Texas incentivizes development of grassroots biorefinery, CCS project

USA BioEnergy LLC, Scottsdale, Ariz., has selected Bon Wier, Newton County, Tex., for construction of the first of its 12 planned advanced biorefineries for production of sustainable aviation fuel (SAF), renewable diesel, and renewable naphtha from a feedstock of wood waste sourced from East Texas forests.

Selected for its location based on economic incentives offered by Texas state and local governments, the proposed Bon Wier renewable fuels production plant—to be operated by USA BioEnergy subsidiary Texas Renewable Fuels (TRF)—will also be equipped with carbon capture and sequestration (CCS) capabilities to support the growing US market for sustainable and renewable fuels as well as the operator’s commitment to deliver 100 million gal/year of SAF to Los Angeles International Airport (LAX) in line with the global energy transition.

This article provides a brief description of the Bon Wier biorefinery project, including feedstock and CCS components, proposed technologies, existing third-party agreements, and USA BioEnergy’s plans to build similar plants across the US.

Project overview, status

First announced in mid-February 2022, the proposed $1.7-billion Bon Wier plant will convert 1 million green tons/year of sustainably sourced wood waste into 34 million gal/year of ultralow-sulfur transportation fuels that, in addition to SAF and renewable diesel, includes renewable naphtha for use as a gasoline blendstock. A green ton is equivalent to 2,000 lb of fresh-cut biomass, or woody material, that includes moisture content.

The plant’s production of renewable fuels—which can be used as a direct replacement for, and reduce carbon dioxide (CO2) emissions by about 80% from, conventional fossil-based fuels—additionally will qualify for the highest levels of federal and state credits under the Renewable Fuel Standard’s (RFS) Renewable Identification Numbers (RINs) and California low-carbon fuel standard (LCFS) programs, respectively, the operator said.

Without disclosing specific details of the parties involved, USA BioEnergy confirmed in a June 2, 2021, presentation that it already had finalized critical elements for the TRF project, including:

- Detailed engineering.

- Licensing of technologies to be implemented.

- Selection of the engineering, procurement, and construction (EPC) contractor.

- Selection of an operations and maintenance (O&M) provider.

With site selection now decided, the operator said in March 2022 that it expects to complete the Bon Wier plant’s first 34-million gal/year phase by late 2025.

Plans, however, are already under way for a future expansion that would double the biorefinery’s production capacity to 68 million gal/year. A timeline for completion of the plant’s proposed second-phase has yet to be revealed.

Feedstock, technology

As with each of its planned US biorefineries, TRF’s Bon Wier plant will process about 1 million green tons/year of locally sourced woody biomass, a renewable feedstock generated from logging operations and comprised of unused material such as limbs, tops, bark, and unutilized trees that would otherwise be left either to decompose or burn in a slash pile to emit additional CO2 into the atmosphere, according to USA BioEnergy.

Necessary to meet verified certification requirements (RFS2) to qualify for RINs under the RFS, USA BioEnergy said TRF’s use of the wood-waste feedstock—which the operator intends to obtain within a 75-mile radius—additionally will enable Bon Wier to reach the lowest possible negative carbon intensity (CI) score, increasing the value of financial credits earned under various state LCFS programs.

On Mar. 10, 2022, USA BioEnergy announced Forest2Market Inc.’s completion of an extensive feedstock study to evaluate RFS2-certified biomass availability and pricing in the area surrounding the proposed biorefinery. Alongside concluding that the region holds an abundance of favorably priced woody biomass supply to support both the first and second phases of the plant, the study’s validation of USA BioEnergy’s pricing model also confirmed the operator’s preliminary projection that the biorefinery would directly result in a nearly $40 million/year investment in the forest industries of East Texas and western Louisiana.

Regarding its system-wide feedstock strategy—which seeks biomass resulting from thinning of southern yellow pine plantations and natural pine forests purposely grown to support commercial lumber operations (e.g., sawmills, paper products)—USA BioEnergy said it continues to work closely with forestry experts to ensure its proposed biorefineries will have a “super redundancy” of stable feedstock supply to support renewable fuel production for at least 20 but preferably 30 years. The company additionally confirms it has verified ample availability of wood waste to allow doubling production capacity of each of its planned biorefineries.

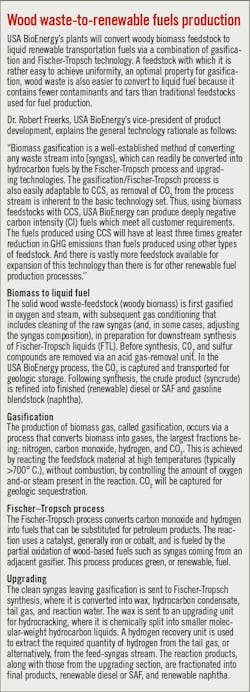

While USA BioEnergy has yet to disclose specific details of technology licensing agreements for TRF’s Bon Weir plant, the company has said its proposed plants will convert woody biomass to renewable fuels via a combination of gasification, partial oxidation, and Fischer-Tropsch processing and upgrading. The biomass gasification process will involve three basic steps:

- Converting woody biomass in gasifiers to a blend of volatile gases.

- Converting raw synthesis gas (syngas) to liquid fuel through a series of cleanup processes.

- Condensing reformed gas into liquid form as renewable diesel, SAF, and renewable naphtha.

The accompanying box includes a more detailed explanation of USA BioEnergy’s proposed production technology process.

CCS capabilities, reduced emissions

The Bon Wier biorefinery—as well as the company’s other proposed plants—will capture CO2 during the production process for storage in salt caverns.

Specifically designed to reduce the greenhouse gas (GHG) emissions of its operations by removing CO2 from flue gases and various process streams, USA BioEnergy said the Bon Wier CCS system will capture and sequester about 50 million tonnes/year (tpy) of CO2 over the biorefinery’s lifetime. The biorefinery will further reduce its emissions via integration and use of on-site green power generation.

While it has yet to officially identify its external industry partner by name, USA BioEnergy has confirmed the partner is building a pipeline to transport CO2 captured at Bon Wier for secure, permanent underground geologic storage in salt cavern, in accordance with the California LCFS.

Alongside managing CO2 transportation and geologic sequestration, USA BioEnergy said its unidentified industry partners also will manage US Environmental Protection Agency and California LCFS monitoring and reporting requirements.

Third-party agreements

In addition to major construction, supplier, and technology licensing contracts, USA BioEnergy said it has secured offtake agreements from one of the US’ largest truck stop companies and a major global airline for all of its proposed renewable diesel and SAF production.

Further details regarding the trucking and airline offtake agreements remain unavailable. Details concerning the operator’s commitment for delivery of 100 million gal/year of SAF into LAX also have yet to be revealed.

State incentives, project benefits

USA BioEnergy’s selection of the Newton County site for TRF’s plant was a direct result of more than $150 million in economic incentives provided by Texas state and local governments, the operator said upon announcing the project in February.

“USA BioEnergy performed an extensive site search and analysis to identify the best location for our project,” said Nick Andrews, USA BioEnergy’s chief executive officer. “State and local incentives then became the key component of our decision.”

Overall, USA BioEnergy’s investment in Newton County will exceed $3.4 billion, according to Andrews.

Alongside creating 142 permanent, full-time jobs at the TRF biorefinery upon its completion, the project will result in an estimated 585 direct construction and related workers’ jobs during construction, with $877 million in direct revenues for construction-related companies. The project will ultimately support an estimated $1.2 billion in gross area product or economic activity during construction, said Newton County Judge Kenneth Weeks.

While a comprehensive list of incentives offered to finalize USA BioEnergy’s selection of Bon Wier for the proposed biorefinery have yet to be verified, Michelle Barrow, superintendent of Newton Independent School District, confirmed the district participated in a Chapter 313 incentive, which temporarily limits a property’s appraised value to encourage business investments within school district borders.

In addition to spurring increased economic development and providing opportunities for a substantial improvement in the quality of life for residents in the rural extreme East Texas county north of Beaumont, various project proponents noted the new plant will lend direct support to ensuring the region’s forest ecosystems remain clean, healthy, and productive, as well as providing a sustainable, in-demand market for local wood fiber.

Future plans

USA BioEnergy’s long-term strategy is focused on building 11 additional US advanced biorefineries, each configured to produce 34 million gal/year of renewable fuels from locally sourced woody biomass.

Like Bon Wier, each of the new plants is designed to double its production capacity to 68 million gal/year, scalable based on available supply of biomass feedstock, the operator said.

Of the 12 proposed biorefineries, six will be designed to produce renewable diesel, with the remaining six for production of SAF and renewable naphtha.

In June 2021, USA BioEnergy said it plans to site its planned biorefineries in a four-state region that includes East Texas, Louisiana, Mississippi, and southern Arkansas.

About the Author

Robert Brelsford

Downstream Editor

Robert Brelsford joined Oil & Gas Journal in October 2013 as downstream technology editor after 8 years as a crude oil price and news reporter on spot crude transactions at the US Gulf Coast, West Coast, Canadian, and Latin American markets. He holds a BA (2000) in English from Rice University and an MS (2003) in education and social policy from Northwestern University.