and gases sampled in the Dorado-1 discovery, where condensate yields ranged from 190-245 bbl/MMscf in the Upper Caley, Crespin, and Milne formations, with gas in the Baxter formation, Santos said.

The Dorado discovery is part of the Great Phoenix Area, covering 22,000 sq km. Fig. 2 shows the area includes the WA-437-P permit along with WA-435-P, WA-436-P, and WA438-P blocks in the Roebuck basin.

Levy notes that Roebuck basin remains mostly unexplored, but he expects to see operators increasing exploration there in the next 5 years.

The Ensco-107 jack up drilled the Dorado-1 to 4,044 m MD. The well yielded condensates ranging between 70-245 bbl/MMscf. Wireline testing showed a net oil pay thickness of 79.6 m.

The well was drilled to analyze the Baxter and Milne sandstones within the Caley Member.

Preliminary estimates put Dorado resources at 448 million barrels of oil-equivalent (Mboe), making it the third biggest oil field in the greater North West Shelf.

The Noble Tom Prosser jack up drilled the Dorado-2 appraisal well to 4,573 m in 91 m of water. Dorado-2 is downdip and 2.2 km from the Dorado-1 well. The appraisal well intersected an oil-water contact in the Caley.

Secondary target condensate-rich gas was extracted from Baxter reservoir and wireline logging showed a hydrocarbon column with no gas-water contact. The Crespin reservoir was water-wet, while the Milne reservoir samples indicated the presence of oil.

Ironbark prospect

BP Development plans for Diamond Offshore Drilling Inc.’s Ocean Apex semisubmersible to spud Ironbark-1 in 5,500 m of water during the second half of 2020.

Ironbark, in the offshore Carnarvon basin, holds an estimated 15 tcf of gas resources. The prospect is in Mungaroo formation within 50 km of the North West Shelf joint venture’s North Rankin platform.

Permit partners BP PLC, Cue Exploration, Beach Energy Ltd., and New Zealand Oil & Gas Ltd. reached a coordination agreement in October 2018 listing BP as the acting operator in planning Ironbark.

Pending regulatory approvals, the coordination agreement provides for BP to become official operator. Participating interests would then be BP 42.5%, Cue 21.5%, Beach 21%, and New Zealand Oil and Gas 15%.

Ironbark is near Chevron Corp.’s Wheatstone infrastructure and Woodside Petroleum Ltd.’s Pluto infrastructure.

BP acquired its interest in Ironbark from Cue, which previously acquired 15,000 sq km of 3D and 2D seismic data to map the Triassic intra-Mungaroo sands. Seismic data interpretation identified the Ironbark prospect, which straddles WA-359-P and WA-409-P.

Otway basin prospects

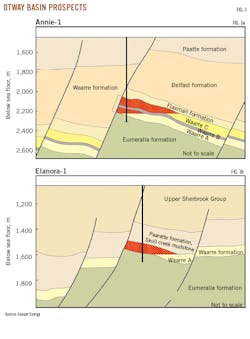

Cooper Energy and joint venture partners spudded the Annie-1 exploration well and planned to start drilling on the Elanora prospect during 2019. Both Annie and Elanora are on the VIC/P44 permit in the Otway basin offshore Victoria.

The Diamond Offshore semisubmersible Ocean Monarch was hired to drill the wells.

The joint venture approved drilling based on interpretation of 3D seismic and a re-evaluation of prospectivity. Both prospects are near production infrastructure with future access to processing and market via the onshore Minerva gas plant.

Combined prospective resources could be more than 170 bcf, with a 56% chance of success at Annie-1 (Fig. 3a) and 44% at Elanora (Fig. 3b), Cooper said, adding seismic data indicates gas is present in both prospects. Successful results could derisk other prospects across the permit.

In other activity offshore Victoria, Cooper plans an appraisal well on the offshore Manta gas discovery in 130 m of water. The Manta-3 well, which will also test the Manta Deep exploration prospect, could get under way during fourth-quarter 2020.

Great Australian Bight

The National Offshore Petroleum Safety and Environmental Management Authority (NOPSEMA) gave Equinor until Aug. 26 to submit an environment plan for its proposed offshore wildcat, the Stromlo-1, in the Ceduna sub-basin within the Great Australian Bight.

If approved, Equinor would drill Stromlo-1 on Permit EPP 39. In June 2017, the company became operator and 100% owner of exploration permits EPP 39 and 40.

The Stromlo-1 well would be 372 km off the coast of South Australia and 476 km west of Port Lincoln. Pending all necessary regulatory approvals, Equinor plans to start drilling in 2020-21.

Rystad Energy conducted a technical and economic assessment of developing the Great Australian Bight, which industry estimates could contain 6 billion boe. The bight is in a remote region off Australia’s southern coastline in deep ocean conditions.

“Compounding these issues, the region has also been identified as environmentally fragile, hosting a significant whale sanctuary,” Levy said. “With these environmental concerns heavily publicized by Australian and global media, approval of Equinor’s Bight drilling plans has already been delayed twice” by regulators.

But the Great Australian Bight is not new territory for industry, which already drilled nine wells in the basin without incident. Woodside Energy Ltd. drilled the latest well, Gnarlyknots-1, in 2003.

“Unfortunately for the exploration and production companies, all of the wells completed so far have failed to find economic volumes of hydrocarbons,” Levy said, adding that the latest geological interpretations suggest the Ceduna sub-basin is the most likely to contain oil.

“Of the nine wells previously drilled, only one has tested the Ceduna sub-basin, and even that penetration is now considered to be sub-optimally placed,” Levy said.

Rystad Energy’s modeling indicates that with a 1.5-billion bbl resource base, the bight would have a full lifecycle breakeven oil price of $52/boe. Analysts estimate that if volumes of around 6 billion boe were discovered, the breakeven price would be $40-$45/boe.

Levy said Rystad used a conservative 1.5 billion boe for its base-case scenario, reflecting high geological, technical, and commercial uncertainties.

“Beginning with the cost of drilling, we can see that the bight will be an expensive place to operate,” Levy said. “With water depths in Equinor’s acreage surpassing 2,200 m, and total drilling depths of beyond 5,000 m, Rystad Energy has modeled the cost of drilling in the sub-basin to average between $70 million and $80 million per well.”

About the Author

Paula Dittrick

Senior Staff Writer

Paula Dittrick has covered oil and gas from Houston for more than 20 years. Starting in May 2007, she developed a health, safety, and environment beat for Oil & Gas Journal. Dittrick is familiar with the industry’s financial aspects. She also monitors issues associated with carbon sequestration and renewable energy.

Dittrick joined OGJ in February 2001. Previously, she worked for Dow Jones and United Press International. She began writing about oil and gas as UPI’s West Texas bureau chief during the 1980s. She earned a Bachelor’s of Science degree in journalism from the University of Nebraska in 1974.